- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

Is Lineage (LINE) Undervalued? A Fresh Look at Recent Share Price and Valuation

Reviewed by Simply Wall St

Lineage (NasdaqGS:LINE) investors have probably noticed the steady slide in the share price over recent months, which may leave some asking if something bigger is happening beneath the surface. There was no single headline event behind this movement, but when a stock is down this much, it often becomes a topic of debate. Is this a classic value play, or a sign of ongoing risks?

Looking at the bigger picture, Lineage’s shares have fallen about 50% over the past year, with momentum still weak after losses in recent months. Even as the core business saw revenue grow at a modest pace and net income showed a sharp year-on-year improvement, the market appears unconvinced. Recent performances hint that sentiment may be shifting; however, for now, weakness is hard to ignore.

After a challenging year like this, investors have to ask whether the current price is a rare chance to buy, or if the market is right to be cautious about future growth.

Price-to-Sales of 1.7x: Is it justified?

Based on the price-to-sales ratio, Lineage currently trades at a significant discount to both the global industrial REITs sector and its peer group. This indicates that the market views its sales as less valuable than those of its rivals.

The price-to-sales (P/S) ratio compares a company’s stock price to its revenues and is widely used for real estate and capital-intensive businesses where profits may be less consistent year to year. A lower P/S can signal undervaluation if the business remains stable or improves, but can also indicate doubts about long-term growth or profitability.

- Lineage’s P/S ratio of 1.7x is substantially below the global industrial REITs sector average of 8.6x as well as the peer average of 10.4x.

- Valuations using this multiple suggest that Lineage is currently underpriced relative to its sales, which may point to market skepticism about future earnings potential or risk concerns specific to the company.

If sentiment shifts or if fundamental performance starts to recover, there may be significant upside if the market closes this valuation gap.

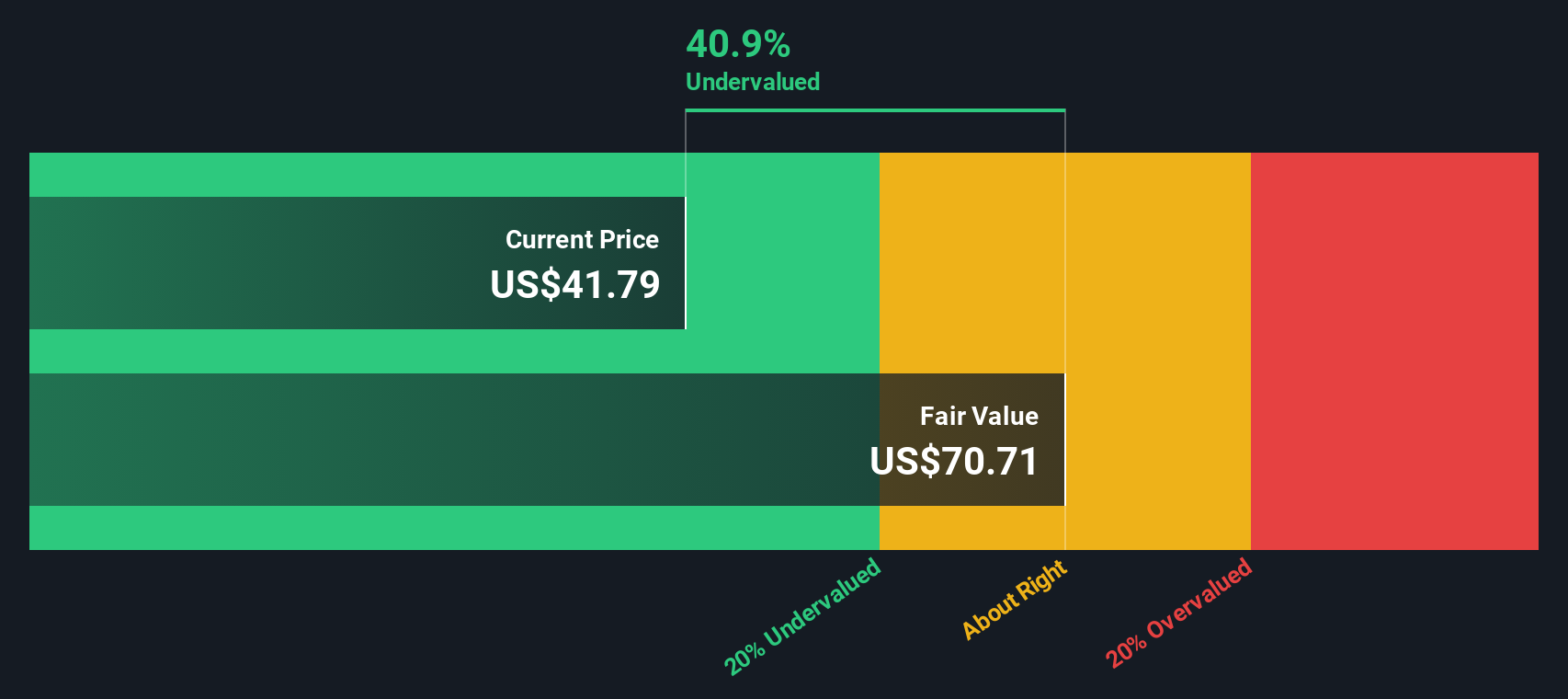

Result: Fair Value of $70 (UNDERVALUED)

See our latest analysis for Lineage.However, ongoing net losses and sluggish recent share performance could continue to weigh on investor confidence if fundamentals do not show clearer improvement soon.

Find out about the key risks to this Lineage narrative.Another View: SWS DCF Model’s Take

While Lineage looks undervalued based on its revenue multiples, our SWS DCF model draws a similar conclusion. Both approaches suggest the company could be trading below its potential. The question remains: will the market ever agree?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lineage Narrative

If you see things differently or want to dive deeper into the numbers, take a few minutes to explore and shape your own perspective, then Do it your way.

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on new opportunities. Don’t let your next breakthrough slip by. Use these powerful tools to see what you’ve been missing:

- Jump on undervalued market gems before the rest by tapping into undervalued stocks based on cash flows.

- Catch high-yield opportunities for steady income with picks from dividend stocks with yields > 3%.

- Ride the AI wave and get ahead of tomorrow’s innovations by tracking AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 88 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)