- United States

- /

- Software

- /

- NasdaqGS:INTU

Exploring 3 High Growth Tech Stocks in United States

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but it is up 33% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Blueprint Medicines | 25.26% | 68.92% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| Cloudflare | 20.51% | 23.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 246 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

CrowdStrike Holdings (NasdaqGS:CRWD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CrowdStrike Holdings, Inc. is a company that offers cybersecurity solutions both in the United States and internationally, with a market capitalization of approximately $84.20 billion.

Operations: CrowdStrike generates revenue primarily from its Security Software & Services segment, which accounts for $3.52 billion. The company focuses on offering cybersecurity solutions globally.

CrowdStrike's recent financial performance and strategic partnerships underscore its growing influence in the cybersecurity sector. In Q2 2024, the company reported a significant revenue increase to $963.87 million from $731.63 million year-over-year, with net income rising to $47.01 million from $8.47 million, reflecting a robust growth trajectory and operational efficiency. Additionally, CrowdStrike's R&D investments remain aggressive as it continues to innovate within AI-driven cybersecurity solutions, enhancing its Falcon platform's capabilities in threat detection and response across diverse environments. This focus on innovation is crucial as it navigates a competitive landscape where staying ahead technologically can significantly impact market share and customer acquisition.

- Take a closer look at CrowdStrike Holdings' potential here in our health report.

Evaluate CrowdStrike Holdings' historical performance by accessing our past performance report.

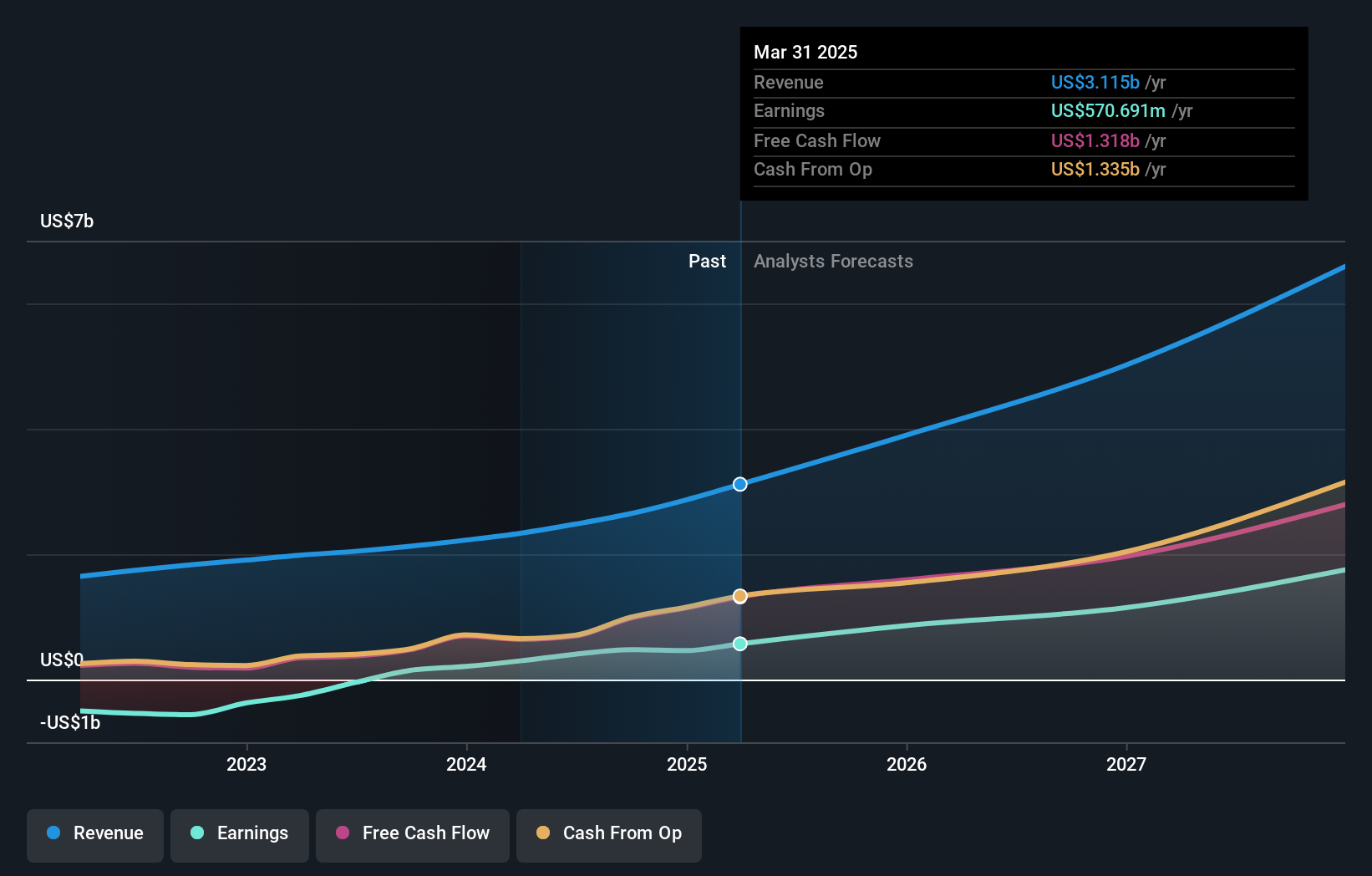

Intuit (NasdaqGS:INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. is a company that offers financial management, compliance, and marketing products and services in the United States, with a market capitalization of approximately $196.06 billion.

Operations: Intuit generates revenue primarily from its Small Business and Self-Employed segment, contributing $9.53 billion, followed by the Consumer segment at $4.45 billion. The Credit Karma and Pro-Tax segments add $1.71 billion and $599 million, respectively, to its revenue streams.

Intuit is capitalizing on robust growth trends within the tech sector, particularly in software and AI innovations. With a projected revenue increase of 10.5% per year, Intuit surpasses the US market average of 9%, demonstrating strong market positioning and potential for sustained growth. Furthermore, its earnings are expected to climb by 16.2% annually, outpacing the broader US market forecast of 15.5%. This financial trajectory is supported by substantial investments in R&D which have bolstered its product offerings like QuickBooks Sole Trader in the UK; these initiatives not only enhance user experience through AI-driven automation but also ensure compliance with upcoming tax regulations, thereby securing long-term customer engagement and retention.

- Dive into the specifics of Intuit here with our thorough health report.

Examine Intuit's past performance report to understand how it has performed in the past.

Palantir Technologies (NYSE:PLTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. develops and implements software platforms that support intelligence agencies in counterterrorism efforts globally, with a market capitalization of $136.34 billion.

Operations: With a market capitalization of $136.34 billion, Palantir Technologies generates revenue through two primary segments: Commercial ($1.21 billion) and Government ($1.44 billion). The company focuses on building and deploying software platforms to aid intelligence communities in counterterrorism operations across the United States, the United Kingdom, and internationally.

Palantir Technologies has demonstrated significant strides in its financial and strategic growth, particularly within the high-growth tech sector. With an impressive earnings increase of 223.5% over the past year, Palantir outperforms the software industry average growth of 24.7%. The company's revenue is also expected to grow by 18% annually, surpassing the U.S. market average of 9%. This upward trajectory is bolstered by a focused investment in R&D which constitutes a substantial part of their expenditure, aligning with their strategic partnerships like that with L3Harris Technologies to advance technology development for defense and security sectors. These collaborations are not only enhancing Palantir's product capabilities but are also pivotal in driving future revenue streams and solidifying its position in critical data-driven sectors.

- Delve into the full analysis health report here for a deeper understanding of Palantir Technologies.

Key Takeaways

- Click this link to deep-dive into the 246 companies within our US High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.