- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (NYSE:CBRE): Assessing Valuation After Hospitality Headwinds and Manhattan Office Strength

Reviewed by Kshitija Bhandaru

CBRE Group (NYSE:CBRE) recently trimmed its forecast for revenue per available room growth in the U.S. hotel sector, highlighting a tougher landscape for hospitality real estate this year. At the same time, Manhattan’s bustling office leasing market, where CBRE has a pivotal role, is delivering a more optimistic contrast for commercial real estate investors.

See our latest analysis for CBRE Group.

CBRE Group’s recent wave of executive appointments and its prominent presence at major real estate events come at a time when the company’s momentum remains solid. Despite some sector-specific headwinds, investors saw a robust 1-year total shareholder return of 26.09% and a striking 5-year total return of 233.31%. This suggests that long-term confidence in CBRE’s strategy and expanding platform is holding firm, even as the share price dipped 5.28% over the past month.

If you’re weighing fresh opportunities in today’s market, now could be a great time to expand your search to fast growing stocks with high insider ownership.

The question now is whether CBRE’s recent share price dip creates an attractive entry point, or if the company’s future growth has already been fully reflected in the current valuation.

Most Popular Narrative: 9.2% Undervalued

CBRE Group's narrative fair value of $172.64 stands notably above the recent closing price of $156.82. Opinions are split on whether the company's robust outlook supports this higher valuation. This sets the stage for a deeper look at the underlying assumptions.

The increased focus on resilient businesses, which now make up over 60% of CBRE's total SOP, is expected to provide stable net revenue growth, even amidst market uncertainties. This is likely to improve net margins due to enhanced operating leverage and cost efficiencies.

Want to know which business pivots and capital deployment moves underpin this valuation? The core of this narrative is a bet on future profitability levels that could outpace the sector. Dive in to uncover the forecasts and financial engineering that drive this bold price target.

Result: Fair Value of $172.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market volatility or a slowdown in major leasing deals could create challenges for CBRE as it seeks sustained high earnings growth in the coming years.

Find out about the key risks to this CBRE Group narrative.

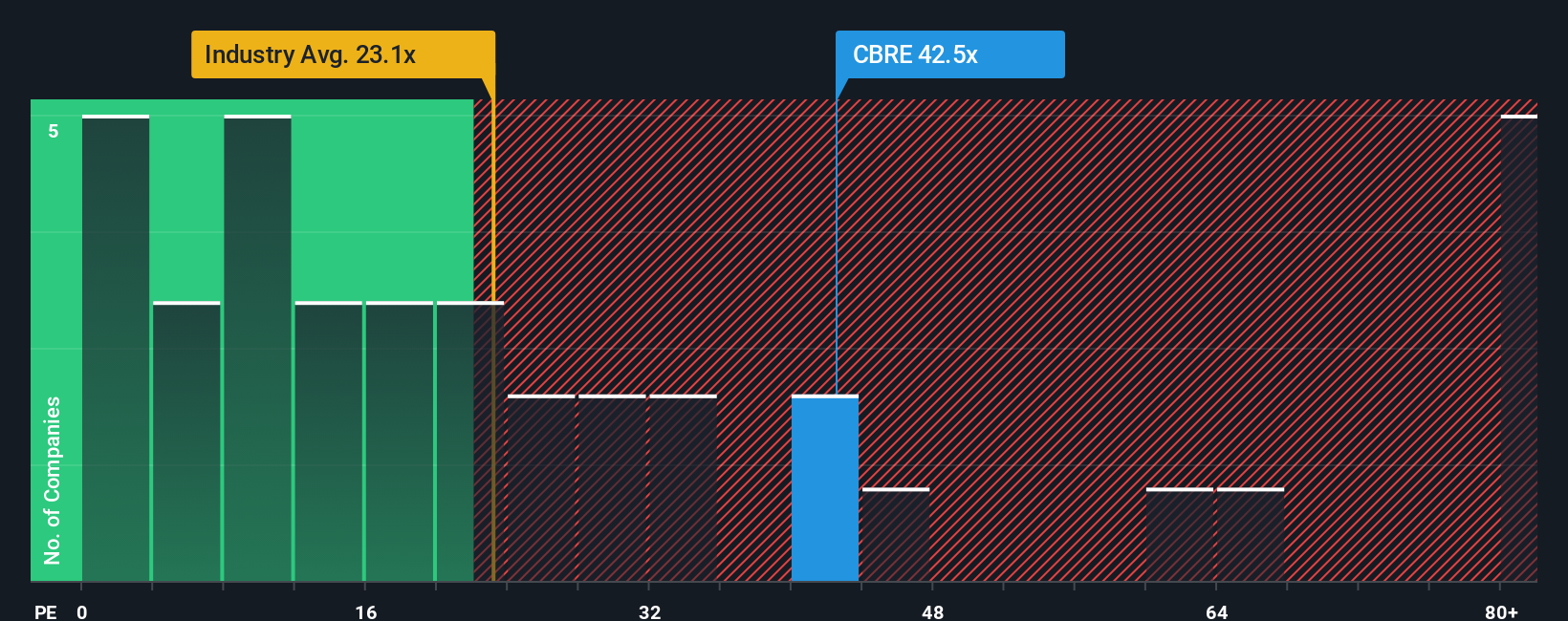

Another View: Multiples Tell a Different Story

While the narrative assessment pins CBRE as undervalued, looking at the company’s price-to-earnings ratio paints a more cautious picture. CBRE trades at 42.2x earnings, which is higher than both the US real estate industry average of 24.8x and its peer average of 31.5x. The market could shift toward the fair ratio of 27.1x. This suggests current pricing factors in high expectations and potential risk if growth slows. Are investors overlooking something, or will CBRE's forward momentum justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If you’re looking to challenge these assumptions or want to explore the numbers firsthand, you can craft your own narrative in just a few minutes and in your own way. Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let tomorrow’s top opportunities pass you by. Use the power of Simply Wall Street’s screeners to spot what the crowd might be missing before anyone else does.

- Target future trend-setters by jumping into these 24 AI penny stocks, which are using artificial intelligence to disrupt major industries worldwide.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3% to secure consistent yields above 3% from proven payers.

- Capitalize on undervalued potential by acting fast with these 874 undervalued stocks based on cash flows, which use real cash flow metrics to reveal hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives