- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

How Investors May Respond To CareTrust REIT (CTRE) Expanding Into UK Senior Housing With $1.1 Billion Acquisition

Reviewed by Simply Wall St

- Earlier in 2025, CareTrust REIT completed a major expansion by acquiring Care REIT in the UK, fueling a US$1.1 billion wave of new investments focused on senior housing and skilled nursing properties.

- The acquisition not only broadened CareTrust’s geographic reach, but also set the stage for management’s projection of strong normalized funds from operations growth for 2025 amid increasing demand for senior care.

- We will now examine how CareTrust’s entry into the UK senior care market may reshape its long-term investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CareTrust REIT Investment Narrative Recap

To be a shareholder in CareTrust REIT, you need to believe in the company’s ability to scale profitably by entering new markets and expanding its senior care portfolio, while managing integration and regulatory challenges. The recent acquisition of Care REIT in the UK gives CareTrust a bigger global presence, which is a key short-term catalyst for growth. However, the largest near-term risk remains effective integration and controlling costs, if the UK expansion runs smoothly, it can boost performance; if not, disruption may weigh on results.

Among the company’s recent actions, the US$640 million follow-on equity offering directly supports its aggressive acquisition pipeline, including the funds needed for UK expansion. This move enables further external growth but also increases the importance of successful asset integration and careful capital deployment, as heightened risks can arise from rapid portfolio and operational expansion.

But investors should also be mindful that, unlike revenue growth, risks around integration and market entry are just beginning to play out…

Read the full narrative on CareTrust REIT (it's free!)

CareTrust REIT's narrative projects $649.2 million revenue and $460.9 million earnings by 2028. This requires 20.2% yearly revenue growth and a $241.6 million earnings increase from $219.3 million.

Uncover how CareTrust REIT's forecasts yield a $36.89 fair value, a 9% upside to its current price.

Exploring Other Perspectives

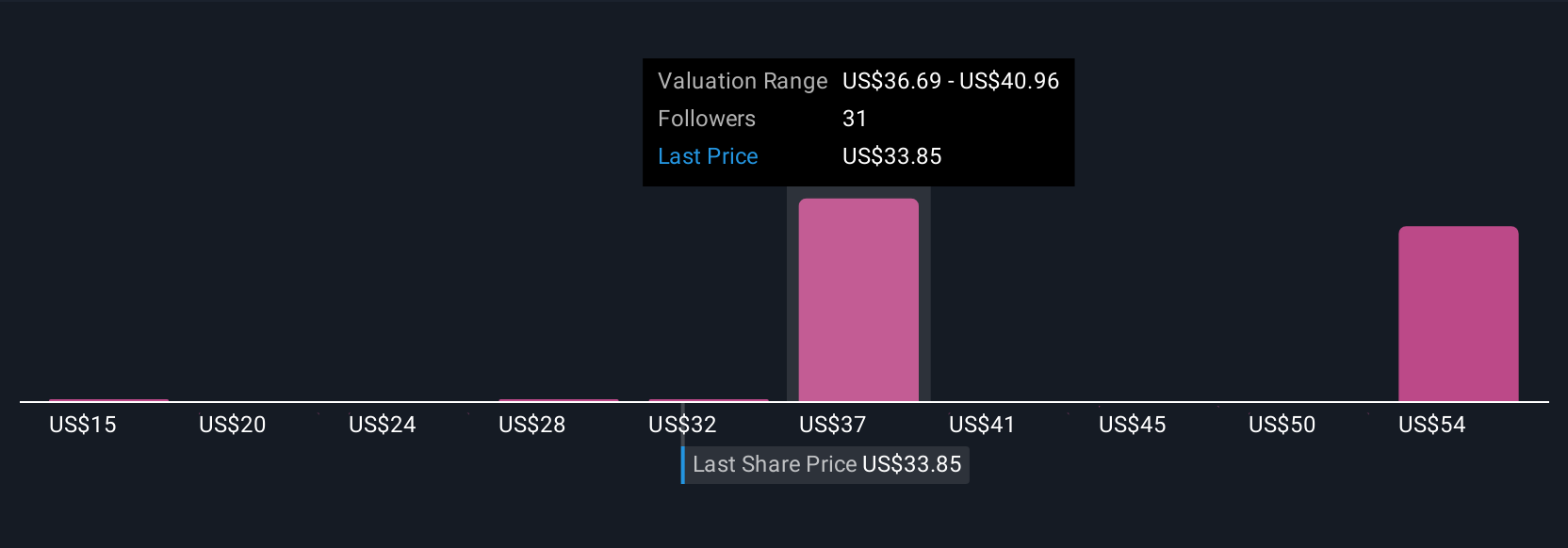

Simply Wall St Community members have posted nine fair value estimates for CareTrust REIT, ranging from just US$15.35 up to US$58.06 per share. With growing integration risk due to UK expansion, these diverse perspectives reflect differing views on how portfolio changes could affect future performance.

Explore 9 other fair value estimates on CareTrust REIT - why the stock might be worth as much as 71% more than the current price!

Build Your Own CareTrust REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CareTrust REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CareTrust REIT's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives