- United States

- /

- Real Estate

- /

- NYSE:COMP

Compass (COMP) Appoints Antitrust Expert Ethan Glass As Chief Legal Officer

Reviewed by Simply Wall St

Ethan Glass's appointment as Chief Legal Officer at Compass (COMP) marks a significant development, aligning with the company's mission to address antitrust issues in the real estate sector. Over the last quarter, Compass's share price rose 43%, a move potentially influenced by various executive changes and financial results. The appointment of a new CFO, Scott Wahlers, might have also instilled confidence in its strategic direction. Additionally, Compass reported strong Q2 earnings, with notable sales and income increases, reinforcing investor sentiment. Amid this context, broader market trends, such as the overall positive performance of indexes like the S&P 500, have likely played a crucial role in bolstering Compass's market performance.

Buy, Hold or Sell Compass? View our complete analysis and fair value estimate and you decide.

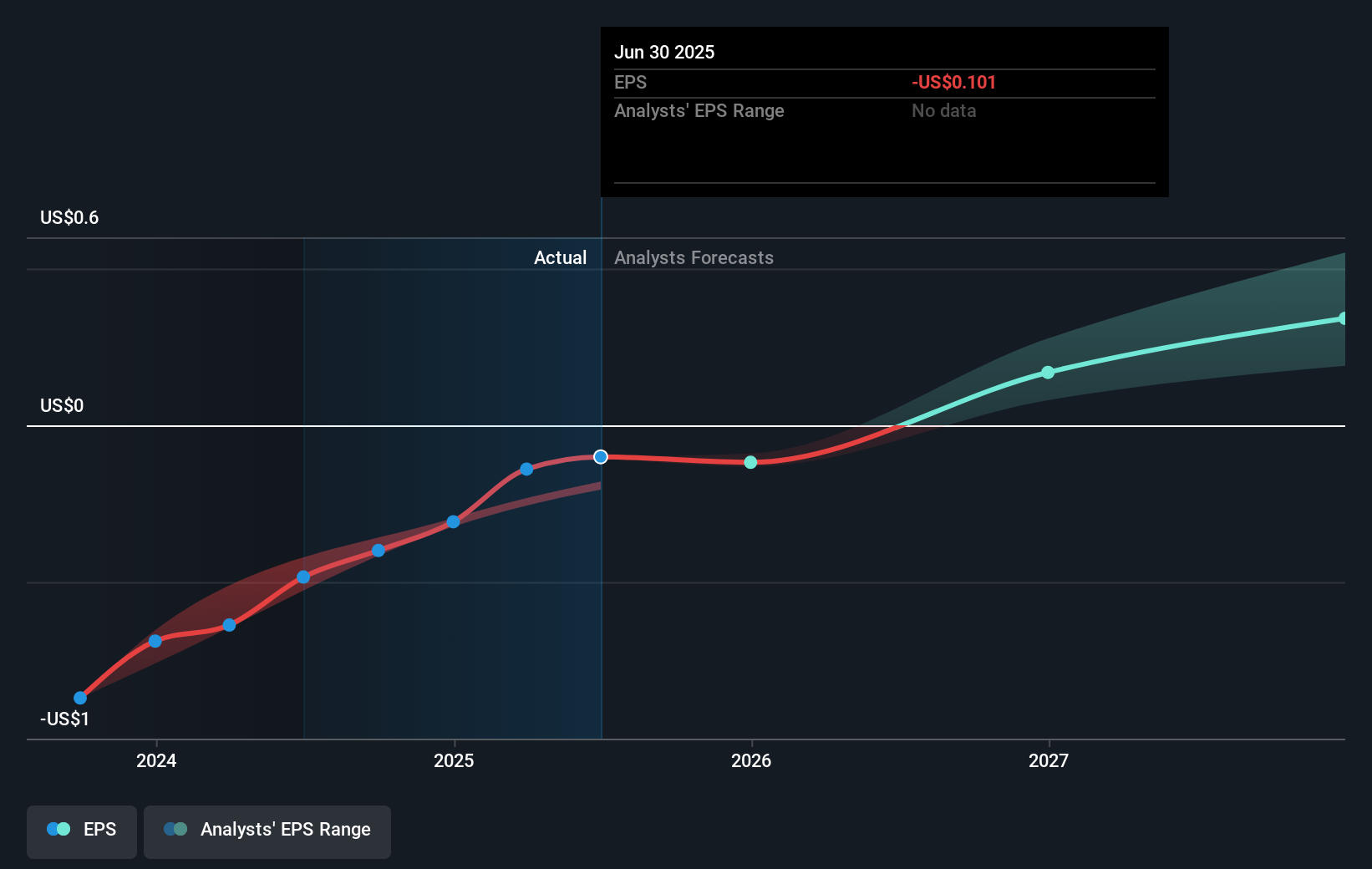

The appointment of Ethan Glass as Chief Legal Officer at Compass aligns with the company's mission to address complex antitrust issues, potentially reinforcing its strategic focus and enhancing investor confidence. This new leadership may impact revenue and earnings forecasts by streamlining operations and supporting AI-driven productivity enhancements. However, it is essential for Compass to navigate external pressures from commissions and industry shifts to maintain momentum.

Over the past three years, Compass's total shareholder return, including share price and dividends, was 205.26%. Comparatively, Compass outpaced both the US real estate market, which returned 28.4%, and the broader US market, which had a 20.5% return over the past year. This outperformance underscores investor confidence in Compass's growth potential, even as the company remains unprofitable and its price-to-sales ratio appears high compared to peers.

The current share price stands at US$9.28, slightly above the consensus analyst price target of US$9.15, suggesting the market may anticipate further growth or an upside from recent strategic initiatives. The company's focus on integrating AI technology and expanding high-margin services could influence future earnings and justify higher valuations, despite current forecasts pointing to a need for earnings growth to align more closely with industry standards.

Our expertly prepared valuation report Compass implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COMP

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)