- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

How Investors Are Reacting To Phillips Edison (PECO) Raising Guidance After Strong Leasing and Acquisitions

Reviewed by Sasha Jovanovic

- Earlier this week, Phillips Edison & Company announced it had raised its full-year guidance following strong Q2 2025 results, driven by high occupancy rates of 97%, robust leasing spreads, and US$287.3 million in acquisitions year-to-date.

- An interesting aspect of the announcement is that the company’s 21 active construction projects are forecast to generate yields between 9% and 12%, highlighting confidence in development-driven growth for its grocery-anchored retail focus.

- We'll examine how Phillips Edison's upward guidance revision, spurred by strong leasing trends, impacts its investment narrative and future outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Phillips Edison Investment Narrative Recap

To own shares in Phillips Edison, you need confidence that grocery-anchored retail centers will continue to thrive despite shifts in consumer behavior. The recent upgrade to full-year guidance, prompted by high occupancy and strong leasing trends, bolsters the short-term outlook but does not materially change the biggest risk: that ongoing e-commerce adoption may pressure long-term demand for physical retail, particularly if major tenants encounter challenges.

Among recent company updates, the September 2025 announcement of a 5.7% increase to the monthly dividend is especially relevant. This move, coming on the heels of stronger-than-expected leasing activity and acquisitions totaling US$287.3 million year-to-date, signals management’s willingness to share incremental gains with shareholders, tying directly to the current catalyst of strong recurring revenue growth.

Yet, in contrast to robust leasing trends, investors should keep in mind the long-term threat posed by changing consumer shopping habits and...

Read the full narrative on Phillips Edison (it's free!)

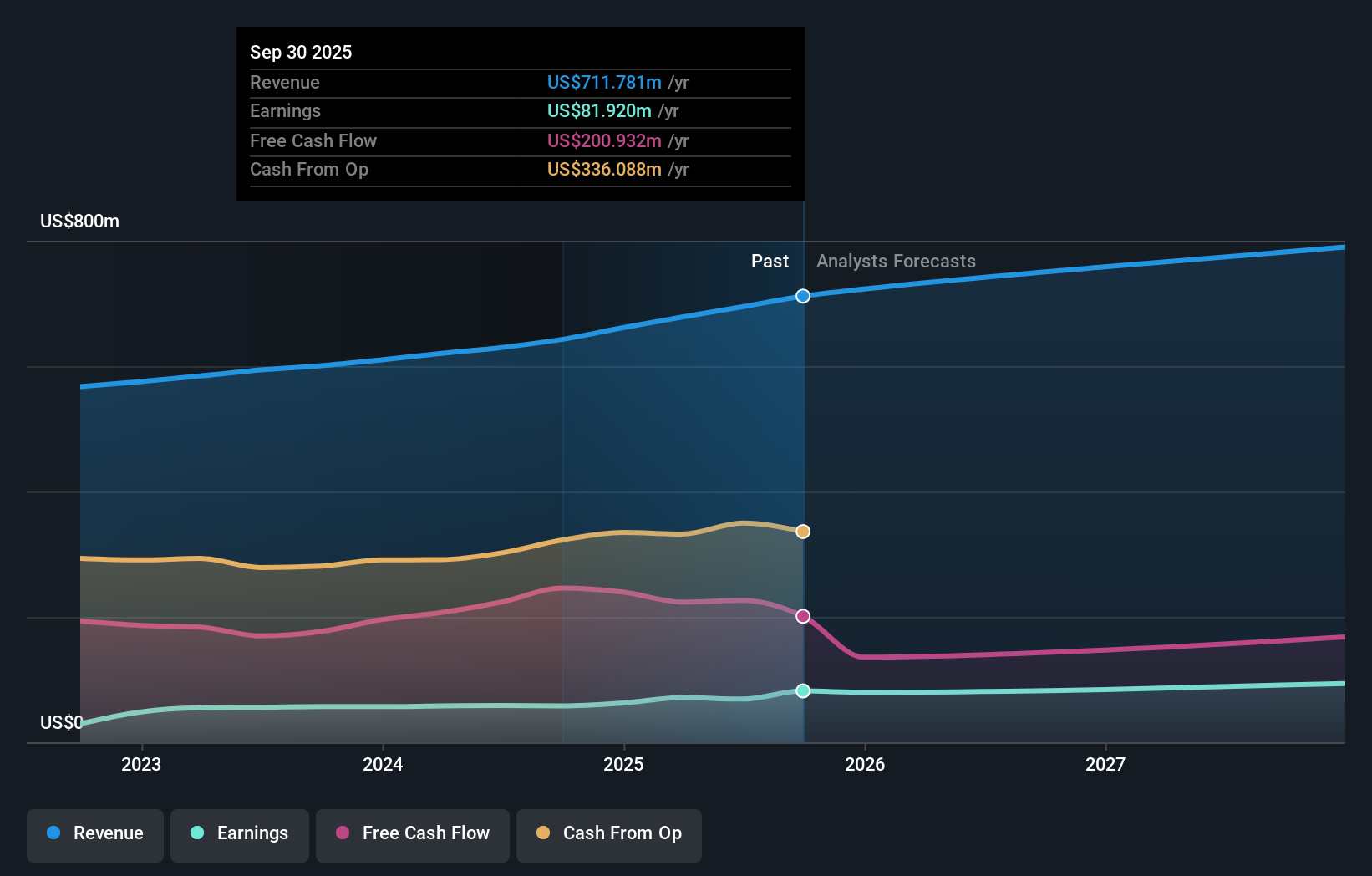

Phillips Edison’s outlook anticipates $811.1 million in revenue and $93.3 million in earnings by 2028. This scenario assumes a 5.3% annual revenue growth rate and a $24.5 million increase in earnings from the current level of $68.8 million.

Uncover how Phillips Edison's forecasts yield a $39.18 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted 1 fair value estimate for Phillips Edison, all at US$39.18 per share. Against this consensus, continued e-commerce growth remains a concern many individual investors weigh when forecasting future returns. Explore other viewpoints from the Community for fresh insight.

Explore another fair value estimate on Phillips Edison - why the stock might be worth just $39.18!

Build Your Own Phillips Edison Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Phillips Edison research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phillips Edison's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives