- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

November 2025 Stocks Estimated To Be Trading Below Their Fair Value

Reviewed by Simply Wall St

In November 2025, the U.S. stock market has experienced significant volatility, with major indices like the Dow Jones and Nasdaq suffering sharp declines due to tumbling tech shares amidst economic uncertainties following a prolonged federal government shutdown. Despite these fluctuations, opportunities may arise for investors seeking undervalued stocks that could be trading below their fair value. Identifying such stocks often involves analyzing companies with strong fundamentals that may have been temporarily overlooked by the market during times of broader economic or sector-specific downturns.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $126.92 | $249.01 | 49% |

| TransMedics Group (TMDX) | $115.55 | $229.20 | 49.6% |

| Phibro Animal Health (PAHC) | $44.70 | $87.83 | 49.1% |

| Old National Bancorp (ONB) | $20.79 | $40.98 | 49.3% |

| Lyft (LYFT) | $23.80 | $47.52 | 49.9% |

| Huntington Bancshares (HBAN) | $15.71 | $31.07 | 49.4% |

| First Busey (BUSE) | $23.01 | $45.34 | 49.3% |

| Caris Life Sciences (CAI) | $24.30 | $47.82 | 49.2% |

| BioLife Solutions (BLFS) | $25.14 | $49.66 | 49.4% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.70 | $37.29 | 49.8% |

Let's dive into some prime choices out of the screener.

Firefly Aerospace (FLY)

Overview: Firefly Aerospace Inc. is a space and defense technology company offering mission solutions for national security, government, and commercial clients, with a market cap of $2.68 billion.

Operations: The company generates revenue primarily from its Aerospace & Defense segment, totaling $102.81 million.

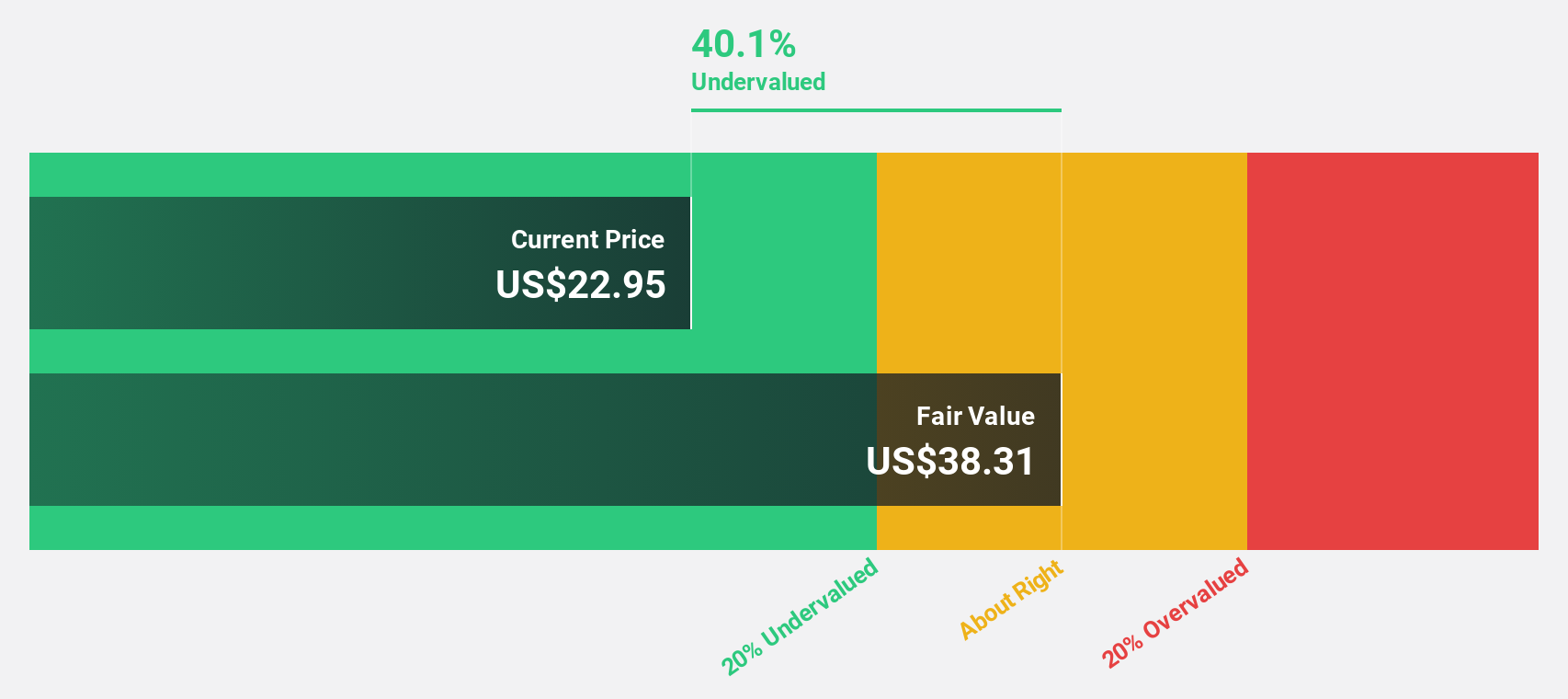

Estimated Discount To Fair Value: 45.1%

Firefly Aerospace is trading significantly below its estimated fair value of US$38.99, with a current price around US$21.42, highlighting potential undervaluation based on cash flows. Despite recent legal challenges and volatile share prices, the company's revenue grew by 77.3% over the past year and is forecasted to grow at 44.4% annually, surpassing market averages. Firefly expects profitability within three years, positioning it for above-average market growth despite current operational losses and legal issues affecting investor sentiment.

- Our earnings growth report unveils the potential for significant increases in Firefly Aerospace's future results.

- Click to explore a detailed breakdown of our findings in Firefly Aerospace's balance sheet health report.

Howard Hughes Holdings (HHH)

Overview: Howard Hughes Holdings Inc. develops and operates master planned communities in the United States, with a market cap of $5.19 billion.

Operations: The company's revenue segments include Operating Assets generating $460.15 million, Strategic Developments contributing $784.82 million, and Master Planned Communities bringing in $588.99 million.

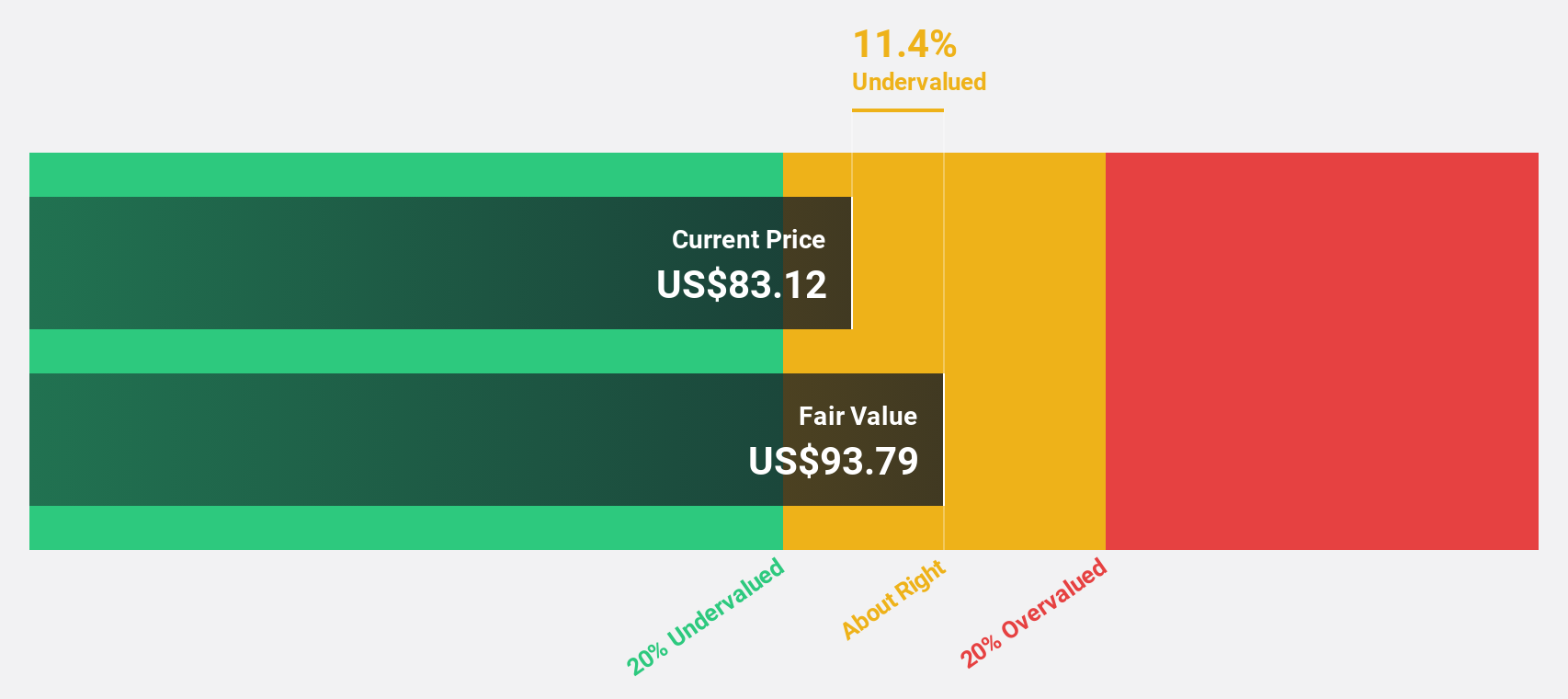

Estimated Discount To Fair Value: 17.7%

Howard Hughes Holdings is trading 17.7% below its fair value estimate of US$105.74, suggesting undervaluation based on cash flows. Recent earnings reveal a net income increase to US$119.51 million for Q3 2025 from US$72.77 million the previous year, despite shareholder dilution concerns and debt coverage issues by operating cash flow. Revenue growth at 13.6% annually surpasses market averages, with expected earnings growth of 24.3% annually positioning it for strong future performance despite low forecasted ROE.

- The analysis detailed in our Howard Hughes Holdings growth report hints at robust future financial performance.

- Get an in-depth perspective on Howard Hughes Holdings' balance sheet by reading our health report here.

Tapestry (TPR)

Overview: Tapestry, Inc. is a company that offers accessories and lifestyle brand products across North America, Greater China, the rest of Asia, and internationally with a market cap of approximately $21.28 billion.

Operations: The company's revenue is primarily derived from its Coach brand at $5.86 billion, followed by Kate Spade at $1.17 billion, and Stuart Weitzman at $176 million.

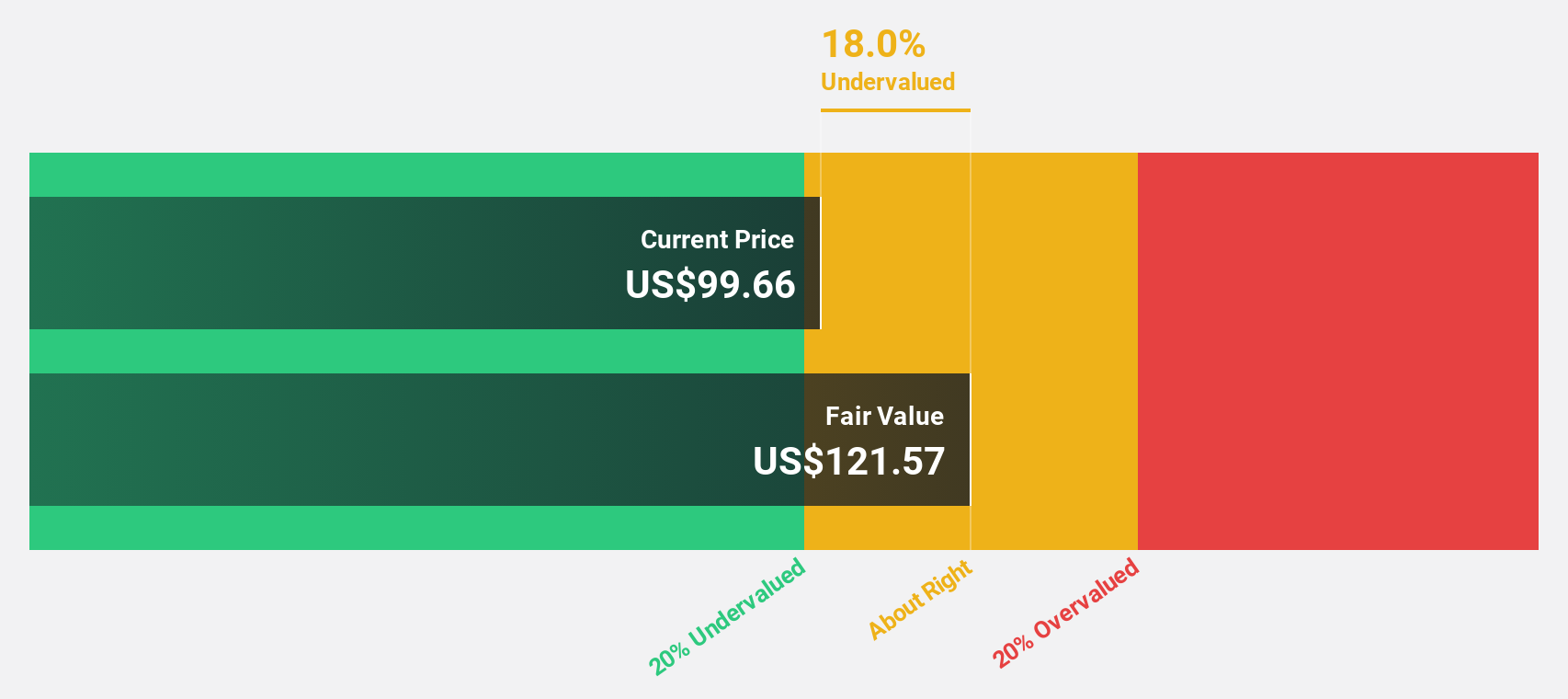

Estimated Discount To Fair Value: 26.3%

Tapestry is trading US$100.76, 26.3% below its fair value estimate of US$136.64, indicating potential undervaluation based on cash flows despite high debt levels and a low net profit margin of 3.8%. Recent earnings show a positive trend with Q1 sales increasing to US$1.70 billion from US$1.51 billion year-over-year, and net income rising to US$274.8 million from US$186.6 million, alongside significant annual earnings growth forecasts at 24.63%.

- Our growth report here indicates Tapestry may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Tapestry.

Where To Now?

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 199 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives