- United States

- /

- Specialized REITs

- /

- NasdaqGS:SBAC

What SBA Communications (SBAC)'s Rising Financial Leverage Risk Means For Shareholders

Reviewed by Sasha Jovanovic

- In recent weeks, analysts have expressed concerns over SBA Communications’ revenue outlook, citing challenges such as the lack of a significant lease agreement with DISH and continued Sprint churn, as well as headwinds from slowing wireless carrier spending and higher interest rates.

- Amid these pressures, the company’s financial leverage and liquidity profile have come under scrutiny, with industry watchers noting its Altman Z-Score places it in a distress zone and highlighting ongoing risks associated with sector competition and regulatory factors.

- We’ll explore how renewed scrutiny of SBA’s financial leverage risk could shape the company’s investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

SBA Communications Investment Narrative Recap

To be comfortable holding SBA Communications stock, an investor has to believe in the long-term case for recurring tower leasing revenue driven by 5G expansion, rising data consumption, and the essential need for wireless infrastructure, even as the company’s short-term performance faces headwinds from delayed lease agreements and wireless carrier consolidation. While recent analyst downgrades and revenue risk concerns appear significant, the main near-term catalyst remains the pace of new leasing activity, and the biggest risk centers on ongoing Sprint churn and muted carrier spending; the market’s reaction to the recent news doesn’t materially shift these priorities, but it heightens focus on near-term execution and balance sheet risk.

Among recent company announcements, the completion of a US$49.2 million share buyback in August stands out, reflecting SBA’s ongoing return of capital to shareholders even as uncertainties persist around earnings and the wireless REIT sector. This move, against a backdrop of cautious analyst sentiment and volatility in sector performance, is important for context when weighing short-term risks and how management is addressing shareholder value amid operational pressures.

Yet, contrasted with these signals, investors should also be aware of SBA’s elevated leverage and exposure to refinancing as low-cost debt matures…

Read the full narrative on SBA Communications (it's free!)

SBA Communications is projected to reach $3.1 billion in revenue and $1.0 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 4.1% and reflects a $121.3 million increase in earnings from the current $878.7 million.

Uncover how SBA Communications' forecasts yield a $248.88 fair value, a 32% upside to its current price.

Exploring Other Perspectives

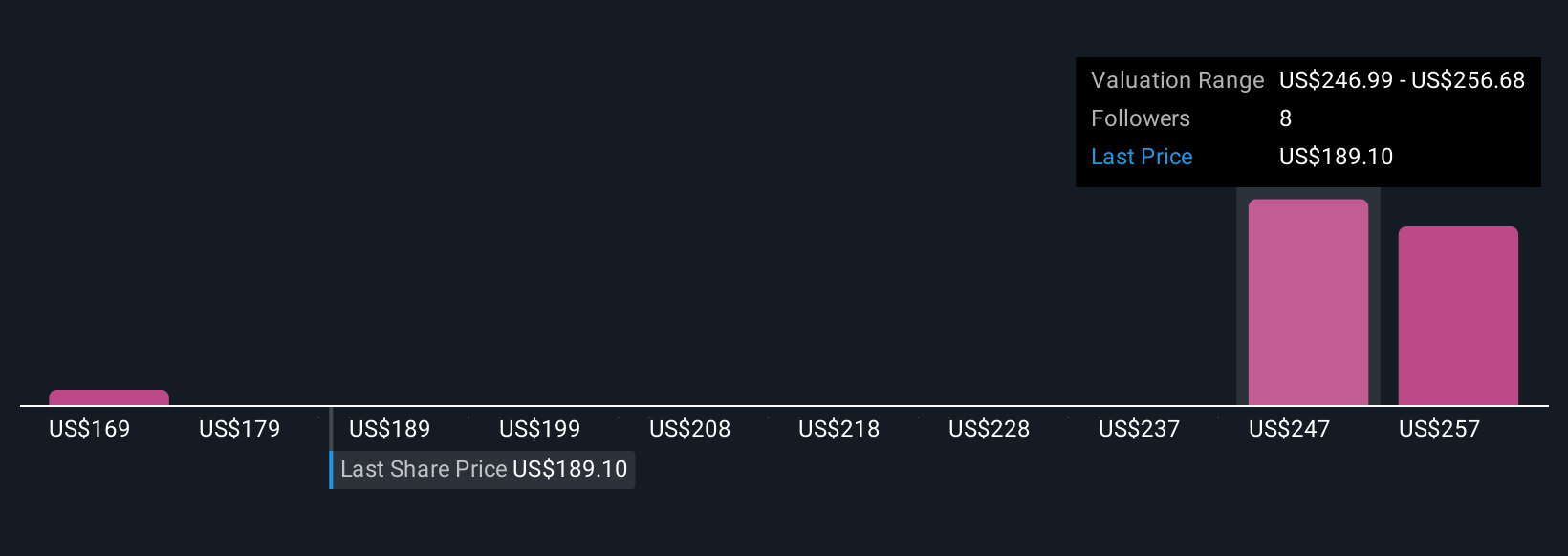

Simply Wall St Community members offered three fair value estimates for SBA Communications ranging from US$169.45 to US$266.38 per share. With ongoing financial leverage risks and cautious analyst sentiment, it is clear that investor outlooks differ widely and a variety of perspectives could influence the company’s next chapter.

Explore 3 other fair value estimates on SBA Communications - why the stock might be worth as much as 41% more than the current price!

Build Your Own SBA Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SBA Communications research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SBA Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SBA Communications' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBAC

SBA Communications

A leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026