- United States

- /

- REITS

- /

- NYSE:ALEX

Did Raised FFO Guidance and Dividend Resilience Just Shift Alexander & Baldwin's (ALEX) Investment Narrative?

Reviewed by Sasha Jovanovic

- Recently, Alexander & Baldwin experienced a 15% share price correction, with market commentary highlighting ongoing robust fundamentals, healthy debt metrics, and improved dividend coverage despite broader regional economic softness.

- Investor optimism appears to be driven by the company's raised FFO growth guidance, stable payout ratio, and prudent fixed-rate debt structure, which collectively signal confidence in dividend sustainability and income potential.

- We'll explore how the company's raised FFO guidance and dividend resilience could reshape Alexander & Baldwin's overall investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Alexander & Baldwin Investment Narrative Recap

To be a shareholder in Alexander & Baldwin, investors must believe in the long-term durability of Hawaii’s commercial real estate fundamentals, underpinned by resilient demand and high occupancy, even as regional economic softness looms. The recent 15 percent share price correction does not appear to materially impact the short-term catalyst of dividend stability, nor does it amplify the biggest risk, Hawaii’s dependence on tourism, as the company retains strong coverage and prudent debt metrics.

Of the recent announcements, the Board’s approval of a steady Q3 2025 dividend of $0.225 per share stands out. This consistency in dividend payments serves as a clear signal regarding management’s confidence in maintaining stable shareholder returns, even as questions about broader regional growth linger around the main business catalysts.

In contrast, investors should be aware that ongoing capital expenditure needs could ...

Read the full narrative on Alexander & Baldwin (it's free!)

Alexander & Baldwin's outlook projects $174.8 million in revenue and $40.7 million in earnings by 2028. This is based on a 9.8% annual revenue decline and a $37.8 million decrease in earnings from the current $78.5 million.

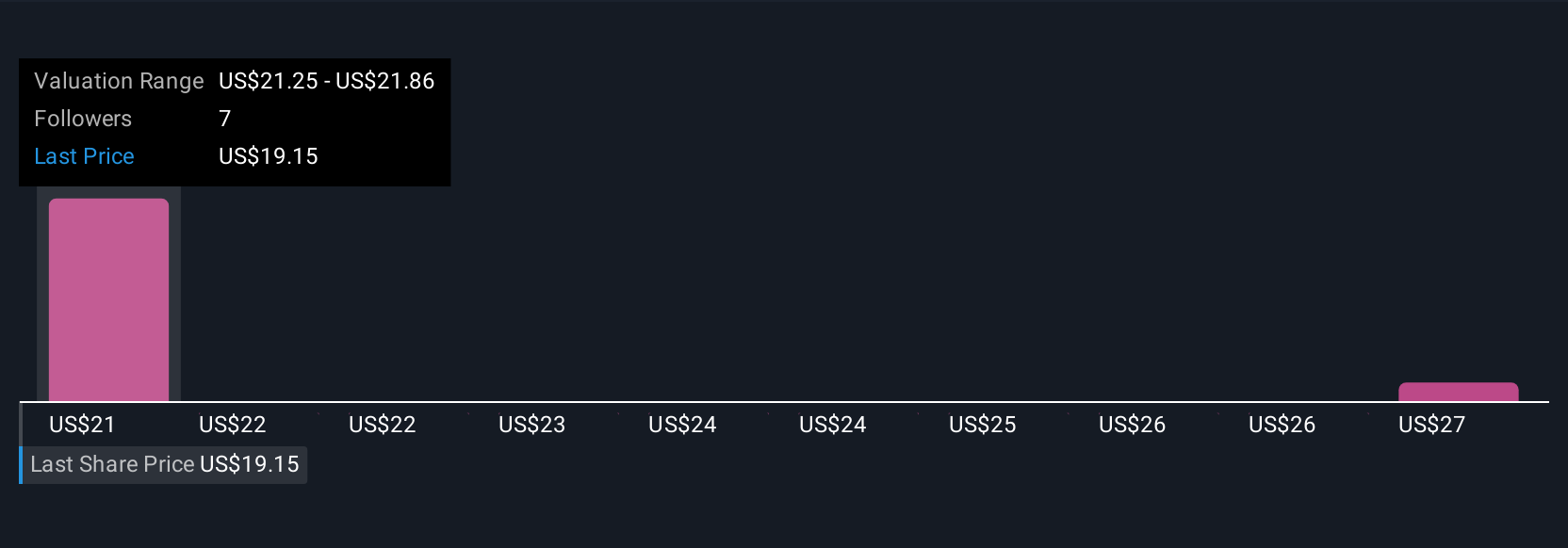

Uncover how Alexander & Baldwin's forecasts yield a $21.25 fair value, a 27% upside to its current price.

Exploring Other Perspectives

With only two community fair value estimates ranging from US$21.25 to US$26.76, investor opinions on Alexander & Baldwin’s upside are divided. Consider how recurring capital expenditures may reduce available cash for dividends as you review these community insights.

Explore 2 other fair value estimates on Alexander & Baldwin - why the stock might be worth as much as 60% more than the current price!

Build Your Own Alexander & Baldwin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Alexander & Baldwin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexander & Baldwin's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALEX

Alexander & Baldwin

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives