- United States

- /

- Real Estate

- /

- NYSE:CBRE

How Investors Are Reacting To CBRE (CBRE) Leadership Shifts, ESOP Filing, and Ecolab Partnership

Reviewed by Sasha Jovanovic

- Earlier this month, CBRE Group announced the promotion of Tom Dancer to lead its European retail occupier business, alongside new executive appointments and a US$315.12 million ESOP-related shelf registration filing.

- Amid these organizational and financial developments, the company also partnered with Ecolab to enhance water efficiency offerings for commercial real estate clients across sectors such as data centers and life sciences.

- We'll explore how CBRE's emphasis on leadership renewal and sustainability partnerships could influence its investment narrative and growth outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

CBRE Group Investment Narrative Recap

Owning CBRE Group shares means believing in the company's ability to drive long-term growth through enhanced operational synergies, resilient revenue streams, and disciplined investments, even as market conditions fluctuate. Recent leadership changes and partnerships, such as the Dancer promotion and Ecolab collaboration, signal continuity in CBRE’s broader strategy, but do not materially impact the most important near-term catalyst: demand recovery in large-scale leasing, which faces ongoing macroeconomic risk.

Among the recent announcements, the $315.12 million ESOP-related shelf registration stands out as most relevant; while this move may support employee retention and align interests internally, its significance for the key catalysts, particularly leasing demand, appears limited.

Yet, in contrast, investors should be aware of how persistent global economic uncertainty could suddenly dampen leasing volumes and stall...

Read the full narrative on CBRE Group (it's free!)

CBRE Group's narrative projects $50.0 billion in revenue and $2.3 billion in earnings by 2028. This requires 9.5% yearly revenue growth and a $1.2 billion earnings increase from $1.1 billion today.

Uncover how CBRE Group's forecasts yield a $172.64 fair value, a 15% upside to its current price.

Exploring Other Perspectives

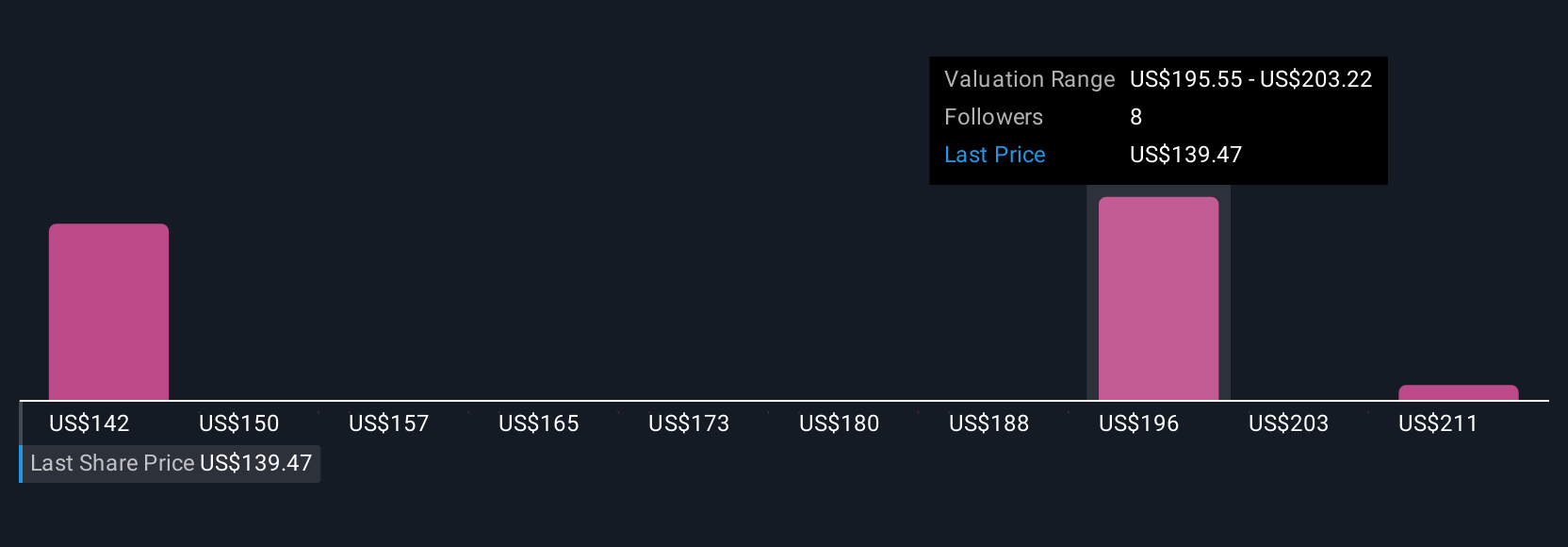

Three retail investors in the Simply Wall St Community estimate CBRE’s fair value between US$154.51 and US$218.54 per share. Against this wide range, ongoing economic uncertainty remains a crucial factor shaping CBRE’s future outcomes, and you can explore these different viewpoints for deeper insight.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth as much as 45% more than the current price!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives