- United States

- /

- Residential REITs

- /

- NYSE:CLPR

Clipper Realty's (NYSE:CLPR) Shareholders Are Down 34% On Their Shares

While it may not be enough for some shareholders, we think it is good to see the Clipper Realty Inc. (NYSE:CLPR) share price up 22% in a single quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 34% in the last year, significantly under-performing the market.

View our latest analysis for Clipper Realty

Because Clipper Realty made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Clipper Realty saw its revenue grow by 7.4%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 34% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

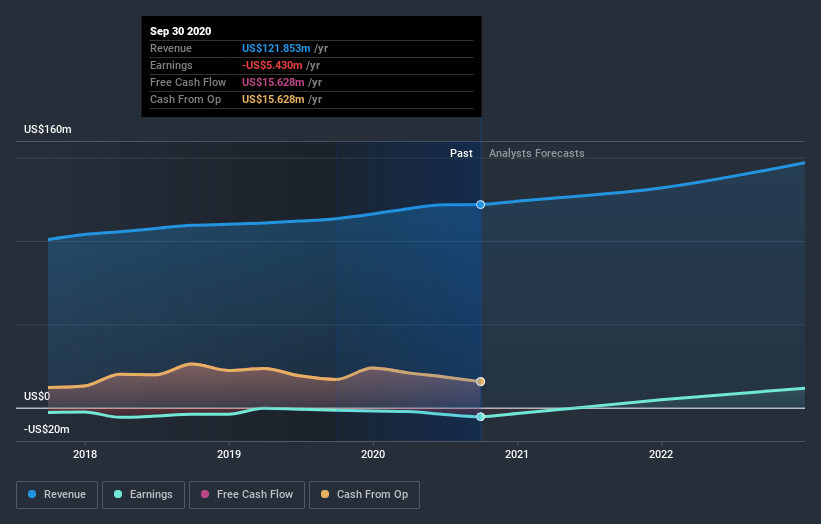

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Clipper Realty in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Clipper Realty, it has a TSR of -30% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Clipper Realty shareholders are down 30% for the year, (even including dividends), but the broader market is up 27%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 6% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Clipper Realty better, we need to consider many other factors. For example, we've discovered 2 warning signs for Clipper Realty that you should be aware of before investing here.

Clipper Realty is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Clipper Realty, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CLPR

Clipper Realty

Clipper Realty Inc. (the “Company” or “we”) is a self-administered and self-managed real estate company that acquires, owns, manages, operates and repositions multifamily residential and commercial properties in the New York metropolitan area, with a current portfolio in Manhattan and Brooklyn.

Average dividend payer and fair value.