- United States

- /

- Real Estate

- /

- NasdaqCM:MAYS

Shareholders Will Probably Not Have Any Issues With J.W. Mays, Inc.'s (NASDAQ:MAYS) CEO Compensation

J.W. Mays, Inc. (NASDAQ:MAYS) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 22 November 2022. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

Our analysis indicates that MAYS is potentially overvalued!

How Does Total Compensation For Lloyd Shulman Compare With Other Companies In The Industry?

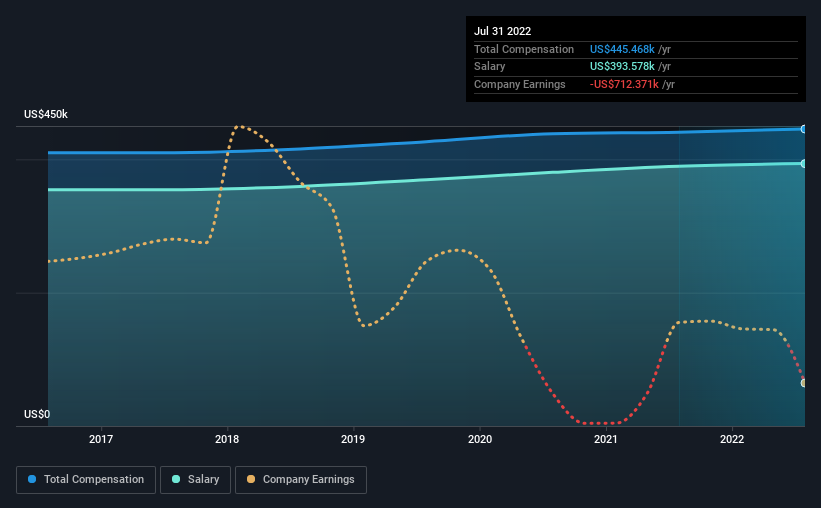

Our data indicates that J.W. Mays, Inc. has a market capitalization of US$93m, and total annual CEO compensation was reported as US$445k for the year to July 2022. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at US$393.6k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$445k. From this we gather that Lloyd Shulman is paid around the median for CEOs in the industry. Moreover, Lloyd Shulman also holds US$13m worth of J.W. Mays stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$394k | US$390k | 88% |

| Other | US$52k | US$51k | 12% |

| Total Compensation | US$445k | US$441k | 100% |

On an industry level, around 22% of total compensation represents salary and 78% is other remuneration. According to our research, J.W. Mays has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

J.W. Mays, Inc.'s Growth

Over the last three years, J.W. Mays, Inc. has shrunk its earnings per share by 52% per year. It achieved revenue growth of 5.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has J.W. Mays, Inc. Been A Good Investment?

Most shareholders would probably be pleased with J.W. Mays, Inc. for providing a total return of 39% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for J.W. Mays (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MAYS

J.W. Mays

Engages in the owning, operation, and leasing of commercial real estate properties in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026