- United States

- /

- Residential REITs

- /

- NYSE:CPT

Camden Property Trust (CPT) Valuation in Focus After Goldman Sachs Downgrade on Rent Growth Concerns

Reviewed by Kshitija Bhandaru

Camden Property Trust (CPT) investors have a lot to digest this week, as Goldman Sachs issued a downgrade on the stock, citing fresh concerns about the company’s near-term prospects. The analyst pointed to weak rent growth expectations through the remainder of 2025 and into next year, along with persistent vacancy challenges in the Sunbelt region. Slower-than-anticipated easing in new housing supply is also weighing on Camden Property Trust’s ability to raise rents, which could make a tough operating backdrop even more challenging.

This analyst move followed several events, including recent conference presentations and dividend affirmations by Camden Property Trust. Combined with the downgrade, these developments contributed to the stock slipping about 11% over the past year, with momentum fading throughout recent months. While the company’s longer-term five-year return remains positive, short- and mid-term price trends are hinting at ongoing caution from the market.

After a period of disappointing stock performance and the most recent negative analyst call, the question emerges: is Camden Property Trust now trading at an attractive valuation for buyers, or is the market simply anticipating weaker earnings to come?

Most Popular Narrative: 12.2% Undervalued

Record-high apartment demand, improving affordability (wages outpacing rent growth for 31 months), and strong resident retention due to high homeownership costs are strengthening Camden's occupancy and ability to grow revenues. This is laying the groundwork for outsized rent growth as supply moderates in 2026 and 2027.

Want to unravel how analyst consensus arrives at this bullish fair value? The secret recipe behind Camden Property Trust’s valuation is not just optimism about rent growth. There is a bold blend of projected profit expansion, margin boosts, and a premium future earnings multiple that rivals some of the market’s biggest names. Discover exactly what future numbers drive this rare “undervalued” rating. Is your curiosity piqued?

Result: Fair Value of $122.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a local economic slowdown in key Sun Belt cities or a prolonged oversupply of apartments could still limit Camden's anticipated rent growth and pricing power.

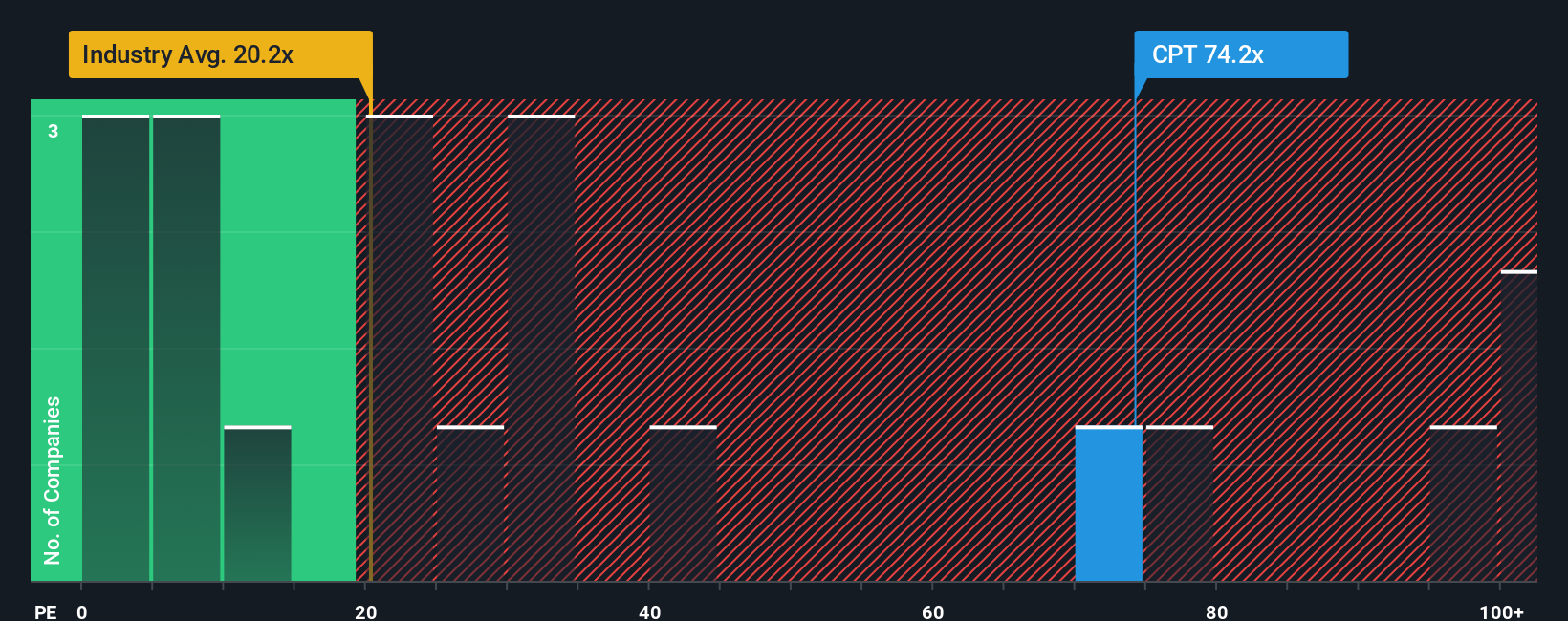

Find out about the key risks to this Camden Property Trust narrative.Another View: What About Camden's Earnings Multiple?

While fair value models point to Camden Property Trust being undervalued, a look at its price compared to earnings tells a much different story. This approach suggests the stock is actually expensive. Which method should investors trust when views like these collide?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you think your perspective differs or enjoy reaching your own conclusions, you can put together your own take on Camden in just a few minutes. Do it your way

A great starting point for your Camden Property Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single stock define your portfolio. Take charge by searching for hidden opportunities that can boost your investment game and keep you ahead of the crowd.

- Find bargains with untapped growth by checking out undervalued stocks based on cash flows before the market catches on.

- Discover the next AI trailblazer making headlines by browsing AI penny stocks for forward-thinking companies using artificial intelligence to shape tomorrow.

- Build a steady income stream from companies known for generous payouts by exploring dividend stocks with yields > 3% with strong yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPT

Camden Property Trust

An S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives