- United States

- /

- Specialized REITs

- /

- NYSE:CCI

How Investors May Respond To Crown Castle (CCI) Divesting Fiber to Refocus on Towers

Reviewed by Sasha Jovanovic

- In recent days, Crown Castle announced plans to sell its fiber segment and shift focus exclusively to its core U.S. tower business amid ongoing sector changes.

- This move is seen as a way to streamline operations, strengthen profitability, and potentially capture greater value as mobile data demand rises with continued 5G expansion.

- We'll take a look at how the decision to divest the fiber segment may alter Crown Castle's investment narrative and long-term prospects.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Crown Castle Investment Narrative Recap

To be a Crown Castle shareholder, you need confidence in the enduring demand for U.S. wireless infrastructure and the company's ability to drive steady revenue through long-term tower leasing, especially as 5G rolls out. The recent announcement to divest the fiber segment has not materially altered the immediate catalyst of capturing mobile data growth, but execution risks and regulatory delays now feel more acute in the short term for the divestiture process.

One announcement closely tied to this shift is the upcoming leadership transition, with Christian H. Hillabrant named as the new CEO, effective September 2025. Leadership changes during a major operational shift can impact both continuity and how well the company delivers on tighter strategic focus, factors that matter for near-term investor confidence as Crown Castle evolves its approach.

On the other hand, investors should be aware that ongoing challenges with the recent dividend reduction could complicate...

Read the full narrative on Crown Castle (it's free!)

Crown Castle's narrative projects $4.6 billion revenue and $1.6 billion earnings by 2028. This requires a 10.7% annual revenue decline and a $5.5 billion increase in earnings from the current -$3.9 billion.

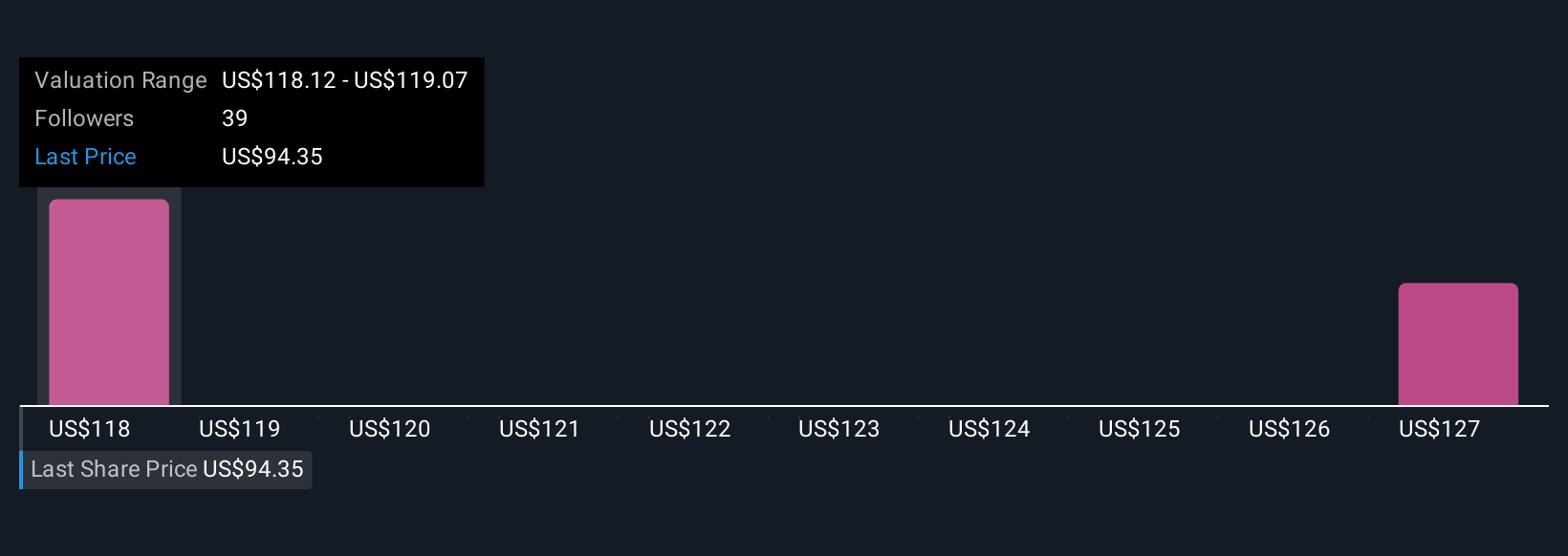

Uncover how Crown Castle's forecasts yield a $118.12 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Crown Castle's fair value between US$102.56 and US$127.97. This range reflects varying views on value, even as some see improving profitability and share repurchases as key positives for the company's next phase, reminding you to consider multiple viewpoints before acting.

Explore 3 other fair value estimates on Crown Castle - why the stock might be worth just $102.56!

Build Your Own Crown Castle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Castle research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crown Castle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Castle's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives