- United States

- /

- Household Products

- /

- NYSE:CLX

3 US Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. market navigates a period of uncertainty with stock futures fluctuating amid anticipation of the presidential election and Federal Reserve's interest rate decision, investors are keenly observing potential opportunities amidst these developments. In this climate, identifying stocks that may be trading below their estimated value can offer a strategic advantage, as undervalued stocks have the potential to provide growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.85 | $37.48 | 49.7% |

| Cadence Bank (NYSE:CADE) | $33.06 | $64.76 | 48.9% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $37.28 | $72.49 | 48.6% |

| MVB Financial (NasdaqCM:MVBF) | $19.10 | $37.09 | 48.5% |

| UFP Technologies (NasdaqCM:UFPT) | $272.655 | $539.63 | 49.5% |

| First Western Financial (NasdaqGS:MYFW) | $18.94 | $37.35 | 49.3% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $273.91 | $546.14 | 49.8% |

| WEX (NYSE:WEX) | $173.79 | $344.90 | 49.6% |

| Alaska Air Group (NYSE:ALK) | $49.23 | $97.63 | 49.6% |

| AeroVironment (NasdaqGS:AVAV) | $216.00 | $419.41 | 48.5% |

We're going to check out a few of the best picks from our screener tool.

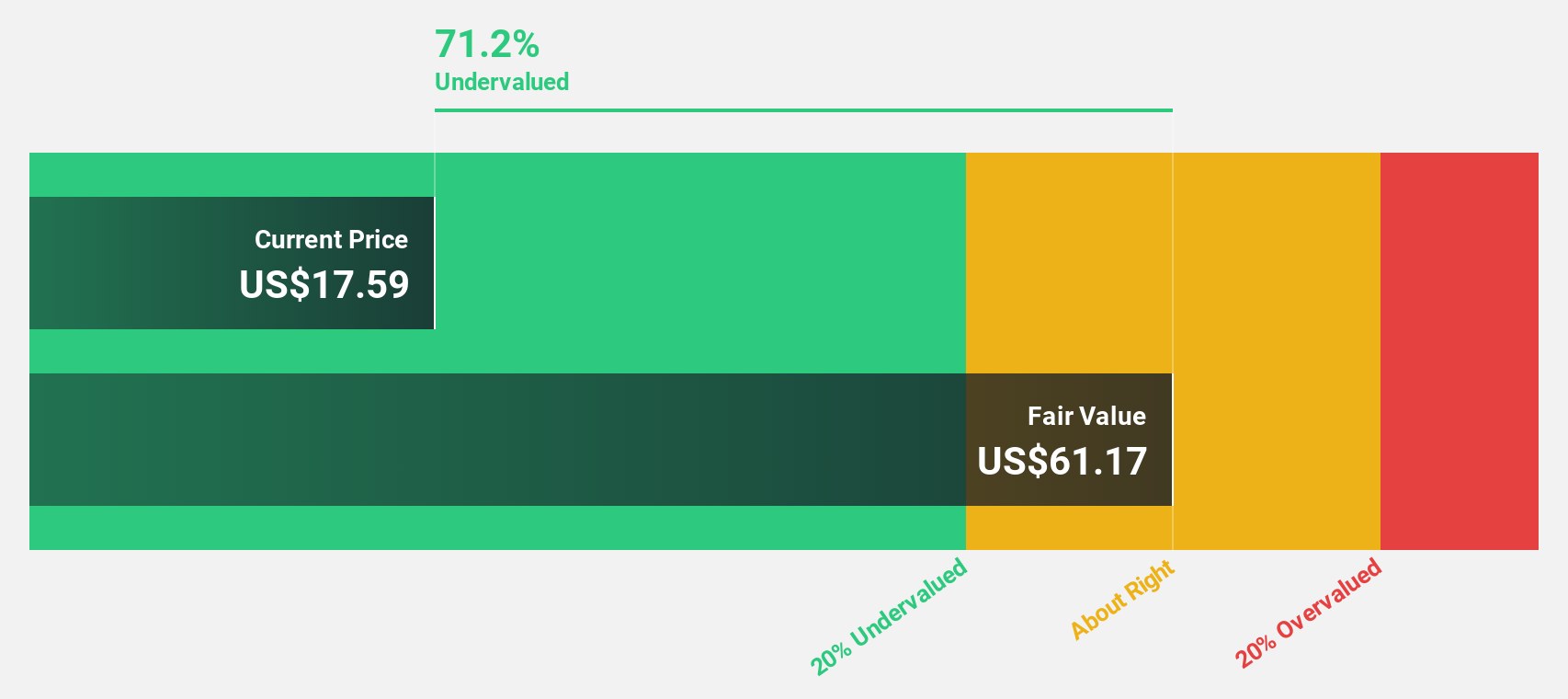

ADMA Biologics (NasdaqGM:ADMA)

Overview: ADMA Biologics, Inc. is a biopharmaceutical company that develops, manufactures, and markets specialty plasma-derived biologics for treating immune deficiencies and infectious diseases globally, with a market cap of $4.51 billion.

Operations: ADMA's revenue is primarily derived from its Biomanufacturing segment, which accounts for $326.70 million, supplemented by $3.41 million from Plasma Collection Centers.

Estimated Discount To Fair Value: 31.5%

ADMA Biologics is trading at US$19.37, significantly below its estimated fair value of US$28.28, suggesting undervaluation based on cash flows. The company has shown substantial revenue growth, reporting US$107.19 million in Q2 2024 sales compared to US$60.12 million the previous year, and turned profitable with a net income of US$32.06 million versus a prior loss. However, recent insider selling and past shareholder dilution could be potential concerns for investors.

- Our earnings growth report unveils the potential for significant increases in ADMA Biologics' future results.

- Get an in-depth perspective on ADMA Biologics' balance sheet by reading our health report here.

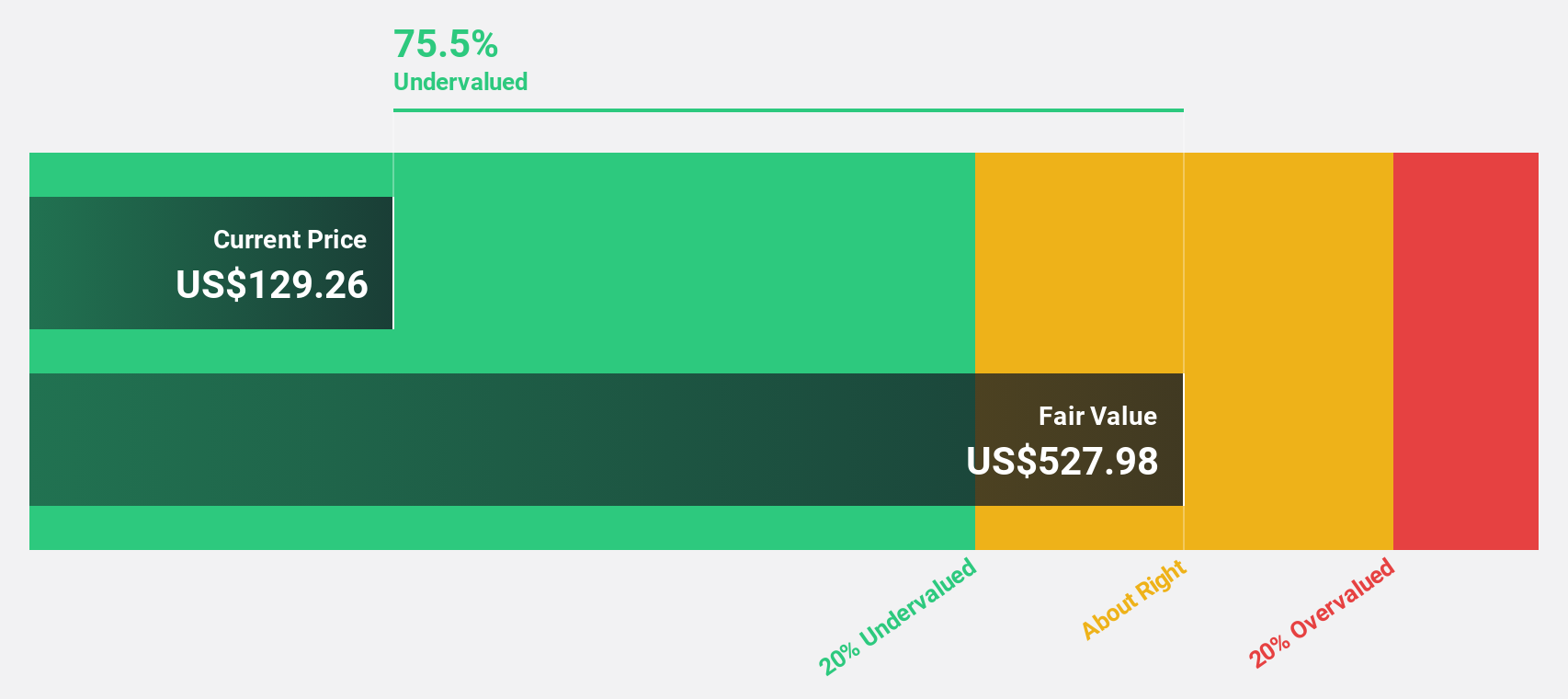

Clorox (NYSE:CLX)

Overview: The Clorox Company manufactures and markets consumer and professional products globally, with a market cap of approximately $20.19 billion.

Operations: The company's revenue segments are comprised of Health and Wellness at $2.68 billion, Household at $2.07 billion, Lifestyle at $1.37 billion, and International at $1.15 billion.

Estimated Discount To Fair Value: 38.1%

Clorox is trading at US$163.11, significantly below its estimated fair value of US$263.47, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to US$99 million in Q1 2025 from US$22 million a year ago. Despite high debt levels and slower revenue growth projections compared to the market, Clorox's expected annual profit growth and revised earnings guidance underscore its robust financial outlook.

- Upon reviewing our latest growth report, Clorox's projected financial performance appears quite optimistic.

- Dive into the specifics of Clorox here with our thorough financial health report.

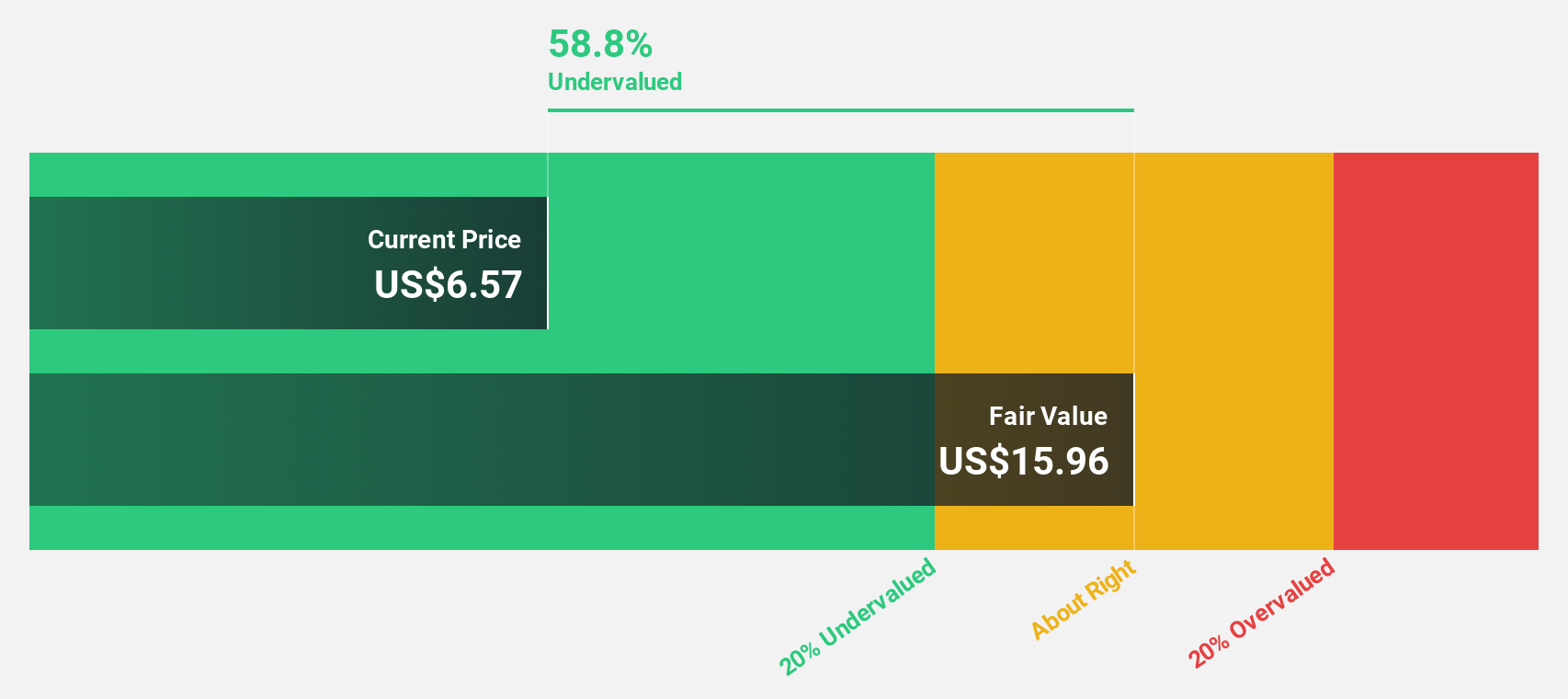

Compass (NYSE:COMP)

Overview: Compass, Inc. operates as a real estate brokerage service provider in the United States with a market cap of approximately $3.27 billion.

Operations: The company generates revenue from its Internet Information Providers segment, amounting to $5.35 billion.

Estimated Discount To Fair Value: 34.1%

Compass is trading at US$6.41, below its estimated fair value of US$9.72, indicating potential undervaluation based on cash flows. The company reported improved earnings with a net loss reduction to US$1.7 million in Q3 2024 from US$39.4 million a year ago and expects revenue growth above the market average over the next three years. However, recent shareholder dilution and low forecasted return on equity might temper enthusiasm despite promising profit growth expectations.

- According our earnings growth report, there's an indication that Compass might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Compass.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 189 more companies for you to explore.Click here to unveil our expertly curated list of 192 Undervalued US Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Engages in the manufacture and marketing of consumer and professional products worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives