- United States

- /

- Oil and Gas

- /

- NYSE:VLO

3 Dividend Stocks To Consider With Up To 5.9% Yield

Reviewed by Simply Wall St

The market has stayed flat over the past week but has risen 11% in the last year, with earnings forecasted to grow by 15% annually. In this environment, dividend stocks can be an attractive option for investors seeking steady income and potential growth, offering yields that can enhance overall portfolio returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.58% | ★★★★★☆ |

| Universal (UVV) | 5.96% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.62% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.01% | ★★★★★★ |

| Ennis (EBF) | 5.42% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.91% | ★★★★★☆ |

| Dillard's (DDS) | 5.92% | ★★★★★★ |

| CompX International (CIX) | 4.50% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.78% | ★★★★★★ |

| Chevron (CVX) | 4.51% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

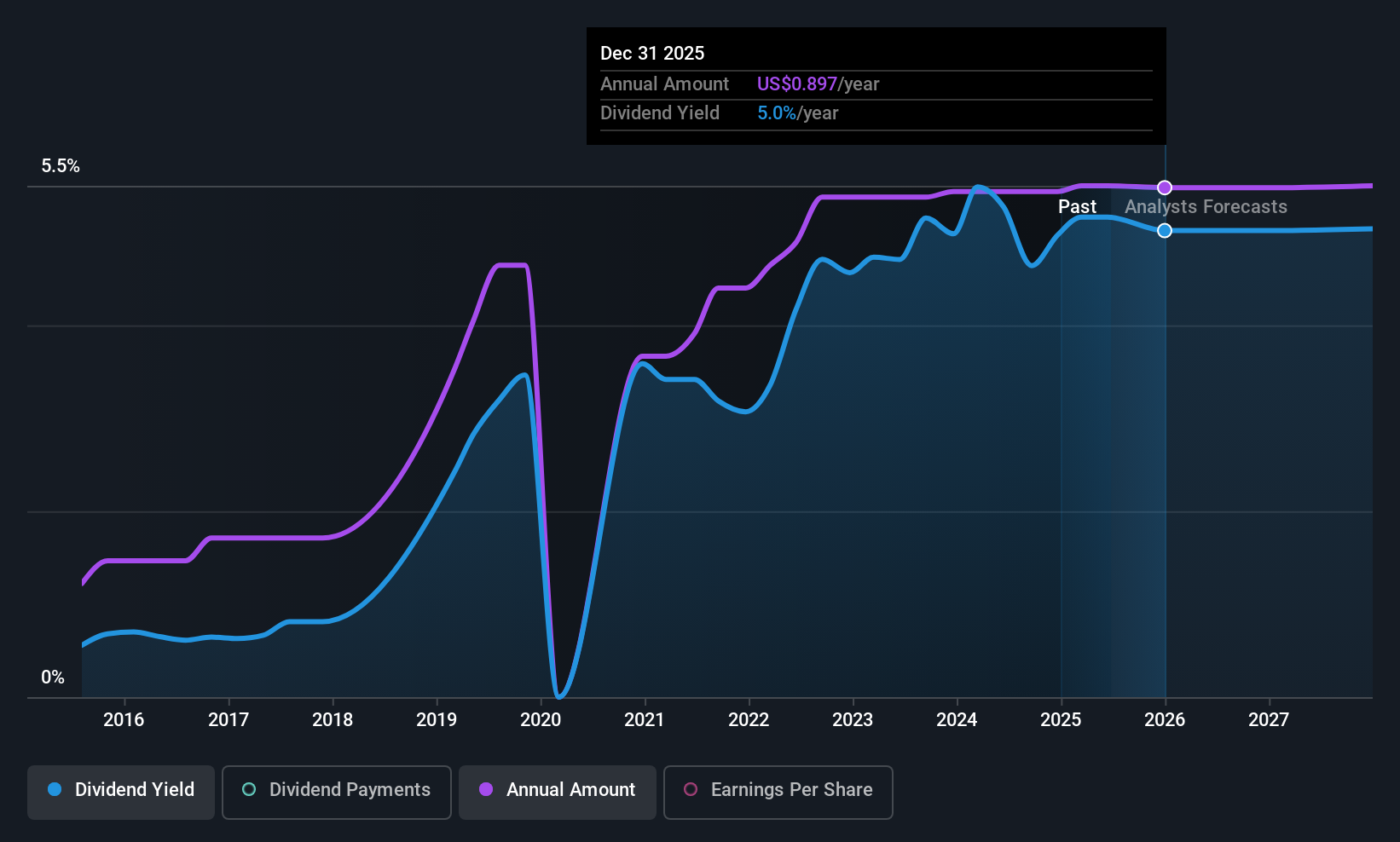

Alexander & Baldwin (ALEX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Alexander & Baldwin, Inc. (NYSE: ALEX) is a real estate investment trust that focuses exclusively on Hawai'i commercial real estate, being the state's largest owner of grocery-anchored neighborhood shopping centers, with a market cap of $1.30 billion.

Operations: Alexander & Baldwin generates revenue primarily from its Commercial Real Estate segment, which accounts for $199.54 million, and its Land Operations segment, contributing $29.66 million.

Dividend Yield: 5%

Alexander & Baldwin offers a dividend yield of 5.01%, placing it in the top 25% of US dividend payers, with dividends covered by earnings and cash flows (payout ratios: 67% and 60.6%). However, its dividend history is unstable, and earnings are forecasted to decline by an average of 8.6% annually over the next three years. Recent developments include redevelopment plans for Komohana Industrial Park, which could impact future revenue streams positively upon completion in late 2026.

- Navigate through the intricacies of Alexander & Baldwin with our comprehensive dividend report here.

- Our expertly prepared valuation report Alexander & Baldwin implies its share price may be lower than expected.

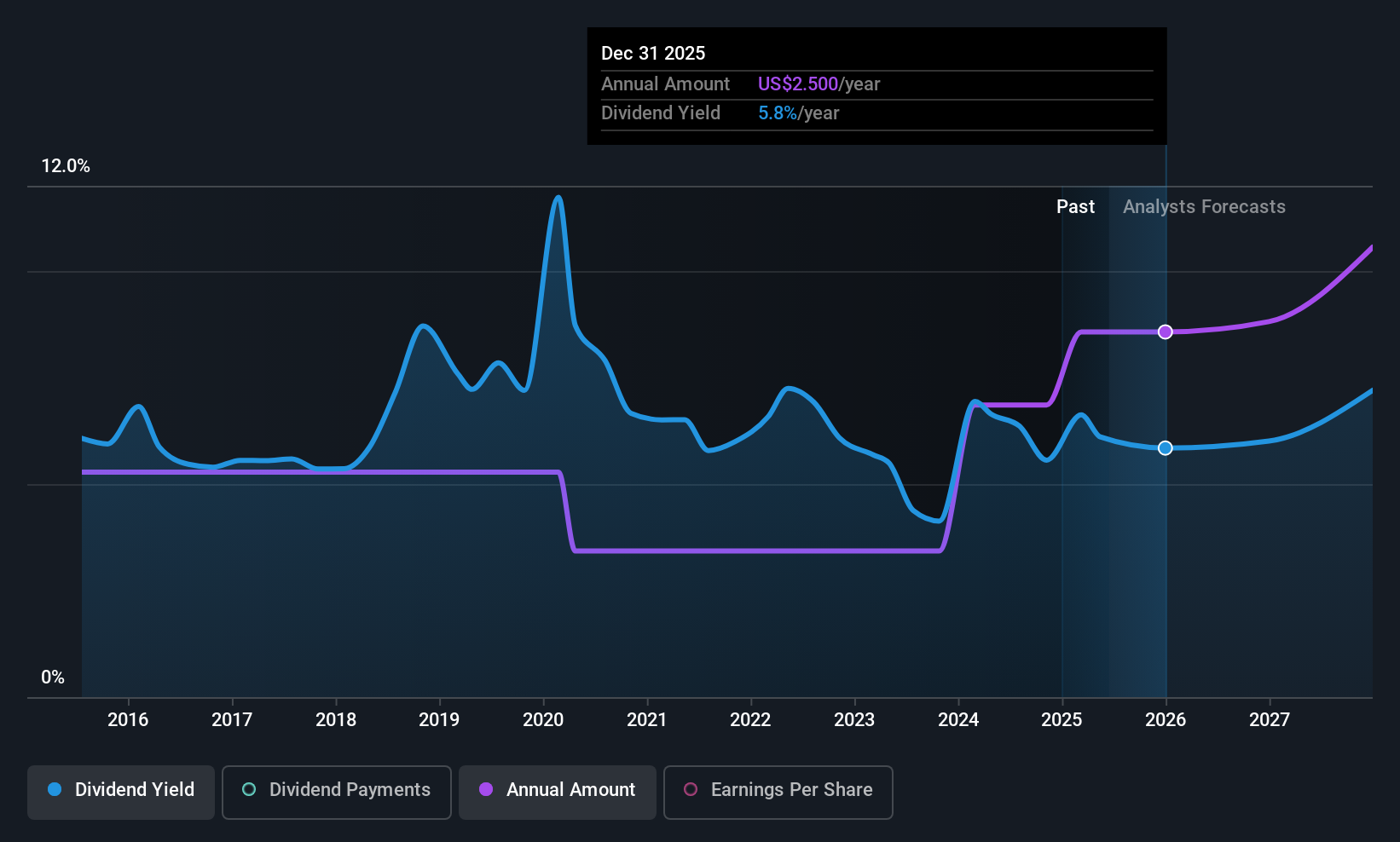

Banco Latinoamericano de Comercio Exterior S. A (BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (BLX) is a financial institution that specializes in providing trade financing solutions across Latin America, with a market cap of approximately $1.55 billion.

Operations: Banco Latinoamericano de Comercio Exterior S.A. (BLX) generates its revenue primarily from two segments: $28.58 million from Treasury and $260.93 million from Commercial activities.

Dividend Yield: 5.9%

Banco Latinoamericano de Comercio Exterior, S.A. provides a dividend yield of 5.91%, ranking it among the top 25% of US dividend payers, supported by a low payout ratio of 40.2%. Despite this, its dividend history has been volatile over the past decade. The company recently dropped from several Russell indices but announced a strategic alliance with Silver Birch Finance to enhance trade financing in Latin America, potentially impacting future growth positively.

- Unlock comprehensive insights into our analysis of Banco Latinoamericano de Comercio Exterior S. A stock in this dividend report.

- Our valuation report here indicates Banco Latinoamericano de Comercio Exterior S. A may be undervalued.

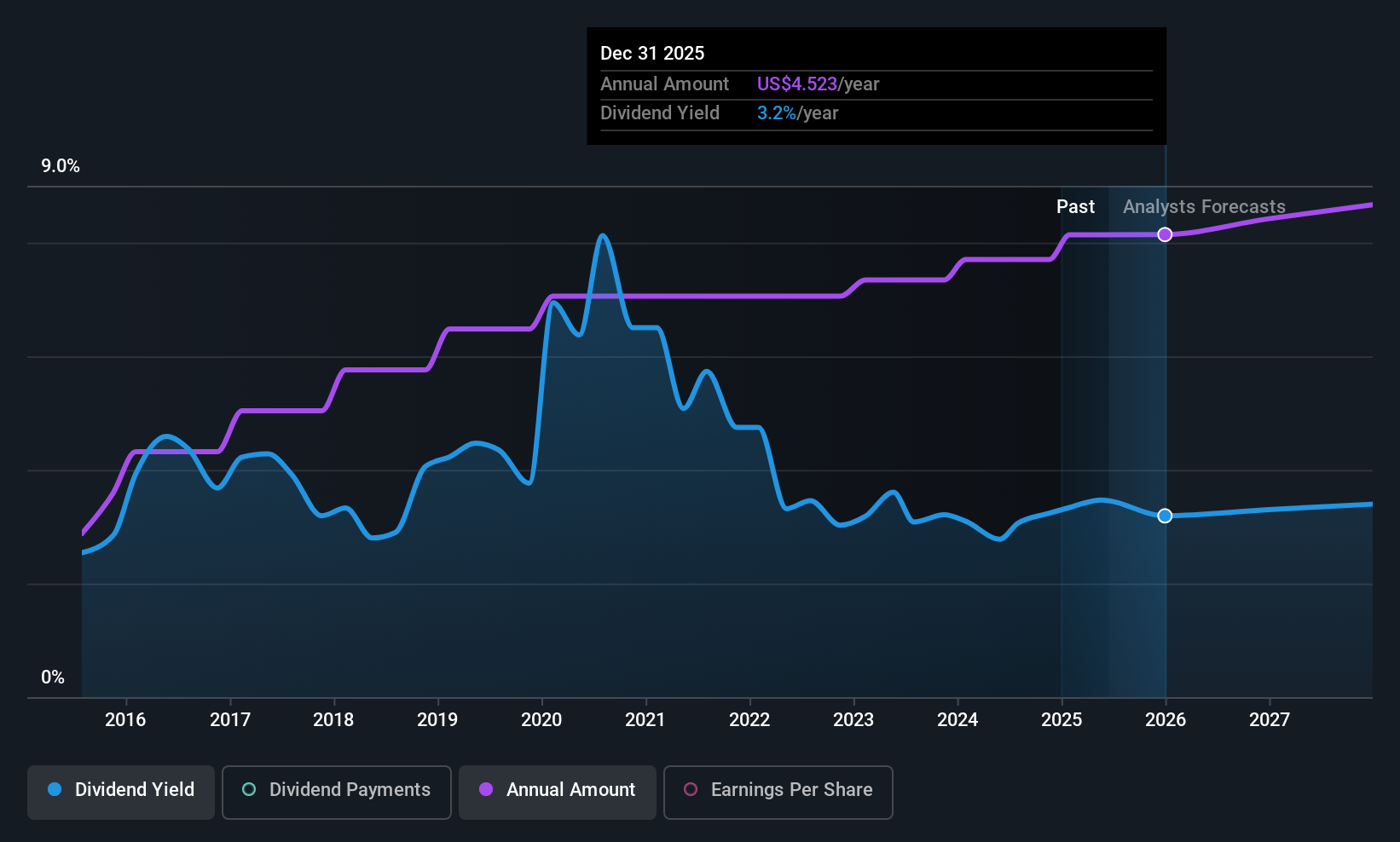

Valero Energy (VLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valero Energy Corporation operates in the manufacturing, marketing, and selling of petroleum-based and low-carbon liquid transportation fuels and petrochemical products across multiple regions including the United States, Canada, Europe, Latin America, and more with a market cap of approximately $47.94 billion.

Operations: Valero Energy's revenue segments include Ethanol at $4.61 billion, Renewable Diesel at $4.56 billion, and Refining (including VLP but excluding Renewable Diesel) at $122.48 billion.

Dividend Yield: 3%

Valero Energy's dividend yield of 3.04% falls short of the top 25% in the US market, and its high payout ratio of 149.2% raises concerns about sustainability, although cash flows cover dividends with a lower cash payout ratio of 29.3%. Despite reliable and growing dividends over ten years, recent financial results show a net loss and reduced profit margins. Valero was recently added to the Russell Midcap Value Index after being dropped from several Russell Top 200 indices.

- Click here and access our complete dividend analysis report to understand the dynamics of Valero Energy.

- Insights from our recent valuation report point to the potential overvaluation of Valero Energy shares in the market.

Seize The Opportunity

- Click here to access our complete index of 136 Top US Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives