- United States

- /

- Banks

- /

- NasdaqGM:SFST

Discovering US Undiscovered Gems May 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of uncertainty marked by tariff discussions and Federal Reserve decisions, small-cap stocks, often represented by indices like the S&P 600, continue to capture investor interest due to their potential for growth and innovation. In this dynamic environment, identifying promising stocks involves looking beyond immediate market fluctuations to find companies with strong fundamentals and unique value propositions that can thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

IBEX (NasdaqGM:IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-driven customer lifecycle experience solutions across the United States and internationally, with a market cap of $335.54 million.

Operations: IBEX generates revenue primarily from its Business Process Outsourcing segment, which brought in $521.73 million. The company has a market cap of approximately $335.54 million.

IBEX, a promising player in the professional services sector, has shown robust growth with earnings rising 26.2% over the past year, outpacing industry averages. The company's debt to equity ratio impressively dropped from 252.4% to 29.8% over five years, indicating improved financial health. Trading at a good value compared to peers and industry standards, IBEX also reported second-quarter sales of US$140.68 million and net income of US$9.27 million, both up from the previous year. Recent buybacks saw 524,459 shares repurchased for US$8.68 million, reflecting strategic capital management efforts by IBEX's leadership team.

- Click here to discover the nuances of IBEX with our detailed analytical health report.

Gain insights into IBEX's historical performance by reviewing our past performance report.

Southern First Bancshares (NasdaqGM:SFST)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern First Bancshares, Inc. is a bank holding company for Southern First Bank, offering commercial, consumer, and mortgage loans in South Carolina, North Carolina, and Georgia with a market cap of $296.29 million.

Operations: Southern First Bancshares generates revenue primarily from its banking operations, totaling $97.50 million. The company focuses on providing commercial, consumer, and mortgage loans across South Carolina, North Carolina, and Georgia.

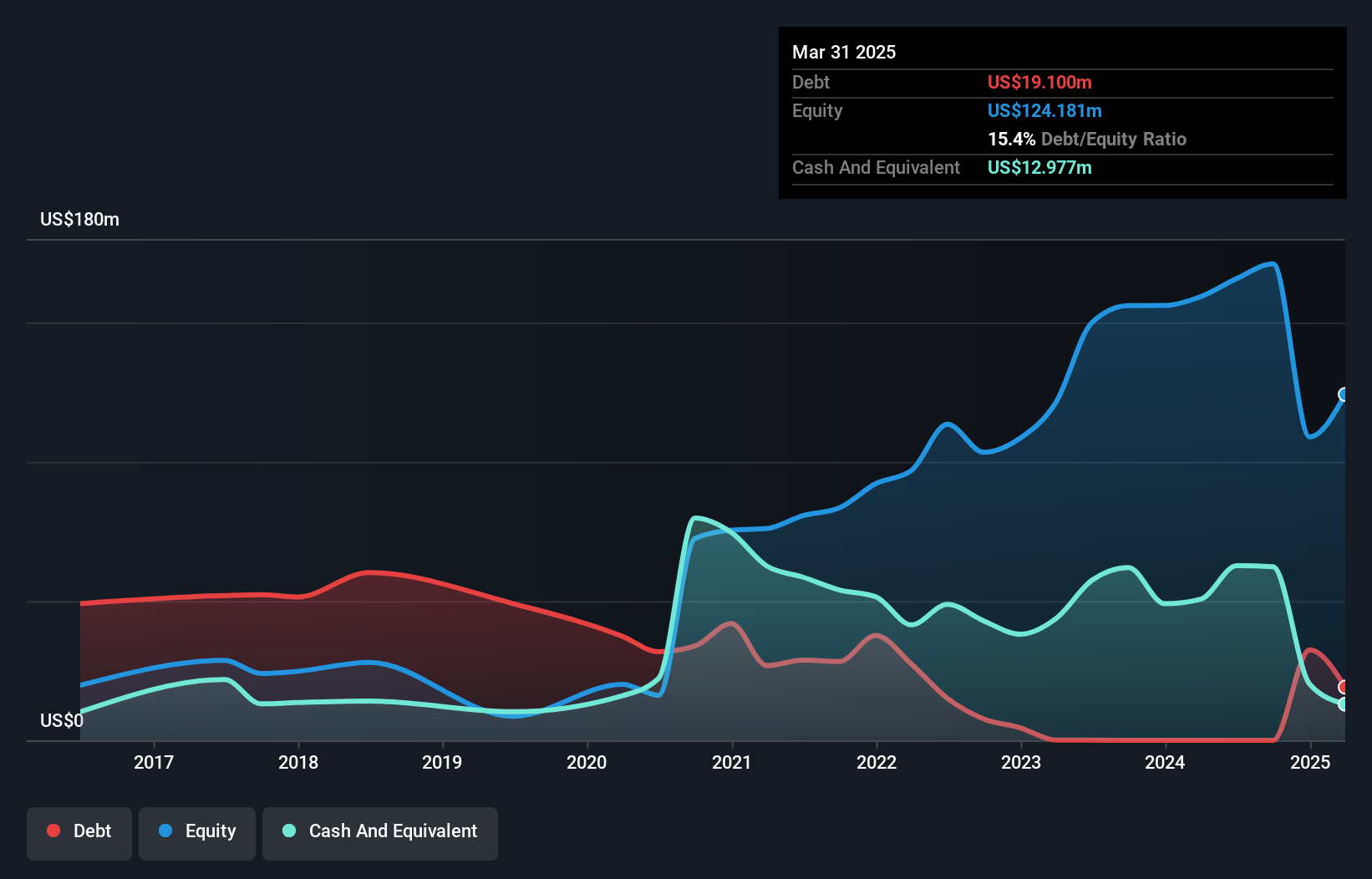

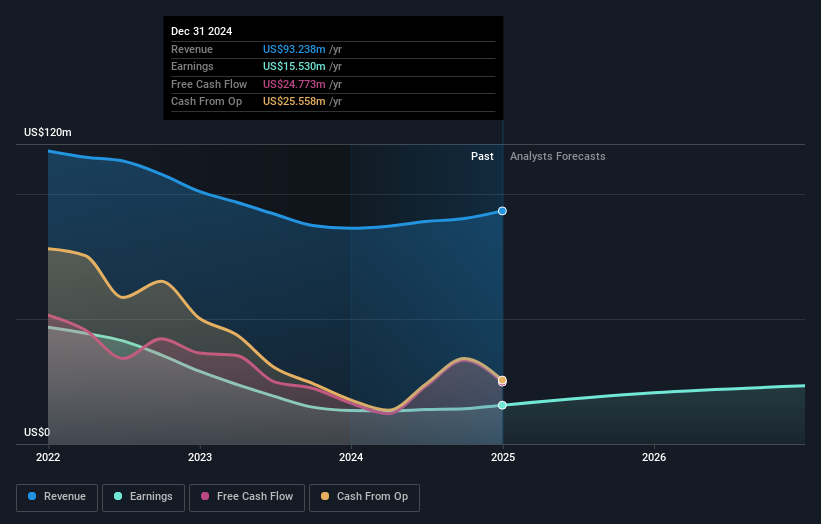

Southern First Bancshares, with assets totaling US$4.3 billion and equity of US$337.6 million, stands out for its robust financial health. The bank's total deposits and loans match at US$3.6 billion, highlighting a well-balanced approach to lending and funding. Impressively, earnings surged 38% last year, outpacing the industry average of 4.6%. A sufficient allowance for bad loans at 0.3% underscores prudent risk management practices while maintaining a competitive price-to-earnings ratio of 16.3x against the broader market's 17.5x suggests potential value for investors seeking growth in the banking sector.

- Dive into the specifics of Southern First Bancshares here with our thorough health report.

Assess Southern First Bancshares' past performance with our detailed historical performance reports.

Transcontinental Realty Investors (NYSE:TCI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transcontinental Realty Investors, Inc., based in Dallas, is a real estate investment company with a diverse portfolio of equity real estate across the U.S., including office buildings, apartments, shopping centers, and land holdings; it has a market cap of $252.10 million.

Operations: The company generates revenue primarily from its commercial and multifamily segments, contributing $12.97 million and $34.10 million respectively.

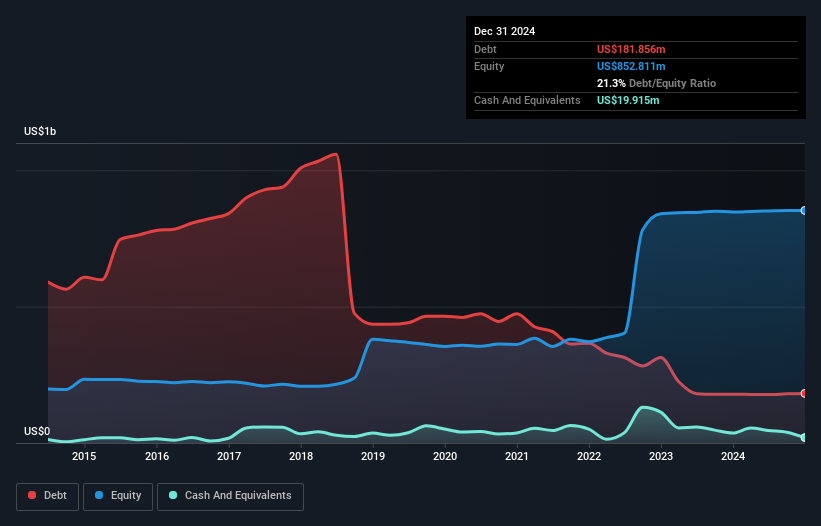

Transcontinental Realty Investors, a small player in the real estate sector, has shown resilience with its debt to equity ratio dropping from 131% to 21% over five years. Despite a slight dip in earnings growth at -1.3%, it remains profitable and boasts high-quality past earnings. Recent financials reveal a positive shift from a net loss of US$2.56 million to net income of US$0.11 million for Q4 2024, alongside improved basic earnings per share from continuing operations at US$0.01 compared to last year's loss per share of US$0.30, indicating potential for recovery and stability moving forward.

- Unlock comprehensive insights into our analysis of Transcontinental Realty Investors stock in this health report.

Understand Transcontinental Realty Investors' track record by examining our Past report.

Where To Now?

- Dive into all 282 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SFST

Southern First Bancshares

Operates as the bank holding company for Southern First Bank that provides commercial, consumer, and mortgage loans to the general public in South Carolina, North Carolina, and Georgia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives