Ken Bernstein has been the CEO of Acadia Realty Trust (NYSE:AKR) since 2001, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the funds from operations and shareholder returns of the company.

View our latest analysis for Acadia Realty Trust

Comparing Acadia Realty Trust's CEO Compensation With the industry

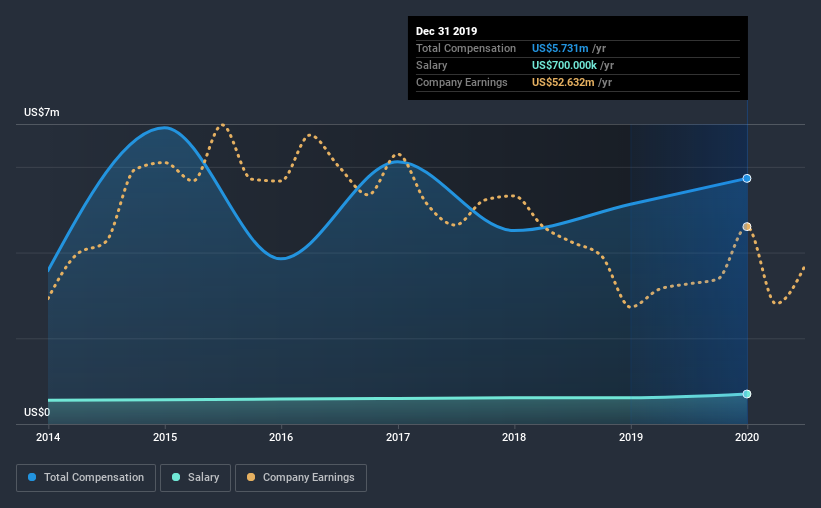

Our data indicates that Acadia Realty Trust has a market capitalization of US$1.1b, and total annual CEO compensation was reported as US$5.7m for the year to December 2019. Notably, that's an increase of 12% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$700k.

In comparison with other companies in the industry with market capitalizations ranging from US$400m to US$1.6b, the reported median CEO total compensation was US$3.2m. This suggests that Ken Bernstein is paid more than the median for the industry. What's more, Ken Bernstein holds US$4.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$700k | US$612k | 12% |

| Other | US$5.0m | US$4.5m | 88% |

| Total Compensation | US$5.7m | US$5.1m | 100% |

On an industry level, roughly 15% of total compensation represents salary and 85% is other remuneration. Acadia Realty Trust pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Acadia Realty Trust's Growth Numbers

Acadia Realty Trust has seen its funds from operations (FFO) increase by 1.9% per year over the past three years. Revenue was pretty flat on last year.

We're not particularly impressed by the revenue growth, but the modest improvement in FFO is good. Considering these factors we'd say performance has been pretty decent, though not amazing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Acadia Realty Trust Been A Good Investment?

With a three year total loss of 55% for the shareholders, Acadia Realty Trust would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we touched on above, Acadia Realty Trust is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. This doesn't look good when you see that Ken is earning more than the industry median. Taking all this into account, it could be hard to get shareholder support for giving Ken a raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Acadia Realty Trust you should be aware of, and 2 of them make us uncomfortable.

Important note: Acadia Realty Trust is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Acadia Realty Trust, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:AKR

Acadia Realty Trust

An equity real estate investment trust focused on delivering long-term, profitable growth.

Moderate risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives