- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

What the Latest Grocery Expansion Means for Phillips Edison’s Current Market Value

Reviewed by Bailey Pemberton

Thinking about what to do with Phillips Edison stock? You're not alone. With market moods shifting and real estate stocks getting a fresh look, it’s natural to wonder if now is the time to hold, buy more, or head for the exit. Over the past year, Phillips Edison has seen some ups and downs, including a recent 1-week slip of -1.4%, a pullback of -6.6% in the last month, and a year-to-date return of -8.7%. Looking over a longer period, the stock is actually up 30.4% over the past three years. This combination of near-term pressure and longer-term growth has investors weighing the risks and rewards more carefully than ever.

When it comes to valuation, the numbers tell an interesting story. Phillips Edison passes 2 out of 6 valuation checks for being undervalued, giving it a modest value score of 2. That might not sound spectacular, but it could signal hidden potential if the market is pricing in too much pessimism or overlooking some strengths. To really get a clear picture, it is important to dig deeper into the methods analysts use to assess value, from price multiples to asset-based approaches. Before wrapping up, another perspective on valuation you might not have considered will be introduced, which could give you an extra edge in evaluating Phillips Edison’s future.

Phillips Edison scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Phillips Edison Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a tool investors use to estimate what a company is worth by projecting how much cash it can generate in the future and then discounting those projections back to today’s dollars. For Phillips Edison, this approach focuses specifically on adjusted funds from operations, providing a clearer sense of the business’s sustainable, ongoing cash flow.

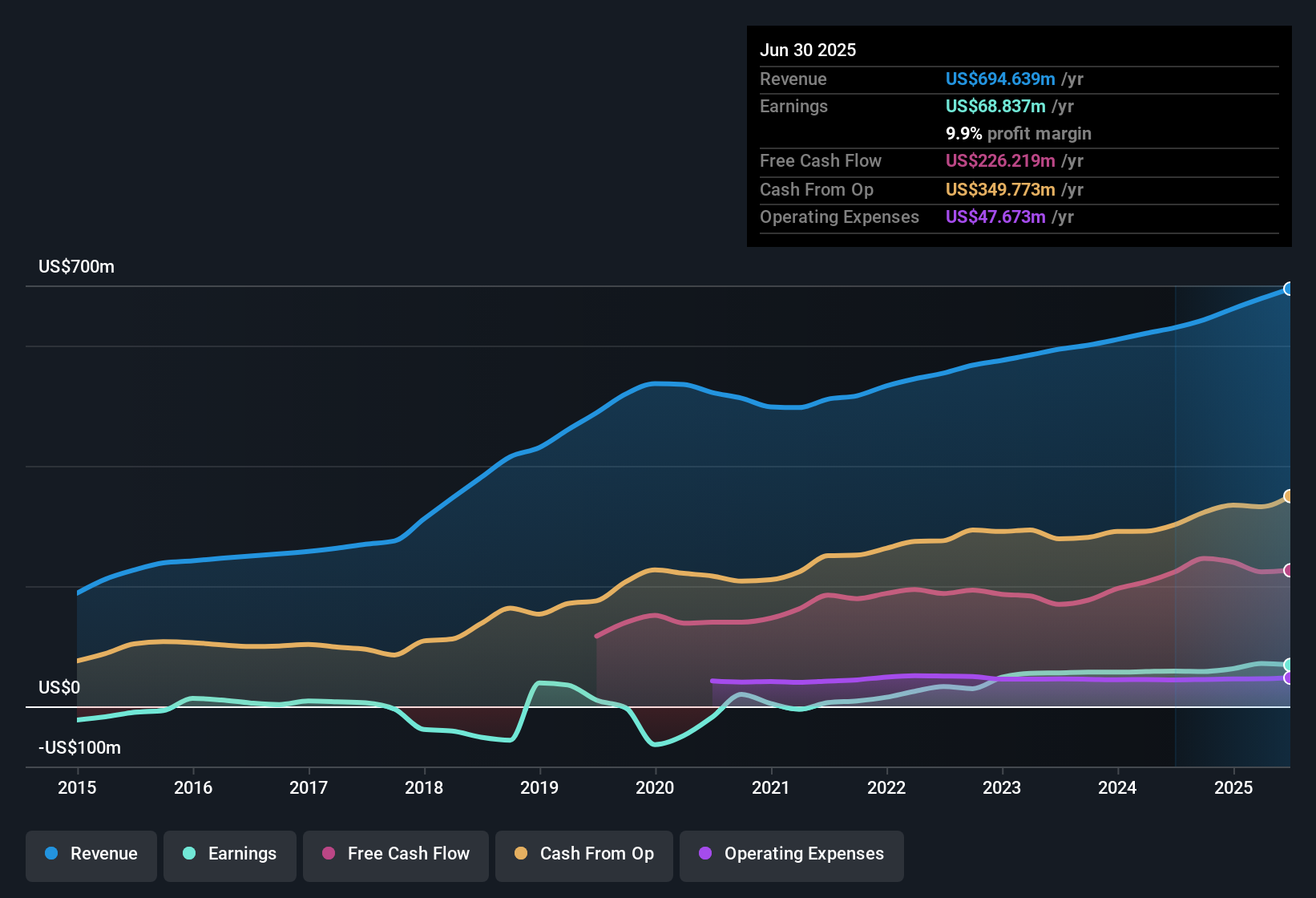

Currently, Phillips Edison produces $273 million in free cash flow, and analysts forecast steady growth over the coming years. For example, free cash flow is expected to reach about $348 million by 2027, with long-term projections extending that trend. By 2035, extrapolated estimates suggest annual free cash flow could surpass $491 million. However, direct analyst forecasts typically only go out five years, and further years are modeled by external sources.

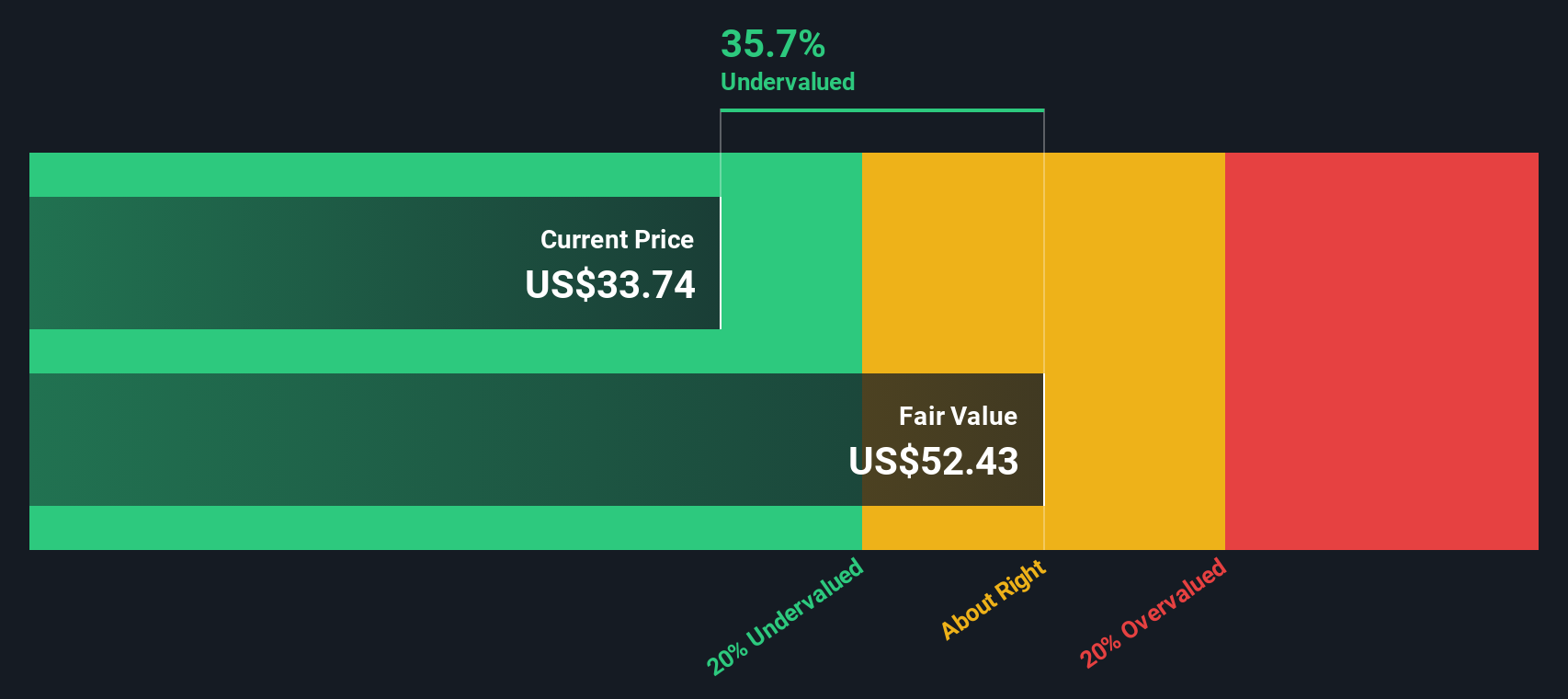

All these future cash flows are discounted back to their present value to arrive at an estimated intrinsic value per share. According to this analysis, the DCF model gives Phillips Edison an intrinsic value of approximately $52 per share, which is about 35.1% above the current share price. This substantial discount implies the stock may be markedly undervalued based on projected cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Phillips Edison is undervalued by 35.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Phillips Edison Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies, as it reflects how much investors are willing to pay today for a dollar of current earnings. For companies like Phillips Edison, which show consistent profitability, the PE ratio can provide insight into whether the stock is trading at a reasonable price relative to its earnings potential.

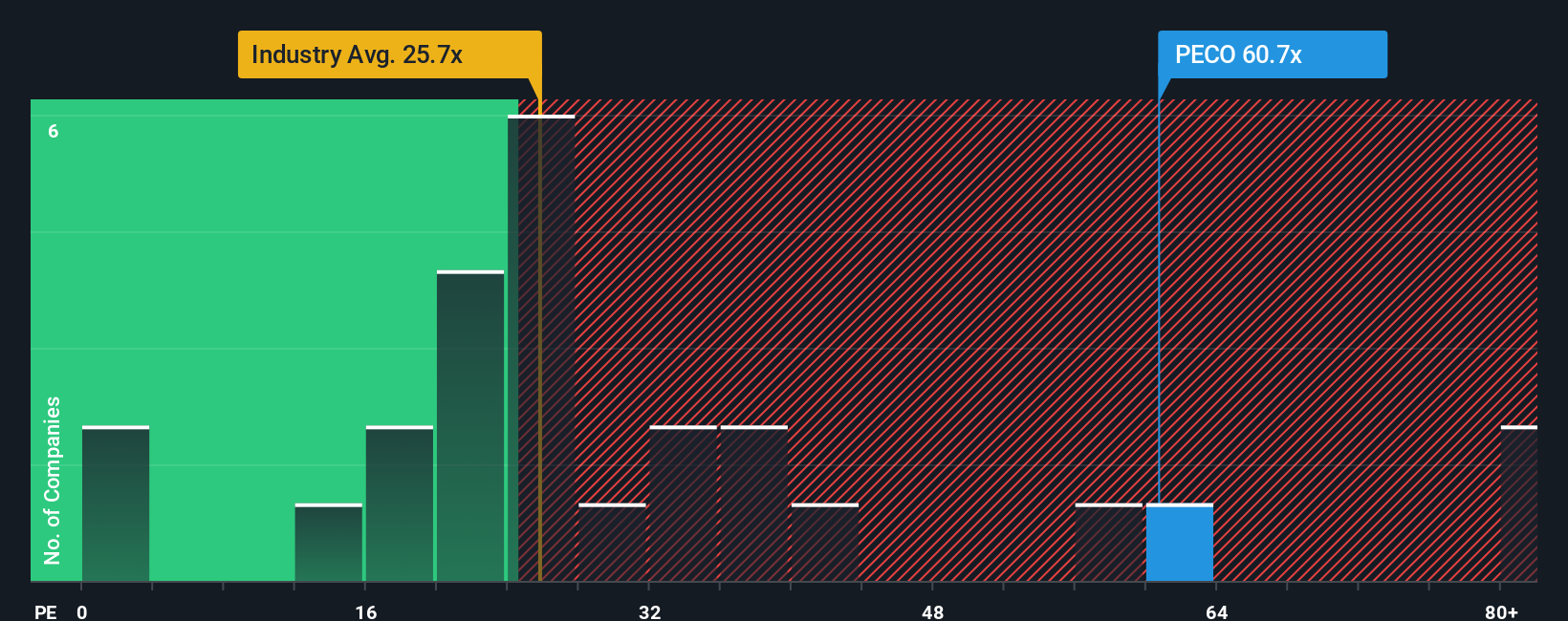

What constitutes a “normal” or “fair” PE ratio can vary, depending on expectations for future earnings growth and perceived business risks. Higher growth prospects usually justify a higher PE, while elevated risks may warrant a lower multiple. As of now, Phillips Edison trades at a PE of 61.6x, which is noticeably higher than the Retail REITs industry average of 26.0x, as well as the peer average of 55.9x. At first glance, this suggests a richer valuation compared to its immediate benchmarks.

Simply Wall St’s proprietary Fair Ratio for Phillips Edison is 34.7x. This measure goes beyond basic peer and industry comparisons by adjusting for the company’s specific growth outlook, profitability, market cap, and particular risks. Because it is tailored to the company’s circumstances rather than broad category averages, the Fair Ratio offers a more nuanced perspective on value.

Comparing the Fair Ratio of 34.7x with Phillips Edison’s actual PE of 61.6x, the stock appears overvalued on this basis, trading at a notable premium to both its peers and its company-specific fair value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Phillips Edison Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an innovative approach that connects a company’s story with financial forecasts and, ultimately, a fair value estimate. A Narrative is your personal perspective on a business, weaving together your expectations for future growth, margins, and risks into a clear, actionable investment thesis. Instead of relying solely on generic ratios or analyst targets, Narratives allow you to visualize how your assumptions translate into valuation, offering a more dynamic and transparent view.

On Simply Wall St’s Community page, millions of investors create, update, and share Narratives for companies like Phillips Edison. This makes it easy to see how a range of perspectives play out in estimated fair values. Narratives empower you to decide when to buy or sell by comparing your calculated Fair Value to the current market Price, and because they update automatically as new information (like earnings or news) emerges, you always have a current and relevant thesis.

For example, among Phillips Edison investors, some see its grocery-anchored focus and robust demographics justifying a fair value as high as $44.0. More cautious views currently put that figure closer to $36.0, highlighting that Narratives help you make decisions that truly reflect your outlook.

Do you think there's more to the story for Phillips Edison? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives