- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow (ZG) Valuation Revisited After Google Tests Home For‑Sale Ads in Search Results

Reviewed by Simply Wall St

Investors in Zillow Group (ZG) are reassessing the story after Alphabet Google began testing home for-sale ads at the top of search results, a shift that directly challenges Zillow’s prime position in online home discovery.

See our latest analysis for Zillow Group.

The Google test hit sentiment hard in the short term, with a sharp drop earlier in the week and a recent 90 day share price return of negative 14.95 percent. However, Zillow still boasts a strong three year total shareholder return of 116.19 percent that suggests longer term momentum is intact.

If this shake up has you rethinking how you spread your bets across digital platforms, it might be worth scanning fast growing stocks with high insider ownership for other fast moving names with committed insiders.

With shares still trading below analyst targets despite double digit revenue growth, the key question now is whether Zillow is quietly undervalued after the Google scare or if the market is already pricing in every ounce of future growth.

Most Popular Narrative: 18.2% Undervalued

With Zillow Group last closing at $72.38 against a popular fair value estimate of $88.46, the narrative frames today’s pullback as an opportunity, not a trend break.

The shift toward integrated, end to end digital transaction ecosystems (like Zillow 360 and Enhanced Markets) is enabling Zillow to capture more ancillary services revenue (mortgages, rentals, software), reducing dependence on advertising and expanding top line growth as well as supporting EBITDA margin expansion through operational efficiencies.

Want to see what powers that confidence? This narrative leans on accelerating revenue, widening margins, and a future earnings multiple more typical of high growth software leaders. Curious which bold assumptions sit under the hood of that valuation roadmap and how far profitability is expected to stretch beyond today’s losses? The full story shows exactly how those moving parts stack up into that mid double digit upside.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly weak housing affordability or tougher commission regulations could undercut transaction volumes and agent ad spend, which could stall Zillow’s high growth roadmap.

Find out about the key risks to this Zillow Group narrative.

Another View on Valuation

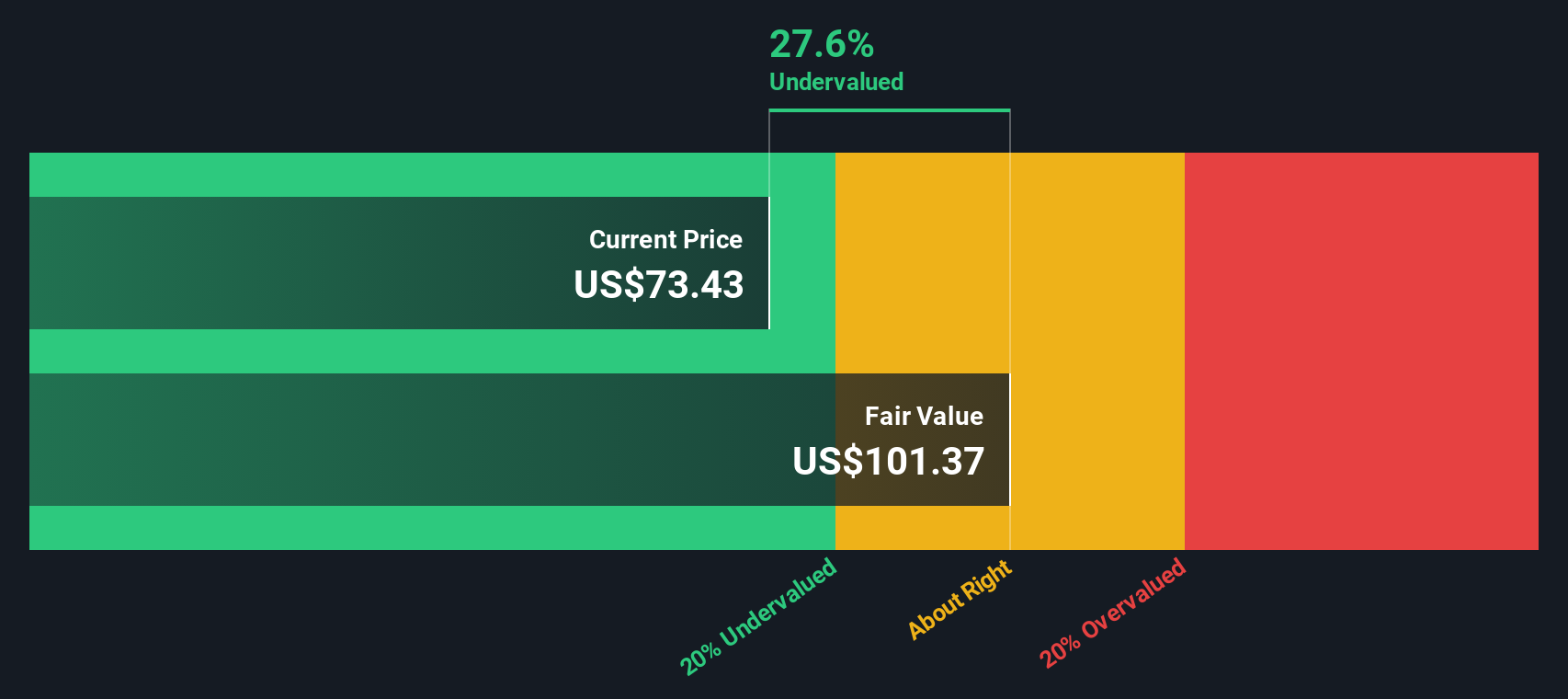

Our SWS DCF model also flags upside, putting fair value around $101.74, roughly 28.9 percent above the current $72.38 share price. If both narrative and cash flow math agree the stock is undervalued, are investors overreacting to near term noise or underestimating long term execution risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zillow Group Narrative

If this perspective does not quite match your own, dive into the numbers yourself and craft a fresh narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for more investment ideas?

Do not stop with one opportunity when the Simply Wall St Screener can reveal more potential winners across themes and sectors that other investors may be overlooking.

- Capture early momentum by reviewing these 3611 penny stocks with strong financials that already show strong balance sheets and fundamentals instead of chasing hype at the peak.

- Position yourself ahead of the next tech wave by evaluating these 26 AI penny stocks that apply artificial intelligence to real world problems with scalable business models.

- Identify potentially attractive entry points by focusing on these 907 undervalued stocks based on cash flows where cash flow strength is a key consideration before broader market sentiment changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)