- United States

- /

- Office REITs

- /

- NYSE:DEA

Easterly Government Properties (DEA): Is the Stock Undervalued After Recent Slide?

Reviewed by Kshitija Bhandaru

Easterly Government Properties (DEA) has seen its stock edge lower over the past month, falling around 10%. While there has not been a single headline-making event, investors have been keeping an eye on the company’s broader performance and valuation.

See our latest analysis for Easterly Government Properties.

After holding up for much of the year, Easterly Government Properties has seen momentum slip, with a 1-month share price return of nearly -10% and its total shareholder return down over 32% in the past year. This trend suggests investors are reassessing the stock’s growth potential and risk profile as the broader real estate sector recalibrates.

If you’re watching market shifts like this and considering where to look next, now is an ideal moment to broaden your horizons and discover fast growing stocks with high insider ownership

The real question now is whether Easterly Government Properties is priced below its true value given recent declines, or if investors have already accounted for any upside in its current share price. Is there a hidden buying opportunity, or is the market one step ahead?

Most Popular Narrative: 11.6% Undervalued

Based on the most followed narrative, Easterly Government Properties is trading below the consensus estimate of fair value, with the last close at $21.29 compared to a narrative fair value of $24.08. This gap frames the discussion over whether the market is overlooking specific growth catalysts and quality factors highlighted by analysts.

Persistent demand for mission-critical, secure, and specialized facilities by federal agencies, such as courthouses, law enforcement labs, and public health clinics, continues to underpin high occupancy and stable rental income for Easterly. This directly supports long-term revenue stability and growth. The federal government's ongoing modernization and renewal of real estate procurement, as evident from recent multi-year lease renewals with built-in rent escalators, positions Easterly to capture rent growth and maintain high tenant retention. This positively influences both revenue and net operating income.

Curious what underpins this bold valuation? Discover the ambitious projections driving this target: steady income streams, government tenants, and a future profit multiple not found in most REIT stories. Find out what narrative ingredient stands out and what’s fueling analyst conviction. The full narrative reveals the details.

Result: Fair Value of $24.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher capital costs and evolving government leasing needs could restrain earnings growth. This could challenge the optimism around Easterly’s long-term stability narrative.

Find out about the key risks to this Easterly Government Properties narrative.

Another View: Multiple-Based Valuation Paints a Different Picture

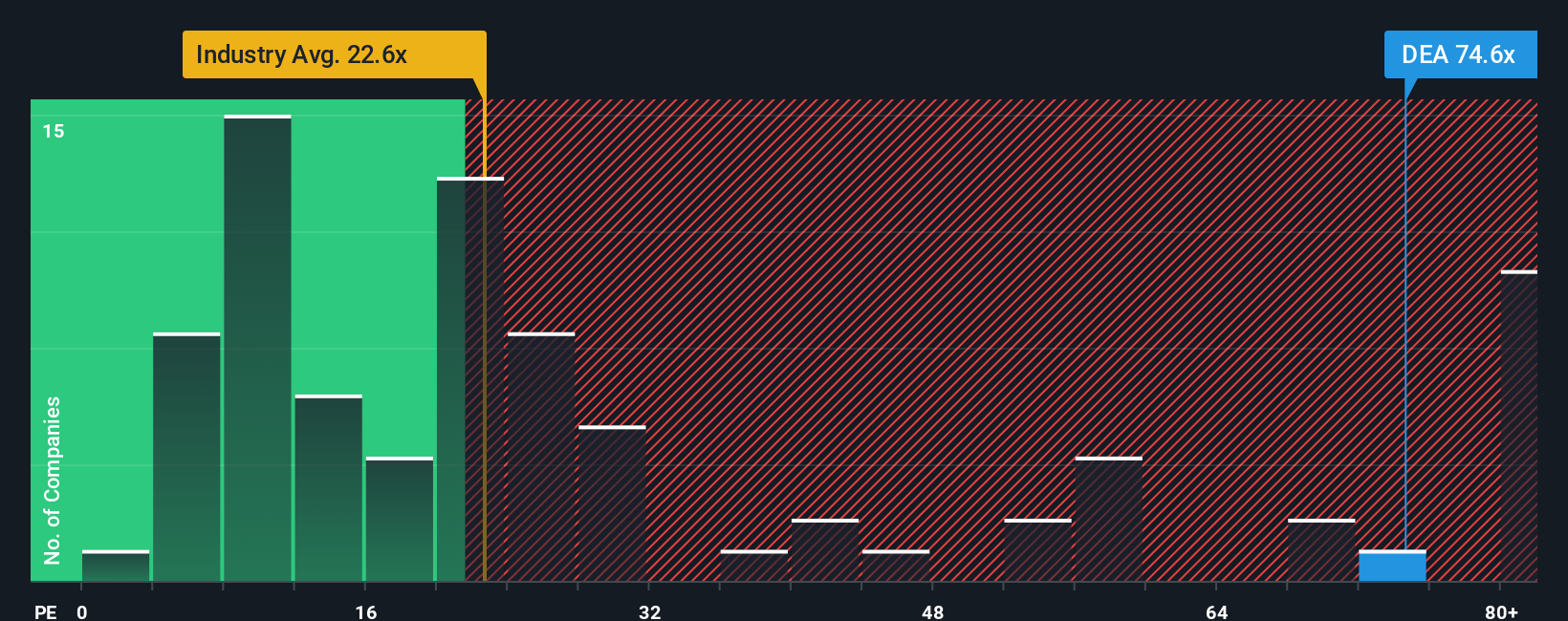

While the consensus fair value suggests Easterly is undervalued, a closer look at its price-to-earnings ratio tells a different story. The company currently trades at 57.1 times earnings, far above both the industry average of 22 and its fair ratio of 33.4. This raises real questions about valuation risk. Is the market pricing in too much optimism, or missing something key?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Easterly Government Properties Narrative

If you see things differently or want to dive deeper, you can craft your own view quickly by exploring the data and building your own perspective. Do it your way

A great starting point for your Easterly Government Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep ahead of market shifts by tracking unique opportunities across the broader market. Take your strategy further with a few of our most compelling handpicked screens. You’ll regret letting these slip past your radar.

- Boost your portfolio with income by targeting these 18 dividend stocks with yields > 3% offering reliable yields and a history of strong payouts.

- Ride the innovation wave by seeking out these 25 AI penny stocks leading advancements in artificial intelligence and shaping tomorrow’s technology landscape.

- Capitalize on value by uncovering these 881 undervalued stocks based on cash flows currently overlooked by the broader market and ripe for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Easterly Government Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEA

Easterly Government Properties

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives