- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

US Stocks Possibly Trading Below Fair Value Estimates In November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a cautious uptick with futures slightly higher, investors are closely watching economic data and Federal Reserve commentary for signs of stability following recent fluctuations. In this environment, identifying stocks that may be trading below their fair value can provide opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $123.80 | $245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | $50.32 | $99.93 | 49.6% |

| Business First Bancshares (NasdaqGS:BFST) | $28.58 | $55.58 | 48.6% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.78 | $63.93 | 48.7% |

| XPEL (NasdaqCM:XPEL) | $45.62 | $91.03 | 49.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.98 | $46.86 | 48.8% |

| Pinterest (NYSE:PINS) | $29.98 | $59.53 | 49.6% |

| Privia Health Group (NasdaqGS:PRVA) | $21.84 | $43.16 | 49.4% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.36 | $30.28 | 49.3% |

| Carter Bankshares (NasdaqGS:CARE) | $19.56 | $38.28 | 48.9% |

Let's dive into some prime choices out of the screener.

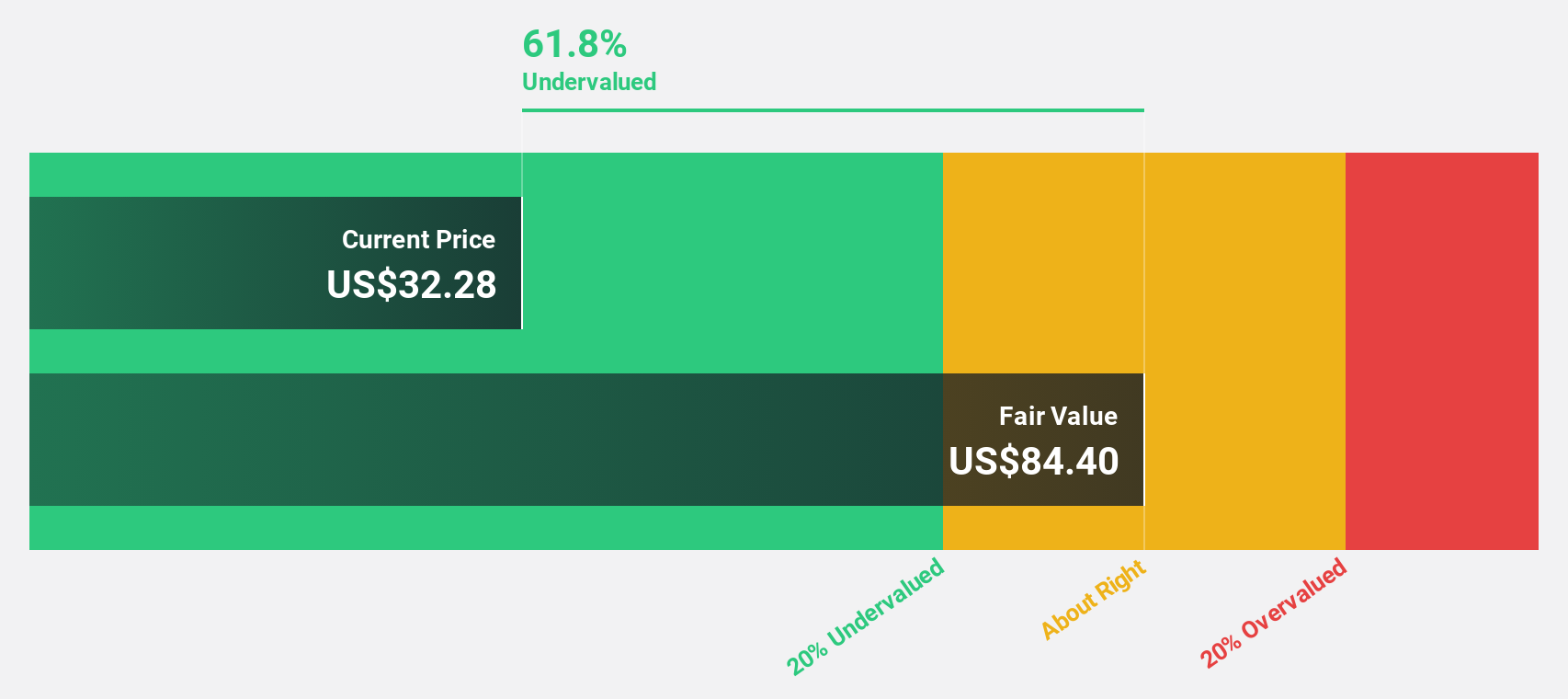

Veracyte (NasdaqGM:VCYT)

Overview: Veracyte, Inc. is a diagnostics company operating in the United States and internationally, with a market cap of $2.96 billion.

Operations: The company generates revenue from its Diagnostic Products segment, amounting to $425.33 million.

Estimated Discount To Fair Value: 23.8%

Veracyte, Inc. is trading at US$39.53, which is 23.8% below its estimated fair value of US$51.87, indicating potential undervaluation based on discounted cash flow analysis. The company reported a significant turnaround with a net income of US$15.16 million for Q3 2024 compared to a loss the previous year and raised its full-year revenue guidance to between US$442 million and US$445 million, reflecting strong growth prospects in testing revenue.

- Our growth report here indicates Veracyte may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Veracyte.

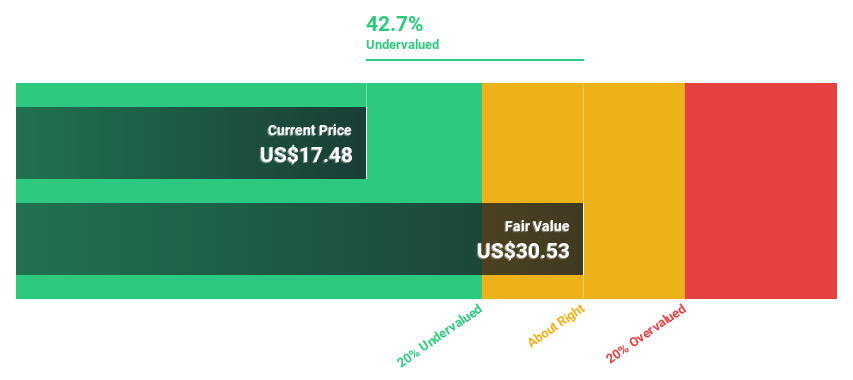

Paycor HCM (NasdaqGS:PYCR)

Overview: Paycor HCM, Inc. provides human capital management solutions for small and medium-sized businesses in the United States and has a market capitalization of approximately $3.15 billion.

Operations: The company's revenue is derived from its Internet Software & Services segment, amounting to $678.84 million.

Estimated Discount To Fair Value: 42.7%

Paycor HCM is trading at US$17.48, significantly below its estimated fair value of US$30.53, indicating potential undervaluation based on discounted cash flow analysis. The company's Q1 2025 revenue increased to US$167.48 million from US$143.59 million a year ago, with a reduced net loss of US$7.28 million compared to the previous year's larger loss. Recent product innovations like Paycor Assistant could enhance operational efficiency and strategic focus for clients, potentially supporting future growth.

- Our expertly prepared growth report on Paycor HCM implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Paycor HCM with our detailed financial health report.

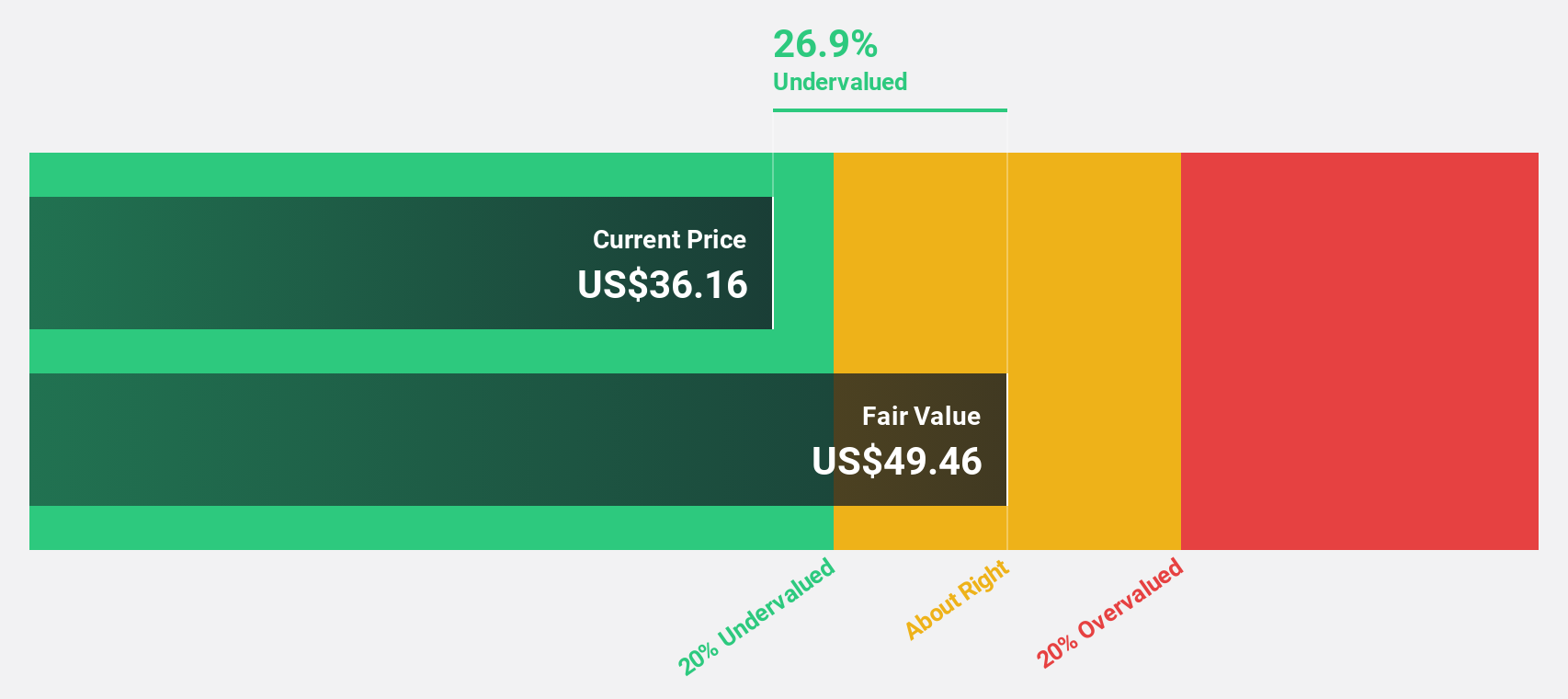

American Healthcare REIT (NYSE:AHR)

Overview: American Healthcare REIT, Inc. is a self-managed real estate investment trust that focuses on acquiring, owning, and operating a diversified portfolio of clinical healthcare properties, with a market cap of approximately $4.02 billion.

Operations: The company's revenue segments include outpatient medical buildings, senior housing, skilled nursing facilities, and other healthcare-related facilities.

Estimated Discount To Fair Value: 26%

American Healthcare REIT is trading at US$26.80, significantly below its estimated fair value of US$36.21, suggesting potential undervaluation based on discounted cash flow analysis. The company's revenue grew to US$523.81 million for Q3 2024 from US$464.24 million a year ago, while net loss decreased to US$4.13 million from the previous year's larger loss of US$5.99 million. The firm is actively seeking acquisitions to enhance its portfolio and drive shareholder value creation.

- Our comprehensive growth report raises the possibility that American Healthcare REIT is poised for substantial financial growth.

- Navigate through the intricacies of American Healthcare REIT with our comprehensive financial health report here.

Taking Advantage

- Click this link to deep-dive into the 197 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.