- United States

- /

- REITS

- /

- NYSE:BNL

Broadstone Net Lease (BNL) Valuation in Focus as Higher Sales Contrast with Lower Profits

Reviewed by Simply Wall St

Broadstone Net Lease recently published its third-quarter and nine-month earnings, showing higher sales compared to last year. However, net income and earnings per share fell. This mix of improving revenues and lower profits will interest investors looking for the story behind the numbers.

See our latest analysis for Broadstone Net Lease.

Broadstone Net Lease’s recent quarterly earnings update, paired with its newly declared dividend, has sparked interest and helped keep momentum positive. The stock has climbed 14.21% on a share price basis so far this year, and its one-year total shareholder return stands at 10.09%. While short-term gains have moderated a bit after recent volatility, the longer-term performance reflects a company that continues to attract investors, even as profits have softened.

If you’re looking for fresh opportunities beyond the familiar names, now could be a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With revenues on the rise but profits slipping and shares trading below analyst price targets, the key question is whether Broadstone Net Lease is undervalued or if the market already anticipates future growth in its current price.

Most Popular Narrative: 9.0% Undervalued

The most widely followed narrative sets Broadstone Net Lease’s fair value at $19.60, above the last closing price of $17.92. This outlook comes as analysts raise their expectations in response to recent growth moves and continued pipeline expansion.

Broadstone Net Lease’s fair value has been revised upward to $19.60 as analysts gain confidence in management’s strategic execution, earnings visibility from a growing development pipeline, and enhanced growth prospects following accretive transactions and strong Q2 results.

Want the playbook behind this upgrade? The answer is a blend of escalating margins, a sharper growth trajectory, and future earnings estimates that most would miss at first glance. Wondering which specific financial levers are fueling the optimism? Click through to see which bold assumptions power this valuation and how they could impact Broadstone Net Lease’s share price.

Result: Fair Value of $19.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant credit issues and elevated acquisition costs could quickly derail Broadstone Net Lease’s optimistic outlook if these factors worsen unexpectedly.

Find out about the key risks to this Broadstone Net Lease narrative.

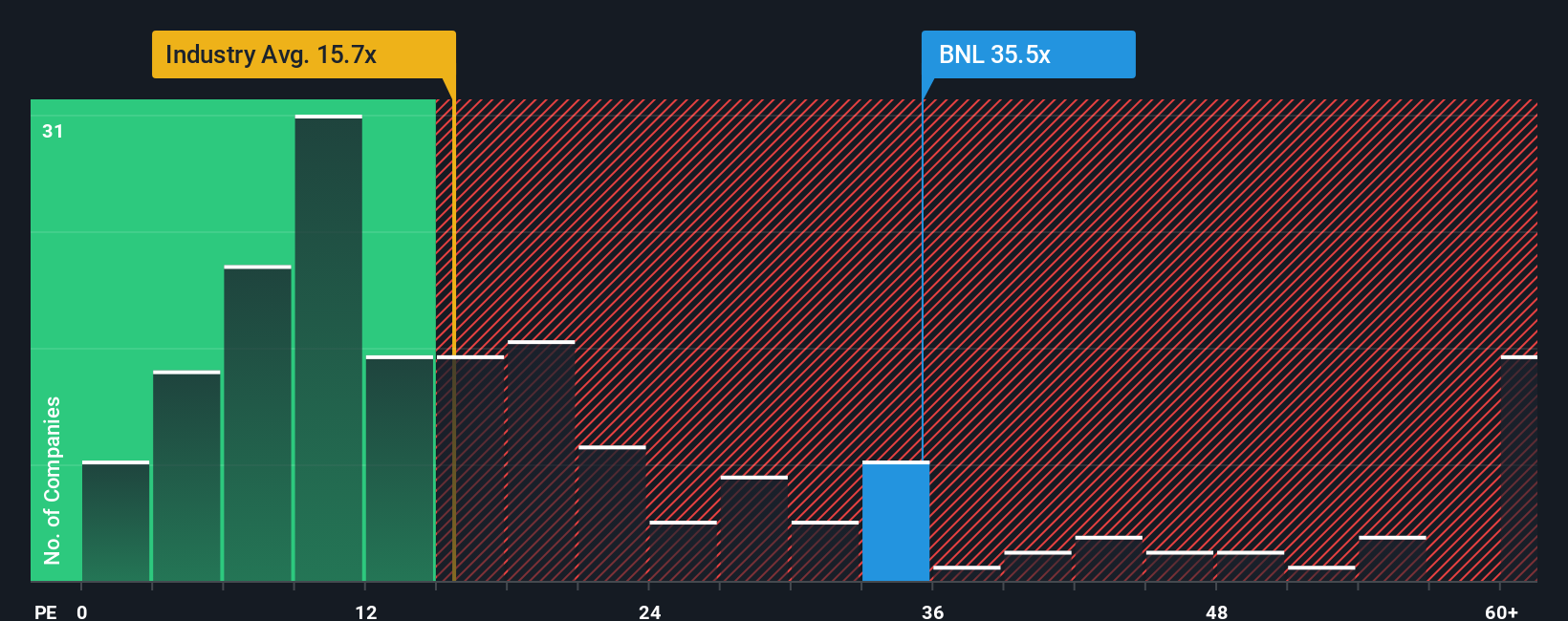

Another View: Price Ratios Signal a Different Story

Looking at price-to-earnings ratios offers a striking contrast. Broadstone Net Lease trades at 38.3 times earnings, which is much higher than its peer average of 22.4 times and above its fair ratio of 36.4 times. This suggests the shares could be on the expensive side, potentially increasing valuation risk if industry trends shift. Could the market be overlooking these signals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadstone Net Lease Narrative

If you think there’s more to the story or want to test your own perspective, it’s easy to dig into the numbers yourself and shape your own view in just a few minutes. Do it your way

A great starting point for your Broadstone Net Lease research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to a single opportunity? Stay a step ahead and tap into fresh possibilities by using the Simply Wall Street Screener to uncover standout stocks others might overlook.

- Tap into tomorrow’s breakthroughs by checking out these 28 quantum computing stocks, which is making waves in the fast-evolving quantum computing sector.

- Catch strong yields by searching for these 22 dividend stocks with yields > 3%, as these may offer compelling income potential even as markets shift.

- Ride the next technology wave and target growth with these 26 AI penny stocks, which is leading innovation in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadstone Net Lease might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNL

Broadstone Net Lease

BNL is an industrial-focused, diversified net lease REIT that invests in primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants.

Average dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion