- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

Lineage (LINE): Assessing Valuation in Light of the Recent IPO Lawsuit

Reviewed by Kshitija Bhandaru

A class action lawsuit has been filed against Lineage and certain officers, alleging that the company made material misrepresentations in its July 2024 IPO registration statement. The legal development is drawing close attention from investors.

See our latest analysis for Lineage.

Shares of Lineage have seen a muted performance since going public, with the 1-year total shareholder return currently at -0.42 percent. After the initial post-IPO buzz, momentum has faded as investors weigh ongoing legal developments and broader market sentiment.

If this wave of IPO activity has you thinking about where momentum could strike next, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Lineage now trading below its IPO price and analysts pointing to a sizable discount to their targets, investors are left to wonder if this recent weakness is an overlooked opportunity, or if the current price already factors in future expectations.

Price-to-Sales Ratio of 1.8x: Is it justified?

Lineage is trading at a price-to-sales (P/S) ratio of 1.8x, which positions it as a comparatively undervalued name among both direct peers and the broader Industrial REITs industry. The current share price of $41.46 reflects this multiple.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of a company’s revenue. For real estate investment trusts, P/S can provide a useful perspective when profits are volatile or negative, as is currently the case for Lineage. This metric helps to neutralize the impact of unprofitability and highlight relative value versus sales generation capacity.

Compared to the sector, Lineage’s P/S ratio of 1.8x stands out against the industry average of 8.7x and an estimated fair P/S ratio of 2.6x. This significant valuation gap suggests the market may be pricing in uncertainty around Lineage’s lack of profits and recent board turnover, even though sales continue to grow. The fair ratio calculation indicates a level the market could eventually move toward if confidence recovers and fair value is recognized.

Explore the SWS fair ratio for Lineage

Result: Price-to-Sales of 1.8x (UNDERVALUED)

However, ongoing legal uncertainty and persistent negative net income could limit near-term upside and may continue to weigh on investor sentiment moving forward.

Find out about the key risks to this Lineage narrative.

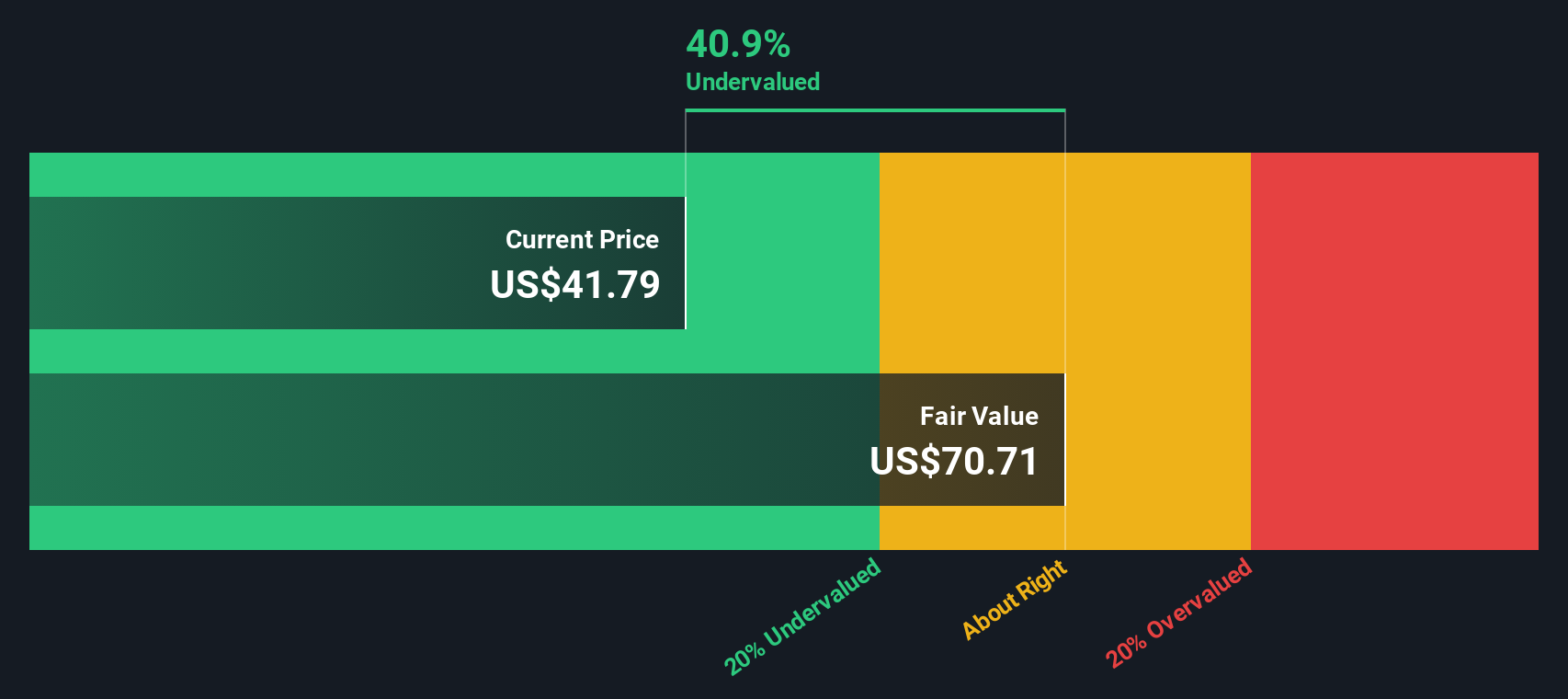

Another View: DCF Model Suggests Deeper Discount

Looking from a different angle, our DCF model estimates Lineage’s fair value at $70.16 per share, which is significantly higher than the current price of $41.46. This method indicates an even greater undervaluation compared to what the market multiples suggest. Could the market be overlooking the broader long-term perspective in this case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lineage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lineage Narrative

If you have a different take or want to dive deeper into the numbers, you can shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Use the Simply Wall Street Screener to pinpoint stocks aligned with your strategy and goals today.

- Uncover high-yield potential by targeting reliable income with these 19 dividend stocks with yields > 3% and see which companies are topping the payout charts.

- Ride the momentum in artificial intelligence as you tap into growth stories with these 25 AI penny stocks, setting new standards in the space.

- Zero in on value with rock-solid fundamentals through these 887 undervalued stocks based on cash flows, spotlighting businesses that could be primed for a rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 86 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Very undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives