- United States

- /

- Real Estate

- /

- NYSE:CWK

How Investors May Respond To Cushman & Wakefield (CWK) Advising on VertiPorts’ Urban Air Mobility Infrastructure

Reviewed by Sasha Jovanovic

- VertiPorts by Atlantic recently announced the selection of Cushman & Wakefield as its preferred real estate advisor to assist in developing vertiports for electric vertical takeoff and landing vehicles across major U.S. urban markets, including California, New York, New Jersey, and Florida.

- This collaboration positions Cushman & Wakefield at the forefront of a new sector within commercial real estate, reflecting growing demand for innovative urban mobility infrastructure.

- We'll explore how Cushman & Wakefield's involvement in urban air mobility infrastructure could reshape the company's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Cushman & Wakefield Investment Narrative Recap

To hold shares of Cushman & Wakefield, an investor needs to believe in the company’s ability to maintain or grow earnings despite its reliance on cyclical transactional revenues and ongoing changes in office space demand. The recently announced VertiPorts partnership could put Cushman & Wakefield at the center of a new growth segment, yet it does not meaningfully change the most immediate catalyst (upcoming earnings) or alter the biggest risk: exposure to downturns in core real estate activity.

Among recent developments, the company’s successful repricing of its $840 million Term Loan stands out. Reducing the interest rate by 25 basis points can support financial flexibility, an important factor as Cushman & Wakefield balances new growth initiatives with careful management of debt and earnings in a still-volatile commercial property market.

On the other hand, if broader real estate demand remains under pressure, investors should be aware that...

Read the full narrative on Cushman & Wakefield (it's free!)

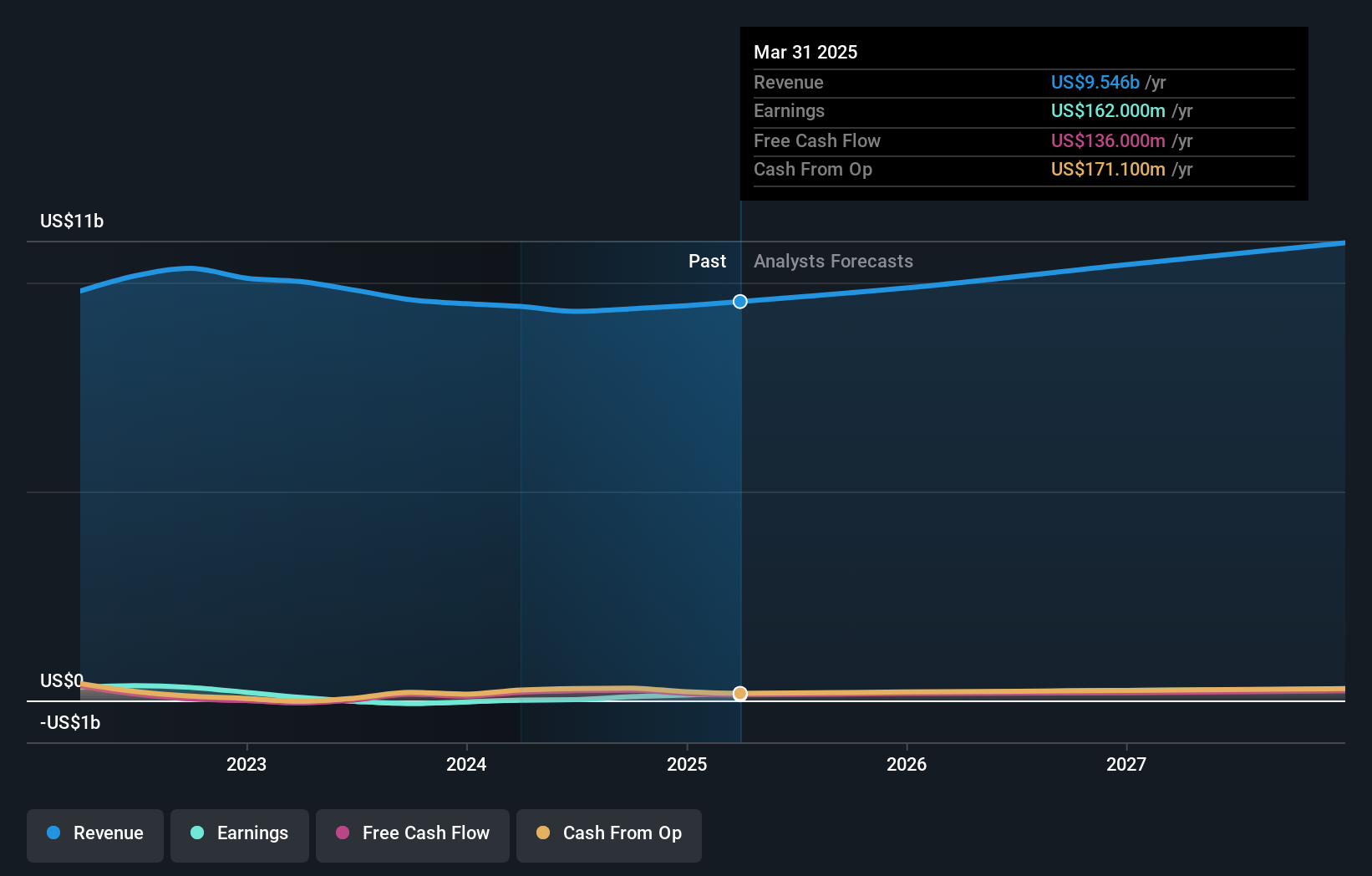

Cushman & Wakefield's narrative projects $11.4 billion revenue and $342.8 million earnings by 2028. This requires 5.4% yearly revenue growth and a $137 million earnings increase from $205.8 million.

Uncover how Cushman & Wakefield's forecasts yield a $16.89 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community range from US$4.64 to US$17.62 per share. With earnings highly sensitive to real estate cycles, your view on market demand may drive expectations for Cushman & Wakefield’s future performance.

Explore 3 other fair value estimates on Cushman & Wakefield - why the stock might be worth as much as 17% more than the current price!

Build Your Own Cushman & Wakefield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cushman & Wakefield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cushman & Wakefield's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWK

Cushman & Wakefield

Provides commercial real estate services under the Cushman & Wakefield brand in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives