- United States

- /

- Residential REITs

- /

- NYSE:CPT

Camden Property Trust (CPT): Is the Current Share Price Leaving Value on the Table?

Reviewed by Kshitija Bhandaru

Camden Property Trust (CPT) shares have traded down about 1% today, continuing a pattern of modest declines over the past month and past 3 months. With a year-to-date dip nearing 9%, investors may be reassessing recent performance trends.

See our latest analysis for Camden Property Trust.

Camden Property Trust’s share price has seen pressure throughout the year as shifting expectations around rental demand and interest rates weigh on the sector. Despite the pullback, its five-year total shareholder return of 26% reflects the company’s ability to create value over time, even as recent momentum has faded.

If you’re curious about where opportunity might be building, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading 16% below analyst targets and financials still growing, the key question now is whether Camden Property Trust is undervalued or if the market already reflects the company’s future prospects. Could this be the opening investors are looking for?

Most Popular Narrative: 14.1% Undervalued

With Camden Property Trust’s last close at $104.42 and the most widely followed narrative projecting fair value at $121.55, the market appears to be overlooking key drivers behind future growth and pricing power.

Record-high apartment demand, improving affordability (wages outpacing rent growth for 31 months), and strong resident retention due to high homeownership costs are strengthening Camden's occupancy and ability to grow revenues. This is laying the groundwork for outsized rent growth as supply moderates in 2026 and 2027.

Want to know the engine behind that narrative? There is a bold set of analyst forecasts boosting this price target, with assumptions around future rent hikes, profit margins, and a valuation multiple rarely seen for REITs. The details might surprise you. Discover which numbers could turn today’s price into a relative bargain if these financial projections hold up.

Result: Fair Value of $121.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. A slowdown in Sun Belt job growth or persistent oversupply could challenge Camden's revenue and margin outlook going forward.

Find out about the key risks to this Camden Property Trust narrative.

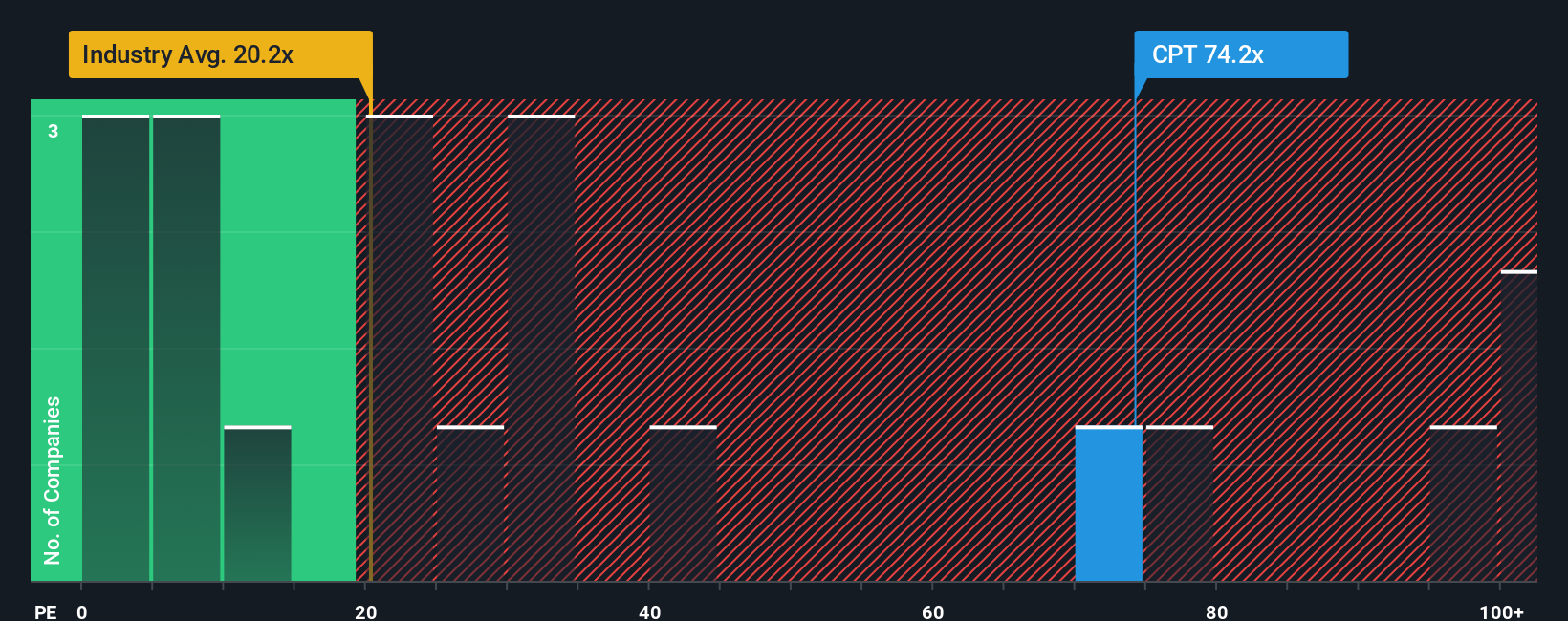

Another View: Valuation by Price-to-Earnings

Taking a different angle, Camden Property Trust trades at a price-to-earnings ratio of 71.7x, which is far above both the global Residential REITs industry average of 19.9x and its peers at 42x. Even against a fair ratio of 34.3x, shares look pricey. This gap suggests valuation risk if earnings do not accelerate as hoped. Is the market simply expecting too much, or could something drive the stock higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you’d rather chart your own path or dig into the numbers yourself, it’s quick and easy to craft a personal view in just a few minutes, so why not Do it your way

A great starting point for your Camden Property Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Stock Ideas?

Why limit your opportunities to just one company? Take charge of your investing journey and get ahead by targeting stocks with fresh momentum and powerful potential for returns.

- Unlock income potential and stability by checking out these 19 dividend stocks with yields > 3% with yields above 3% to support your portfolio.

- Accelerate your search for tomorrow's market movers by reviewing these 24 AI penny stocks that could capitalize on rapid advances in artificial intelligence.

- Stay ahead of the curve and position yourself for growth with these 904 undervalued stocks based on cash flows based on robust cash flows and attractive price points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPT

Camden Property Trust

An S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives