- United States

- /

- REITS

- /

- NYSE:BNL

Broadstone Net Lease (BNL): Evaluating Valuation Following Analyst Upgrades and $350M Capital Raise

Reviewed by Kshitija Bhandaru

Broadstone Net Lease (BNL) has drawn fresh attention from Wall Street following a string of positive analyst moves and a recently completed $350 million senior notes offering. This influx of support comes as the company refines its portfolio and prepares for new growth initiatives.

See our latest analysis for Broadstone Net Lease.

Momentum seems to be building for Broadstone Net Lease, with its successful $350 million notes offering and notable analyst upgrades reflecting a more optimistic outlook among investors. Over the last twelve months, steady developments have been matched by a 1-year total shareholder return of 7% and a five-year total return just under 50%. This signals that patient shareholders have seen meaningful gains even as share price movement has been more modest in recent months.

If Broadstone’s evolving story has you curious about wider opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below consensus price targets and analysts pointing to improved prospects, investors are left to consider this question: Is Broadstone Net Lease undervalued, or have markets already factored in the next wave of growth?

Most Popular Narrative: 6.7% Undervalued

Broadstone Net Lease’s most-followed valuation narrative places its fair value at $19.70, a premium over the last close of $18.38. This subtle gap has the market debating whether recent strategic moves are fully reflected in the current price or if there is room for further re-rating.

"Disciplined portfolio repositioning, reducing exposure to riskier healthcare and office assets while recycling capital into resilient industrial and retail assets, has improved risk-adjusted returns and reduced lease rollover risk, which should lead to future multiple expansion and increased AFFO per share."

Want to know what is fueling this market optimism? The crux of the narrative centers around ambitious growth targets and a hard-to-reach profit margin. The assumptions behind that price could surprise you. Ready to dive in and uncover the bold projections and the key levers supporting this premium valuation? Do not miss what is baked into the analyst consensus.

Result: Fair Value of $19.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant credit risks and growing competition for industrial assets could pressure occupancy and margins. This could potentially derail the upbeat analyst outlook.

Find out about the key risks to this Broadstone Net Lease narrative.

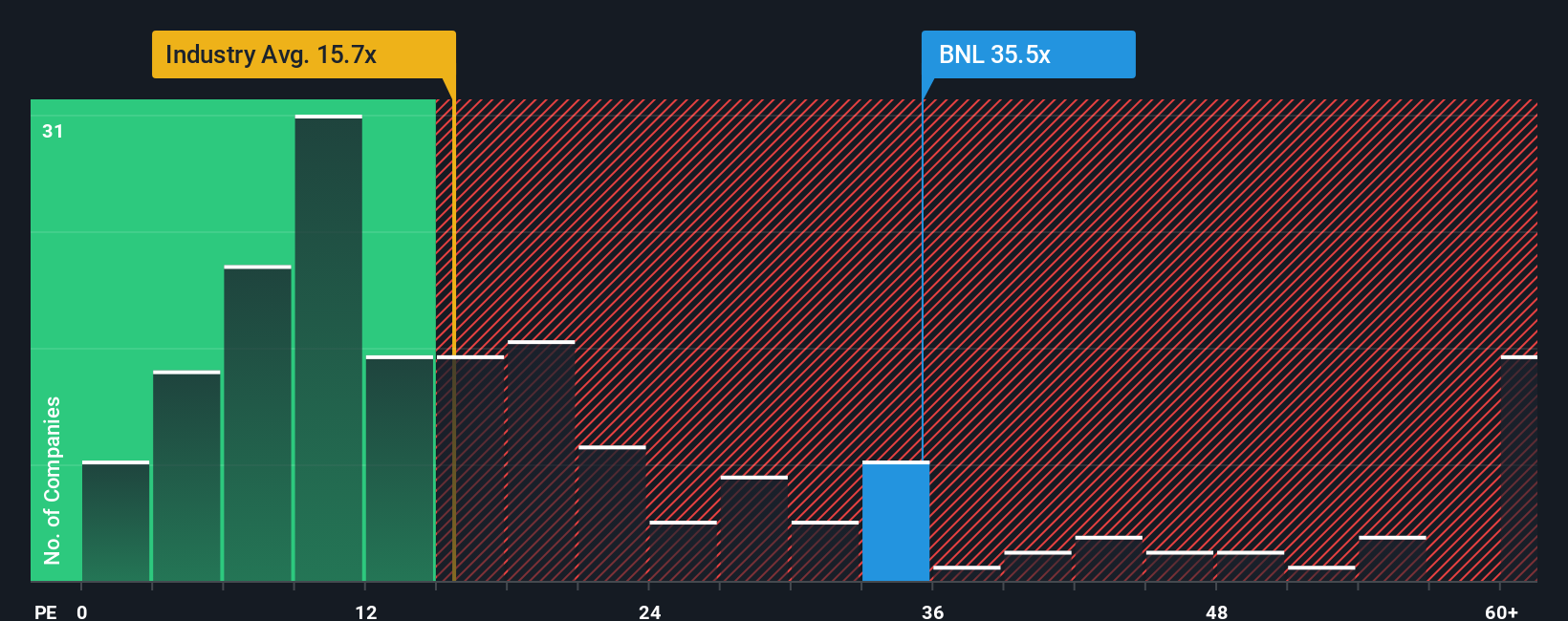

Another View: Market Multiples Paint a Different Picture

Looking through market ratios, Broadstone Net Lease appears expensive. Its price-to-earnings ratio is 35.6x, which is notably higher than the peer average of 23.1x and the global REIT industry average of just 15.7x. Even compared to its fair ratio of 35.4x, the stock is slightly above where the market could head if sentiment shifts. This premium could mean investors are factoring in more optimism than fundamentals warrant, or perhaps the market simply expects outperformance. What do you think?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadstone Net Lease Narrative

If you think there is more to Broadstone’s story, or you want to uncover your own insights from the numbers, you can create your own analysis in just a few minutes: Do it your way

A great starting point for your Broadstone Net Lease research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are ready to make smarter moves, do not limit yourself to one stock. Branch out and find unique opportunities you will not want to miss.

- Secure reliable income streams by checking out these 19 dividend stocks with yields > 3%, which offers impressive yields that can strengthen your portfolio’s foundation.

- Capitalize on AI’s unstoppable progress by targeting these 24 AI penny stocks, leading the way in artificial intelligence innovation and market disruption.

- Uncover hidden gems trading below their worth as you pursue value with these 904 undervalued stocks based on cash flows, featuring companies that could be tomorrow’s outperformers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadstone Net Lease might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNL

Broadstone Net Lease

BNL is an industrial-focused, diversified net lease REIT that invests in primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives