- United States

- /

- Real Estate

- /

- NYSE:LB

3 Stocks Possibly Trading At Up To 49.5% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As major stock indexes in the United States recently ended lower due to ongoing U.S.-China trade tensions and mixed earnings reports, investors are keenly observing potential opportunities within the market. In such a climate, identifying stocks that are possibly trading below their intrinsic value can be particularly appealing, as they may offer a margin of safety amid broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $135.58 | $258.37 | 47.5% |

| Udemy (UDMY) | $7.00 | $13.52 | 48.2% |

| SLM (SLM) | $27.00 | $53.06 | 49.1% |

| Phibro Animal Health (PAHC) | $40.19 | $77.67 | 48.3% |

| Horizon Bancorp (HBNC) | $15.96 | $31.41 | 49.2% |

| Hess Midstream (HESM) | $33.68 | $66.70 | 49.5% |

| Flux Power Holdings (FLUX) | $6.66 | $13.01 | 48.8% |

| First Busey (BUSE) | $23.30 | $45.91 | 49.2% |

| Corpay (CPAY) | $283.06 | $547.53 | 48.3% |

| Beacon Financial (BBT) | $24.22 | $45.85 | 47.2% |

We're going to check out a few of the best picks from our screener tool.

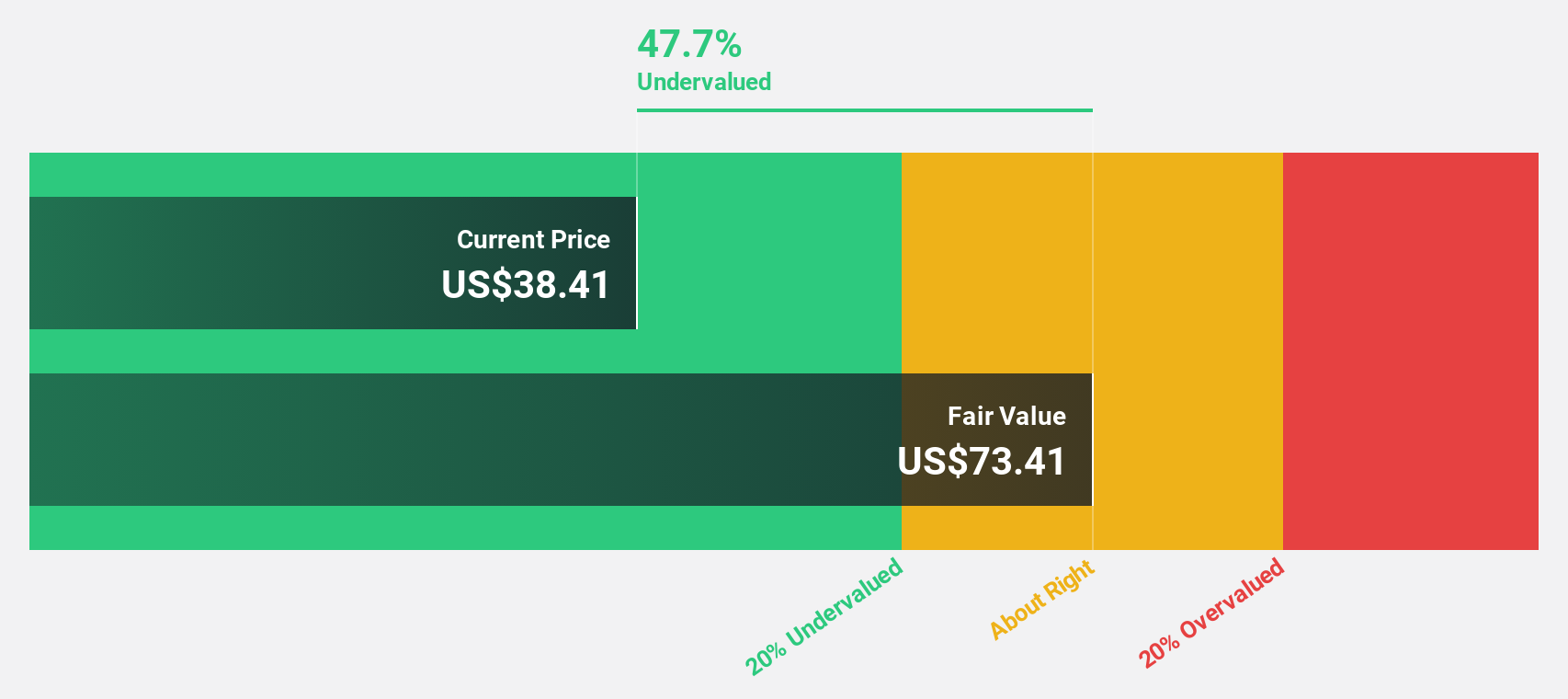

Privia Health Group (PRVA)

Overview: Privia Health Group, Inc. is a national physician-enablement company in the United States, with a market cap of $3.19 billion.

Operations: Privia Health Group generates revenue primarily from its Healthcare Facilities & Services segment, totaling $1.90 billion.

Estimated Discount To Fair Value: 34.8%

Privia Health Group is trading at US$25.97, significantly below its estimated fair value of US$39.83, indicating potential undervaluation based on discounted cash flow analysis. Despite a modest revenue growth forecast of 10.8% annually, the company's earnings are expected to grow substantially at 36.9% per year, outpacing the broader US market's growth rate. Recent financial guidance revisions and increased sales figures further bolster its investment appeal amidst low return on equity forecasts.

- The analysis detailed in our Privia Health Group growth report hints at robust future financial performance.

- Take a closer look at Privia Health Group's balance sheet health here in our report.

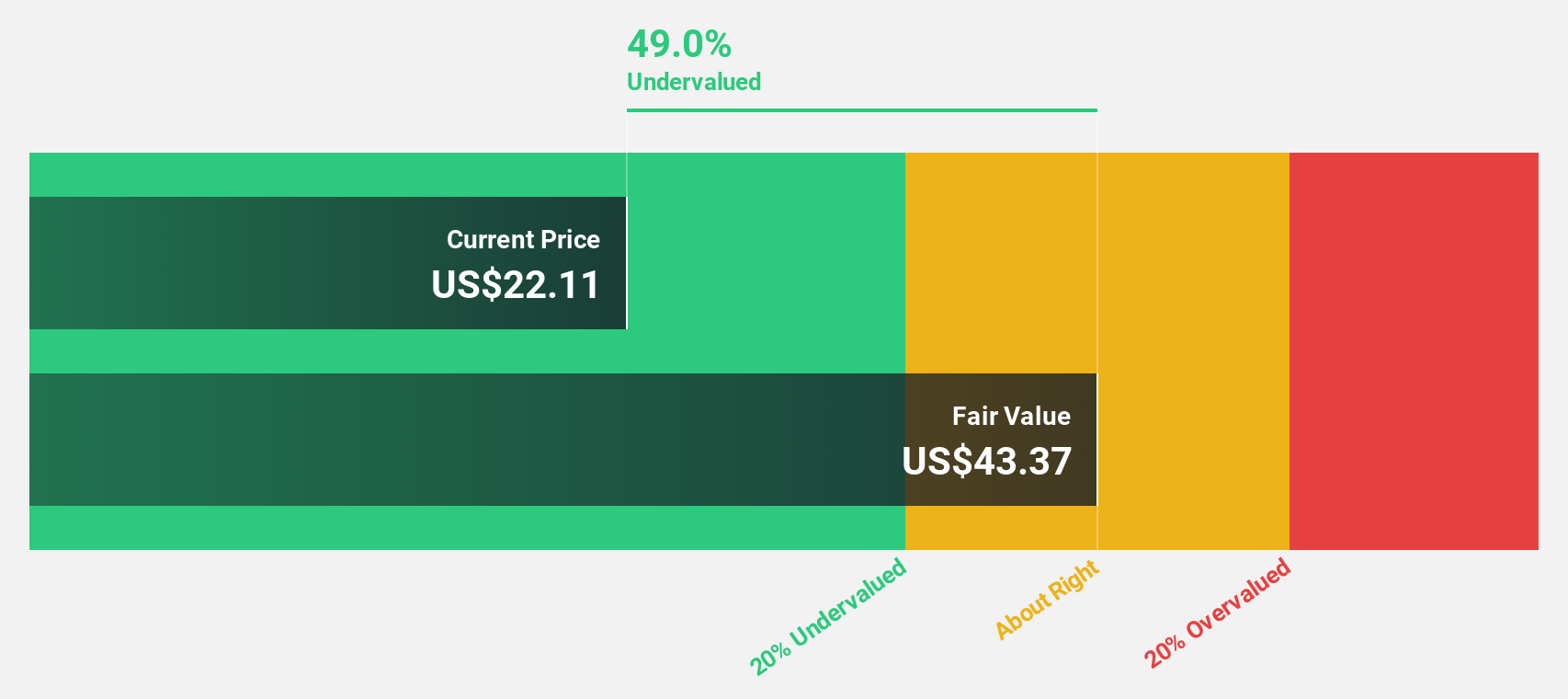

Hess Midstream (HESM)

Overview: Hess Midstream LP owns, operates, develops, and acquires midstream assets to provide fee-based services to Hess and third-party customers in the United States with a market cap of approximately $6.98 billion.

Operations: The company's revenue is primarily derived from three segments: Gathering ($841.50 million), Processing and Storage ($604.80 million), and Terminaling and Export ($124.30 million).

Estimated Discount To Fair Value: 49.5%

Hess Midstream, trading at US$33.68, is considerably undervalued with an estimated fair value of US$66.7 based on discounted cash flow analysis. Despite high debt levels and insider selling, its earnings are projected to grow at 25.7% annually, surpassing the US market average. Recent guidance revisions indicate challenges in gas throughput due to weather and maintenance issues but highlight a robust financial position supported by buybacks and dividend increases amidst substantial profit growth over the past year.

- Our earnings growth report unveils the potential for significant increases in Hess Midstream's future results.

- Unlock comprehensive insights into our analysis of Hess Midstream stock in this financial health report.

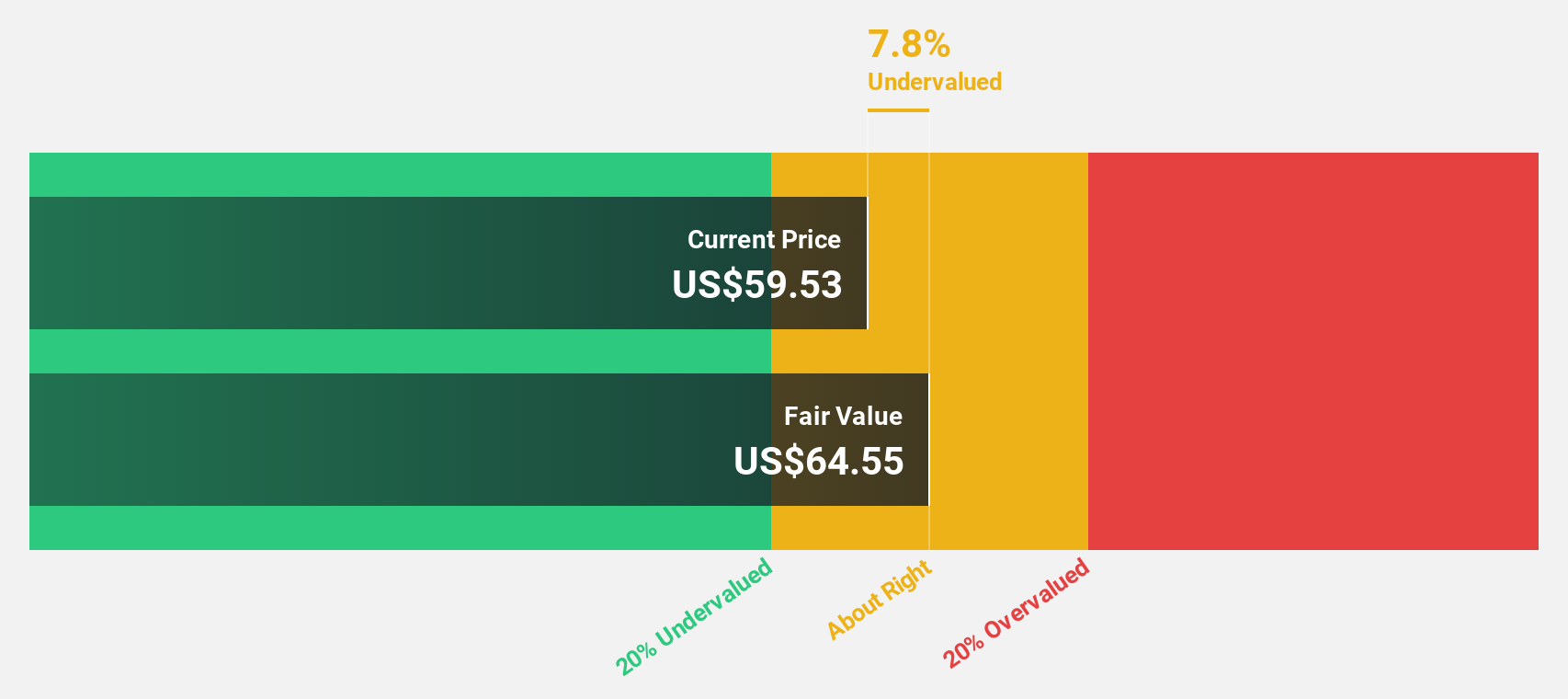

LandBridge (LB)

Overview: LandBridge Company LLC, along with its subsidiaries, focuses on owning and managing land and resources to facilitate oil and natural gas development in the United States, with a market cap of approximately $4.33 billion.

Operations: The company's revenue segment includes Real Estate - Rental, generating $156.47 million.

Estimated Discount To Fair Value: 12.6%

LandBridge, trading at US$56.78, is undervalued with a fair value estimate of US$64.97 based on discounted cash flow analysis. Despite interest payments not being well covered by earnings and low forecasted return on equity, its earnings are expected to grow significantly at 36.7% annually, outpacing the US market average. Recent strategic expansions and alliances in Texas enhance its asset base and potential for alternative energy development, supporting long-term revenue growth prospects.

- Our growth report here indicates LandBridge may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of LandBridge.

Seize The Opportunity

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Undervalued US Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LB

LandBridge

Owns and manages land and resources to support and enhance oil and natural gas development in the United States.

High growth potential and good value.

Market Insights

Community Narratives