- United States

- /

- Retail REITs

- /

- NYSE:AKR

How Does Acadia Realty Trust Stack Up After Its 2025 Rental Income Guidance Cut?

Reviewed by Bailey Pemberton

Deciding what to do with Acadia Realty Trust stock in this market can feel like standing at a crossroads. You want to make a move that makes sense for your portfolio, but the stock's recent price swings might have you second-guessing whether to buy, hold, or move on. Over the last year, Acadia has seen its value decline by 8.7%, with a year-to-date return of -16.6%. Yet, if you zoom out, the longer-term performance tells a different story. Over the past five years, the stock is up an impressive 126.9%, and even over three years it boasts a gain of 81.8%.

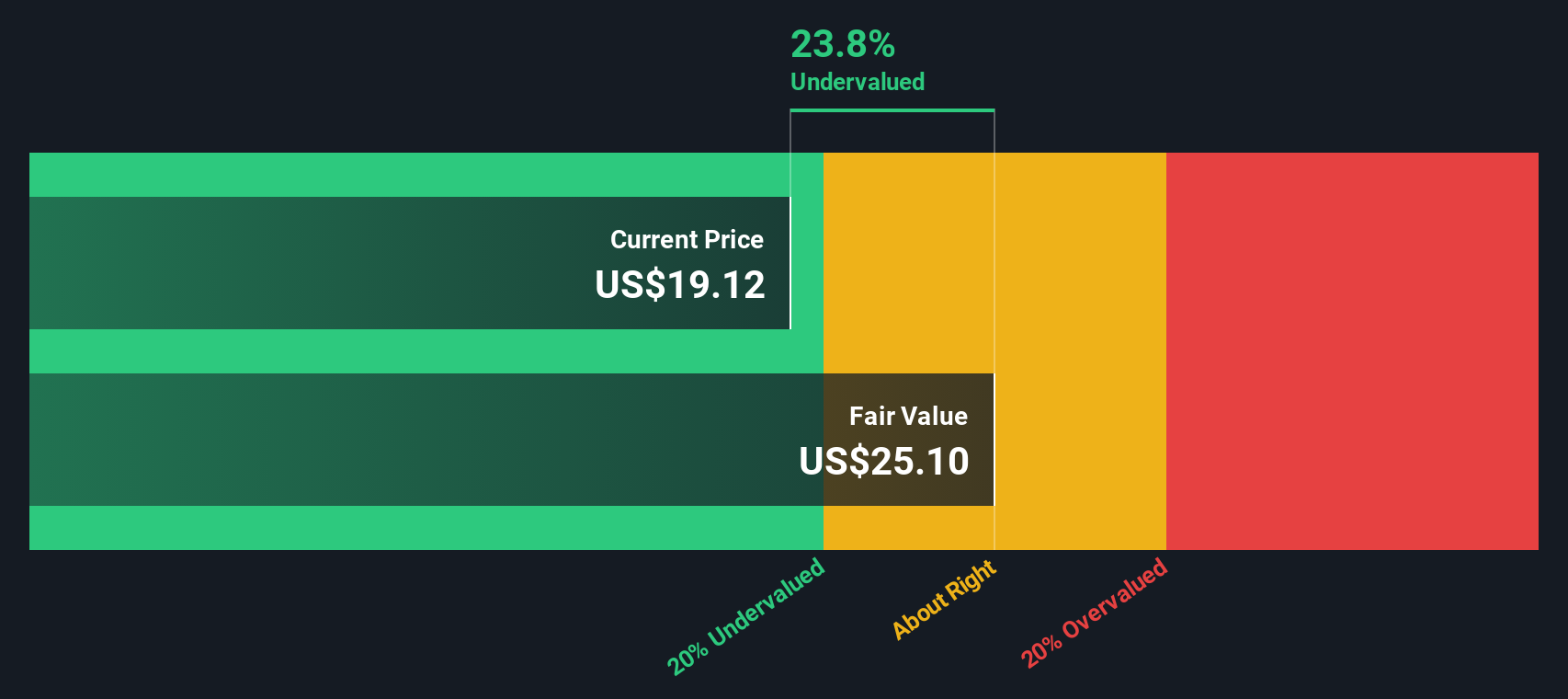

That kind of volatility can be a signal that the market is re-evaluating how much risk (and reward) is really here. Recent shifts in real estate sentiment and a focus on property fundamentals have played a big role, but the question now is whether these numbers represent a real bargain or an ongoing risk. Our valuation score for Acadia Realty Trust comes in at 1 out of 6, which means it's currently undervalued by just one measure. But as you'll see, different methods can paint different pictures and there's more to fair value than any single metric. In a moment, we'll break down the main valuation approaches, and later, explore an even deeper way to think about what Acadia is truly worth.

Acadia Realty Trust scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Acadia Realty Trust Discounted Cash Flow (DCF) Analysis

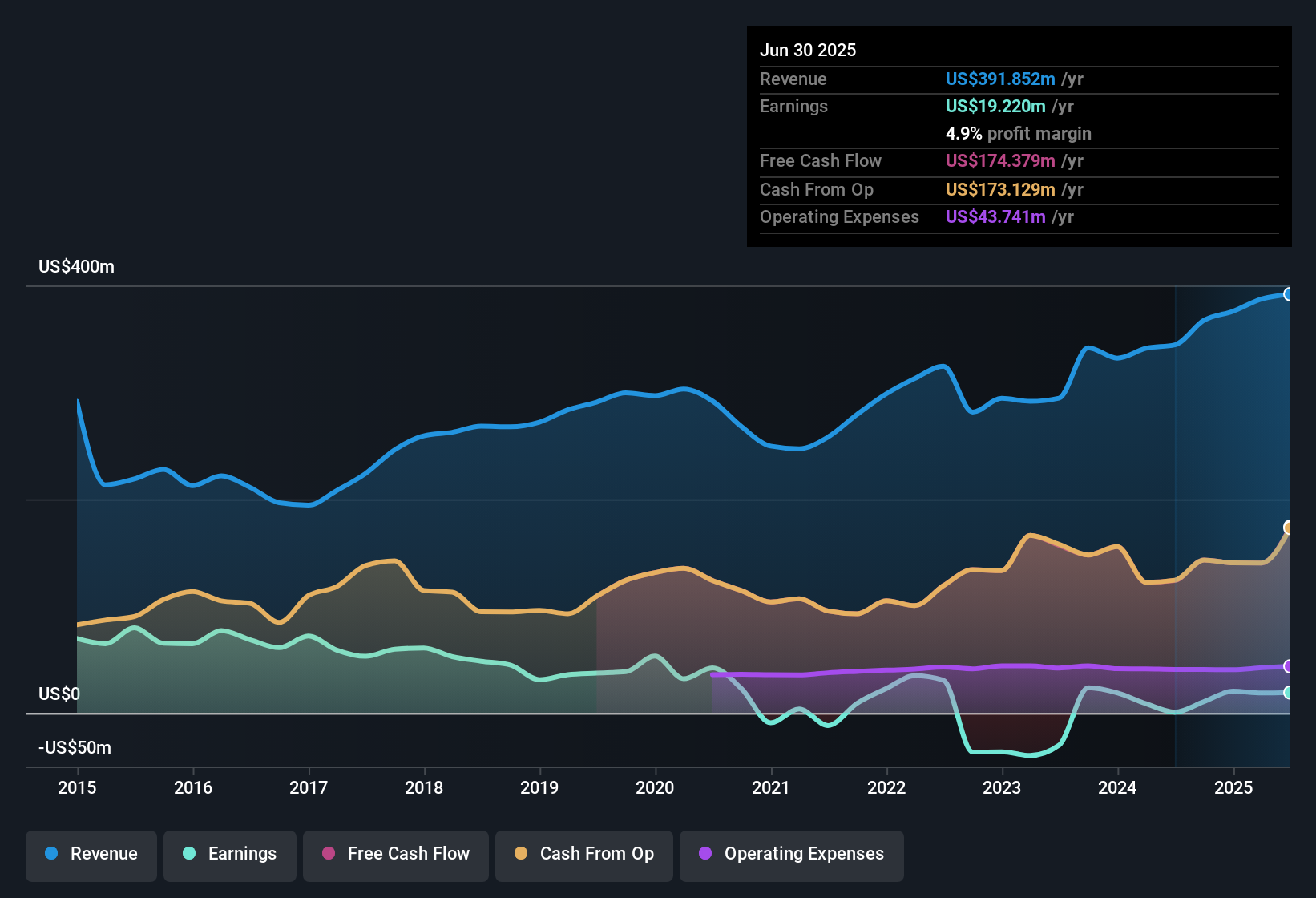

The Discounted Cash Flow (DCF) model estimates a company's value by projecting future adjusted funds from operations. In this case, Acadia Realty Trust's free cash flows are used, and those projections are discounted back to today’s dollars. This helps investors determine what the company may truly be worth based on the money it is expected to generate.

Currently, Acadia Realty Trust reports Free Cash Flow of $134.5 Million. Analyst estimates project gradual growth, with cash flows expected to reach $192 Million by the end of 2029. Analyst forecasts guide the next several years, while longer-term projections are extrapolated using a standard baseline growth rate. All cash flows are measured in $USD.

- 2026 (analyst consensus): $163.7 Million

- 2027 (analyst consensus): $170.6 Million

- 2028 (analyst consensus): $196.7 Million

- 2029 (analyst consensus/single estimate): $192 Million

Based on this DCF approach, Acadia's estimated intrinsic value comes out to $24.71 per share, which represents a 19.3% discount relative to its current trading price. This suggests that the stock is undervalued according to the DCF model, offering potential upside if future cash flow growth materializes as projected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Acadia Realty Trust is undervalued by 19.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Acadia Realty Trust Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies because it quickly tells you how much investors are paying for each dollar of earnings. A company with steady or growing profits is usually best judged using this benchmark. For real estate investment trusts like Acadia, it helps investors see how the company compares to its sector.

A high PE ratio may signal optimism about future growth, or it could indicate elevated risk expectations. Conversely, a lower PE could mean the market expects earnings to stagnate or that investors demand a higher return given uncertainties. What counts as a “normal” or “fair” PE is not universal. It depends on the pace of expected earnings growth and the risks the business faces.

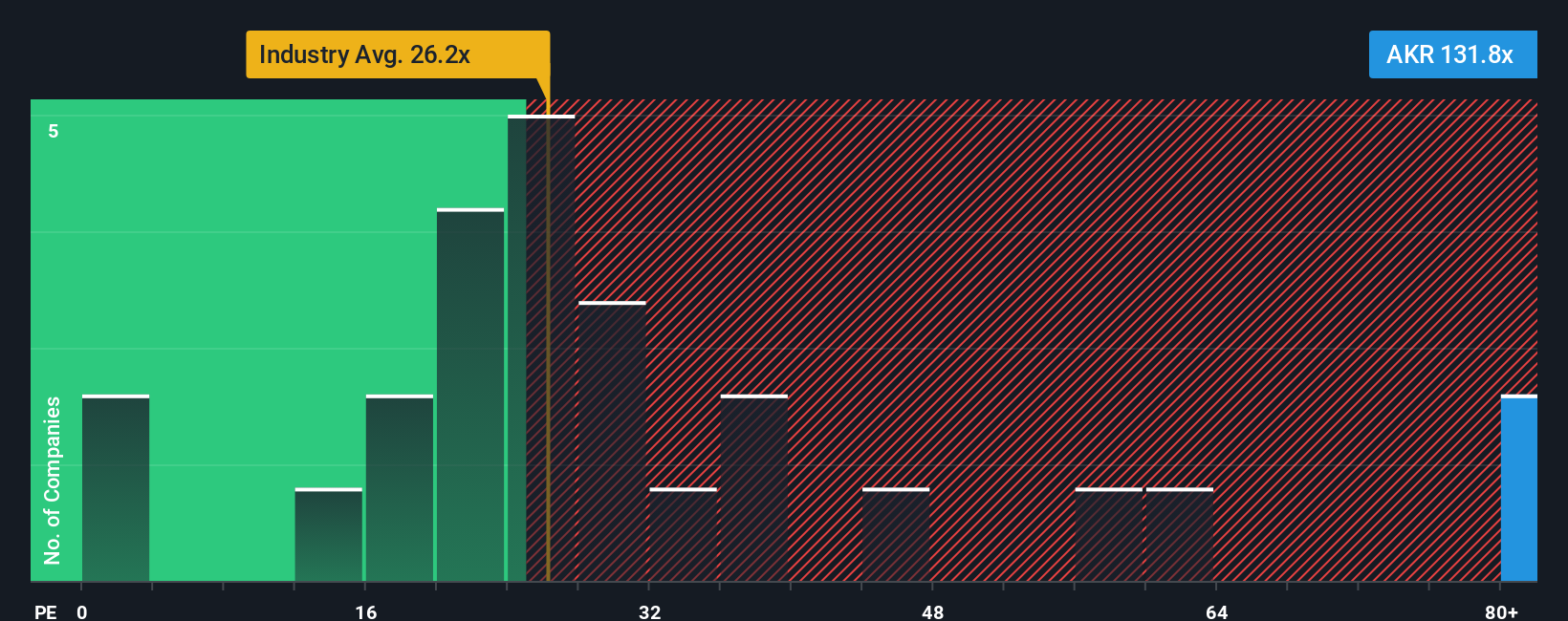

Right now, Acadia Realty Trust trades at a PE ratio of 135.85x. This is substantially higher than both the Retail REITs industry average of 26.06x and the peer group average of 57.33x. That kind of premium can raise eyebrows unless it is supported by major growth prospects or unique strengths.

To get a more tailored sense of value, Simply Wall St’s “Fair Ratio” comes into play. Unlike a straight comparison to industry or peers, the Fair Ratio blends together factors like Acadia’s actual and forecast earnings growth, sector risks, profit margins, market capitalization, and more. For Acadia, the Fair Ratio is calculated at 32.44x, which is well below its current multiple.

Because this Fair Ratio incorporates growth, profitability, risk, and industry specifics, it delivers a more balanced view than just comparing Acadia to competitors. Comparing this number to the current PE, Acadia’s shares look considerably overvalued on earnings alone. The market is pricing in far more optimism than the fundamentals suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Acadia Realty Trust Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a straightforward but powerful tool that lets you connect your view of Acadia Realty Trust's story—why you believe the company might succeed or struggle—to real financial assumptions like future revenue, profit margins, and growth. By defining your Narrative, you link a company’s qualitative outlook to its financial forecast, then see how these expectations translate to a fair value right now.

Narratives are available with just a few clicks within Simply Wall St’s Community page, a feature used by millions of investors to test their ideas and compare with others. They help you decide when to buy or sell, instantly showing whether your version of fair value is higher or lower than the current share price.

What sets Narratives apart is that your forecasts and fair value update automatically as real-world news or earnings reports are released, making sure your investment thesis evolves with the latest information. For example, one investor’s Acadia Narrative may be optimistic, factoring in strong urban retail growth and forecasting a fair value as high as $24.00 per share, while another may be more cautious given e-commerce headwinds, estimating a lower fair value of $20.00 per share. Narratives let you decide what story you believe, and invest accordingly.

Do you think there's more to the story for Acadia Realty Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AKR

Acadia Realty Trust

An equity real estate investment trust focused on delivering long-term, profitable growth.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives