- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

Allegations of Misleading IPO Disclosures Might Change The Case For Investing In Lineage (LINE)

Reviewed by Simply Wall St

- In recent days, several law firms have announced class action lawsuits against Lineage, Inc., alleging that the company misled investors ahead of its July 2024 initial public offering, particularly regarding weakening demand and unsustainable growth in its cold-storage business.

- This legal action highlights broader concerns about transparency and disclosure practices for newly public companies operating in evolving post-pandemic market conditions.

- We'll explore how allegations of undisclosed demand challenges and overstated growth may influence Lineage's overall investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Lineage's Investment Narrative?

Owning shares of Lineage right now requires conviction in the company's ability to stabilize its core cold-storage business amid demand uncertainty and shifting industry trends. The class action lawsuit alleging misleading disclosures ahead of the July 2024 IPO immediately elevates scrutiny on management’s transparency, which may overshadow short-term catalysts like new technology partnerships and expansions. Before this news, investors would have likely focused on upcoming earnings performance, ongoing warehouse acquisitions, and recent partnership announcements as near-term drivers. However, the litigation and focus on allegedly overstated growth make potential legal liabilities and customer demand trends the most acute risks for now. While the stock's value metrics appeared compelling and price movement after the lawsuit announcement was moderately positive, it's too early to dismiss the possible material influence that litigation and reputational issues could have on investor sentiment and near-term business priorities.

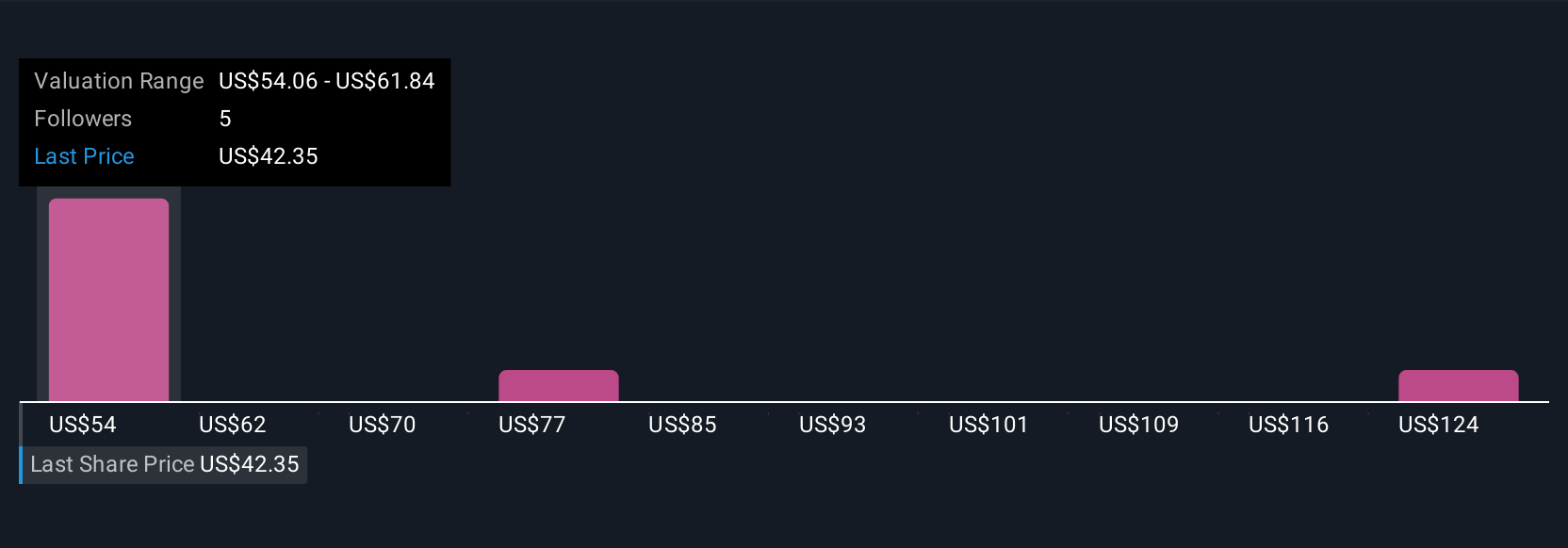

But one risk stands out: questions about Lineage’s demand strength remain front and center. Lineage's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Lineage - why the stock might be worth over 3x more than the current price!

Build Your Own Lineage Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lineage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lineage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lineage's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 86 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Very undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives