- United States

- /

- Hotel and Resort REITs

- /

- NasdaqGS:HST

Is There Value Left in Host Hotels After Strong Q1 Earnings and Raised Guidance for 2025?

Reviewed by Bailey Pemberton

If you are navigating the world of real estate investment trusts, chances are you are considering what to do with your Host Hotels & Resorts shares right now. You are not alone—investors across the board have been debating whether this stock is a hidden gem or one that is already reflecting its full potential. Looking at the numbers, Host Hotels & Resorts ended the most recent session at $17.11, and while the stock has dipped by 1.2% over the past week, it is holding steady for the past month, inching up just 0.2%. Year-to-date returns are down only 0.5%, but a glance at the bigger picture shows a 4.1% climb over the past year, with substantial long-term growth of 21.1% over three years and an impressive 71.3% across five years.

What is driving these moves? Broader market optimism and sector trends continue to shape investor sentiment, with hospitality and travel-related REITs like Host often reflecting shifts in economic reopening and travel confidence signals. These dynamics have helped the stock deliver a blend of resilience and steady long-term growth, even as short-term fluctuations arise.

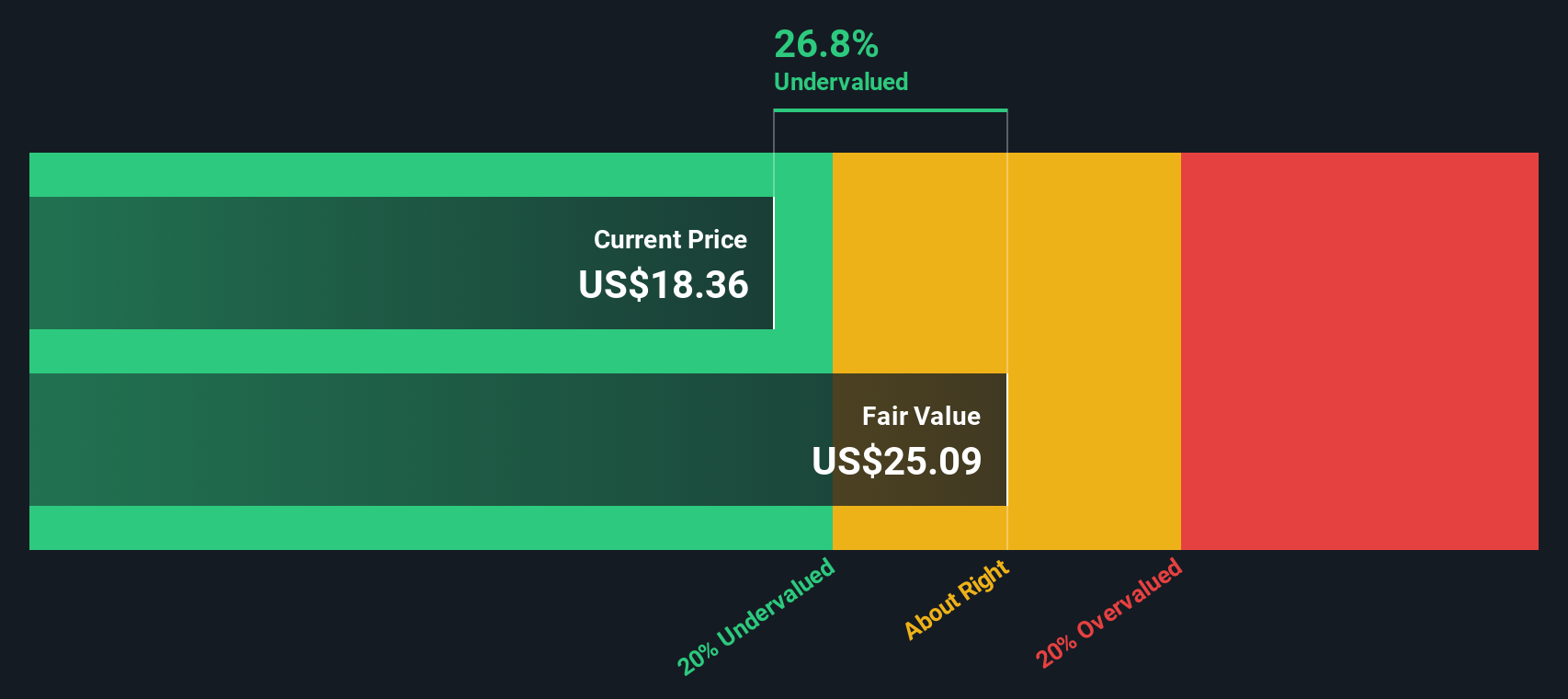

Of course, price charts can only say so much. When it comes to making a smart decision about Host, the real insight comes from a closer look at its valuation. I ran the numbers across six different valuation checks commonly used by analysts—from price-to-earnings to asset multiples—and Host came up undervalued in four out of six, giving it a strong value score of 4. Curious how these checks stack up, and if they are really the best way to size up a stock? Let’s dive into each approach next, before exploring an even better way to spot value opportunities.

Approach 1: Host Hotels & Resorts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects how much free cash Host Hotels & Resorts is expected to generate in the future and discounts those flows back to their value in today's dollars using adjusted funds from operations as its baseline.

Currently, Host Hotels & Resorts reports free cash flow of $1.387 billion. Analysts provide forecasts for up to five years, but further cash flow projections, such as the estimate of $1.31 billion in 2035, are extrapolated based on trends identified by Simply Wall St. Over the next decade, these cash flows show moderate annual increases, with figures ranging from $1.2 billion to $1.3 billion per year. All cash flows are denominated in US dollars ($).

By aggregating and discounting these projected free cash flows, the DCF model calculates an intrinsic value of $27.50 per share for Host Hotels & Resorts. Compared to its current share price of $17.11, this represents a substantial 37.8% discount to intrinsic value, suggesting the stock is notably undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Host Hotels & Resorts is undervalued by 37.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Host Hotels & Resorts Price vs Earnings

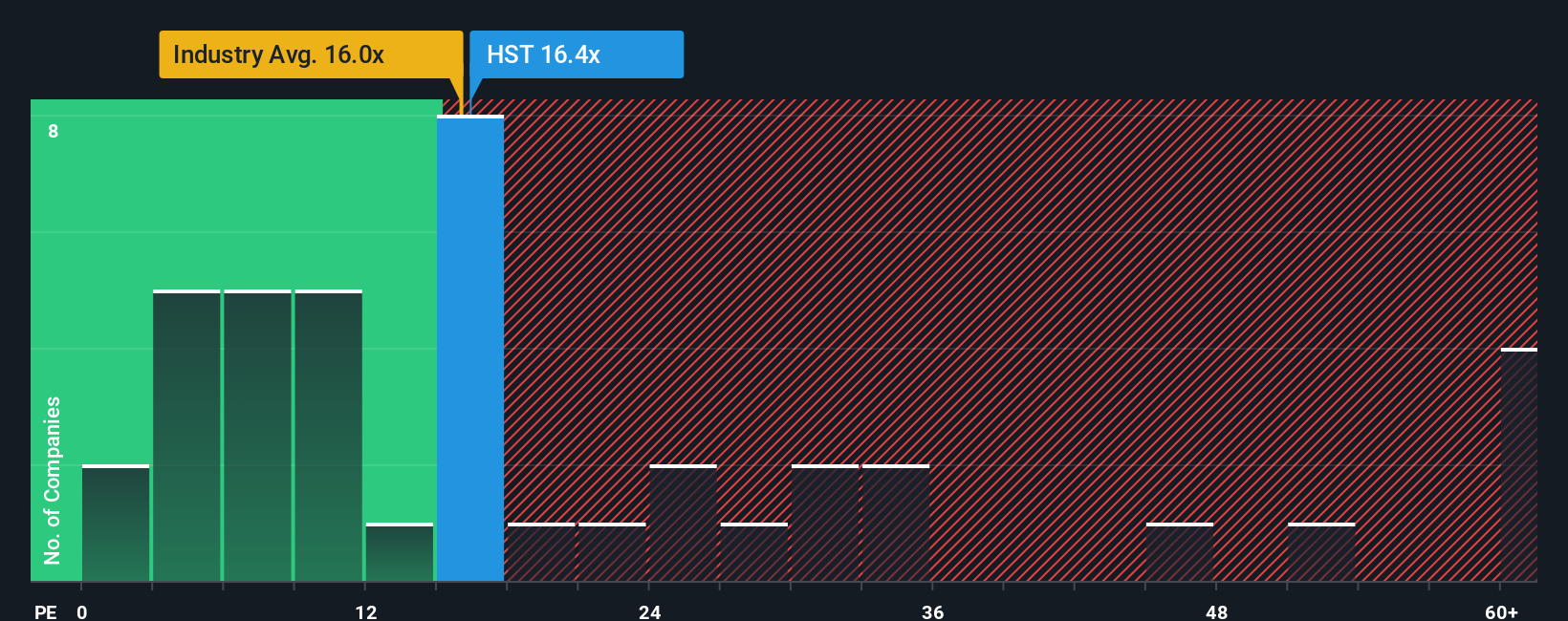

When evaluating profitable companies like Host Hotels & Resorts, the Price-to-Earnings (PE) ratio is widely considered one of the most effective valuation metrics. It allows investors to quickly gauge how much they are paying for each dollar of the company's earnings, making it a trusted tool for comparing businesses in the same sector.

The "right" or "fair" PE ratio for a stock does not exist in isolation. It is shaped by the company’s growth prospects, profit stability, and risk profile. Faster-growing companies or those in rapidly expanding sectors tend to command higher PE ratios, as investors are willing to pay a premium for future earnings. On the flip side, companies with slower growth or greater risk usually trade at lower multiples.

Currently, Host Hotels & Resorts trades at a PE ratio of 17.9x. For context, the average PE of Hotel and Resort REITs stands at 17.4x, while its peer group averages a much higher 26.1x. However, rather than relying solely on these broad comparisons, Simply Wall St’s proprietary Fair Ratio, calculated specifically for Host by factoring in its growth outlook, risks, profit margins, industry, and size, lands at 34.0x.

This Fair Ratio approach is more comprehensive than a simple peer or industry average as it adjusts for factors like Host’s earnings quality, market positioning, and distinct risk profile. By doing so, it aims to reflect what would truly be a reasonable multiple given Host’s specific circumstances, instead of painting with a broad brush.

With Host’s actual PE multiple of 17.9x sitting well below its calculated Fair Ratio of 34.0x, the numbers point to the stock being attractively priced relative to its potential. This suggests opportunity for investors who are confident in its future growth.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Host Hotels & Resorts Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more dynamic tool to guide your investment decisions. A Narrative weaves together the story you believe about a company, the financial forecasts that flow from that story, and an estimated fair value, going far beyond traditional ratios and static models.

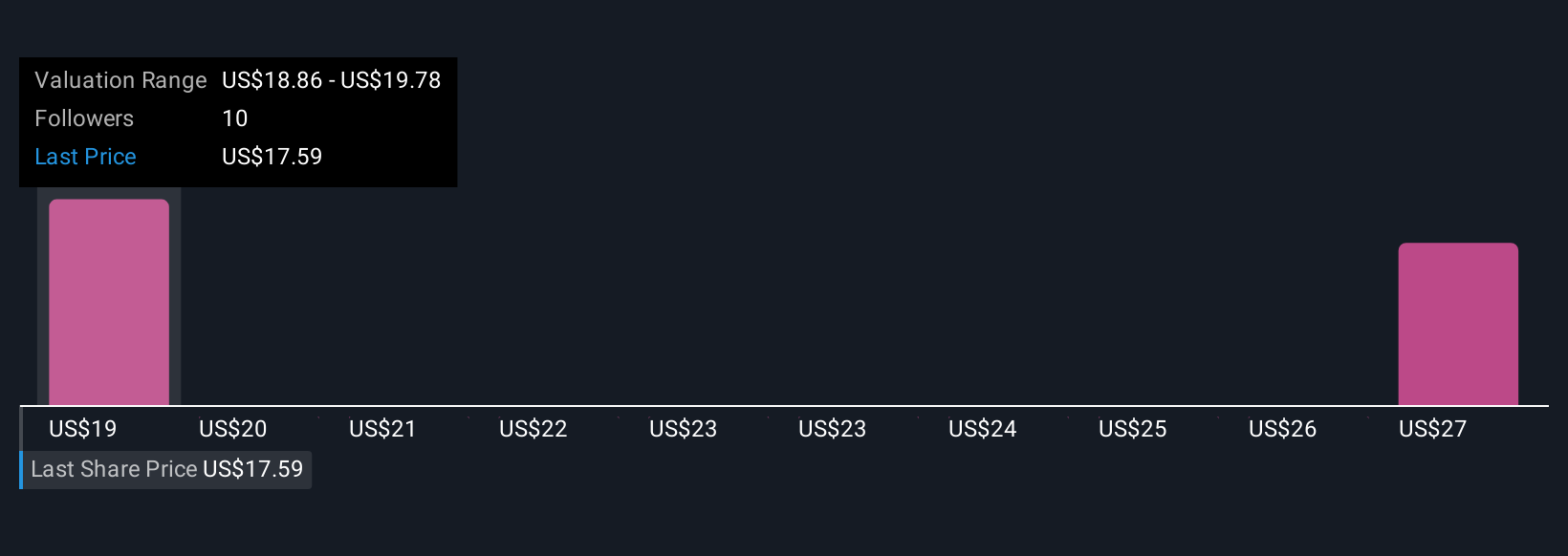

Unlike fixed formulas, Narratives let you personalize your view of Host Hotels & Resorts by combining your perspective on its future opportunities and risks, such as premium asset upgrades or climate challenges, with your assumptions about growth rates, profit margins, and valuations. Available on Simply Wall St’s Community page, used by millions of investors, creating or following a Narrative is simple and accessible to all users.

With Narratives, you can decide at a glance if Host is a buy or sell by comparing your Narrative-driven Fair Value to the current share price. Your estimates update automatically as new news or earnings arrive, keeping your view always up-to-date.

For example, while some investors believe Host’s luxury focus will drive shares as high as $22.00, others see risks that could justify a much lower fair value of $16.00. This underscores how Narratives help connect your market view to actionable decisions.

Do you think there's more to the story for Host Hotels & Resorts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Host Hotels & Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HST

Host Hotels & Resorts

An S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion