- United States

- /

- Real Estate

- /

- NYSE:BEKE

S&P Global BMI Index Inclusion Could Be a Game Changer for KE Holdings (BEKE)

Reviewed by Simply Wall St

- On September 21, 2025, KE Holdings Inc. (SEHK:2423) was added to the S&P Global BMI Index, expanding its reach to a broader spectrum of institutional investors.

- This index inclusion can make the company’s shares more accessible to global investment funds, potentially broadening its international investor base.

- With greater global visibility following its index inclusion, we’ll explore how this development interacts with KE Holdings’ long-term investment thesis.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

KE Holdings Investment Narrative Recap

To own shares in KE Holdings today, investors need to believe in a recovery of China’s real estate sector, ongoing digital transformation, and the company’s ability to expand recurring revenue streams while managing operational efficiency. The S&P Global BMI Index addition raises KE Holdings’ profile internationally but does not materially impact the most important short-term catalyst, continued platform growth as the property market stabilizes, or alleviate the biggest risk, which remains persistent weakness in China’s real estate sector.

Of the company’s latest announcements, KE Holdings’ decision to increase its buyback authorization by US$2 billion on August 26, 2025, is most relevant in this context. While strong buyback activity can signal management’s confidence and potentially support the share price amidst heightened visibility from the index inclusion, its impact on addressing challenges from soft property market demand remains limited for now.

On the other hand, investors should be aware of the ongoing risk from demographic pressure and weak transaction volumes that could...

Read the full narrative on KE Holdings (it's free!)

KE Holdings' outlook anticipates CN¥136.4 billion in revenue and CN¥8.6 billion in earnings by 2028. This is based on forecast annual revenue growth of 9.8% and an earnings increase of CN¥4.7 billion from the current CN¥3.9 billion.

Uncover how KE Holdings' forecasts yield a $22.83 fair value, a 16% upside to its current price.

Exploring Other Perspectives

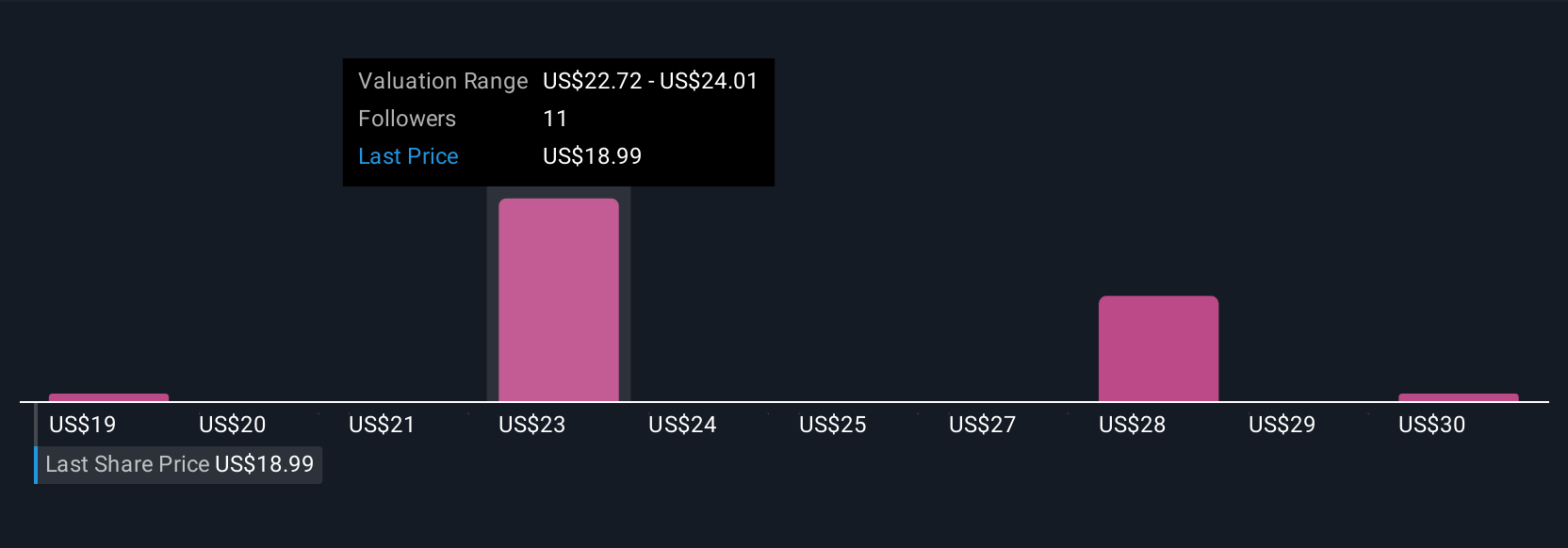

Fair value estimates from four members of the Simply Wall St Community range from US$18.86 to US$31.74 per share. While these views highlight the variety of outlooks, persistent pressure in China’s property market remains a key challenge influencing company performance and future returns.

Explore 4 other fair value estimates on KE Holdings - why the stock might be worth just $18.86!

Build Your Own KE Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KE Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KE Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KE Holdings' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)