- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow (ZG): Evaluating Valuation Following New Partnership to Broaden AI Listing Tech Reach

Reviewed by Simply Wall St

Zillow Group (ZG) has just grabbed attention with a new partnership, this time teaming up with Berkshire Hathaway HomeServices to bring Zillow Showcase, its AI-driven premium listing tool, to a wider network of U.S. agents. The move isn’t just about signing a fresh agreement; it’s about leveraging digital marketing to help listings stand out, sell faster, and fetch higher prices. The latest rollout builds on an earlier collaboration with HomeServices of America, pointing to growing trust in Zillow’s technology to help agents win in a crowded real estate market.

Momentum seems to be on Zillow’s side, with shares gaining an impressive 21% this year and up more than 61% over the past twelve months. The ongoing rollout of product updates, such as interactive tours and better data analytics, continues to capture industry interest. Compared to three years ago, Zillow stock has soared over 125%, outpacing many peers, although the five-year return is still hovering just below break-even. Investors may be sensing growing confidence in the company’s push to innovate and partner up, or perhaps the market is simply embracing renewed optimism in real estate tech.

After such a run, is Zillow Group trading at a compelling price, or has the recent surge already baked in much of its growth potential?

Most Popular Narrative: 2.5% Undervalued

According to the most widely followed market view, Zillow Group shares are trading just below their estimated fair value. Digital transformation and recurring partnerships are seen as major drivers of its future potential.

"The accelerated digital transformation of real estate, combined with Zillow's leading traffic, engagement, and product innovation, including AI-powered tools, integrated communication platforms, and immersive experiences, positions the company to expand market share and drive higher user conversion rates. This is likely to result in above-industry revenue growth and higher monetization per transaction."

Curious how ambitious tech bets and a digital-first strategy could reshape Zillow’s financial outlook? Analysts supporting this fair value anticipate a profit rebound, rising revenues, and a growth profile often found in industry disruptors. Interested in the financial assumptions, bold projections, and valuation approach that inform this narrative? The details may be surprising.

Result: Fair Value of $86.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising interest rates and increased competition from alternative real estate platforms could challenge Zillow’s growth projections and put pressure on its margins.

Find out about the key risks to this Zillow Group narrative.Another View: Industry Metrics Paint a Different Picture

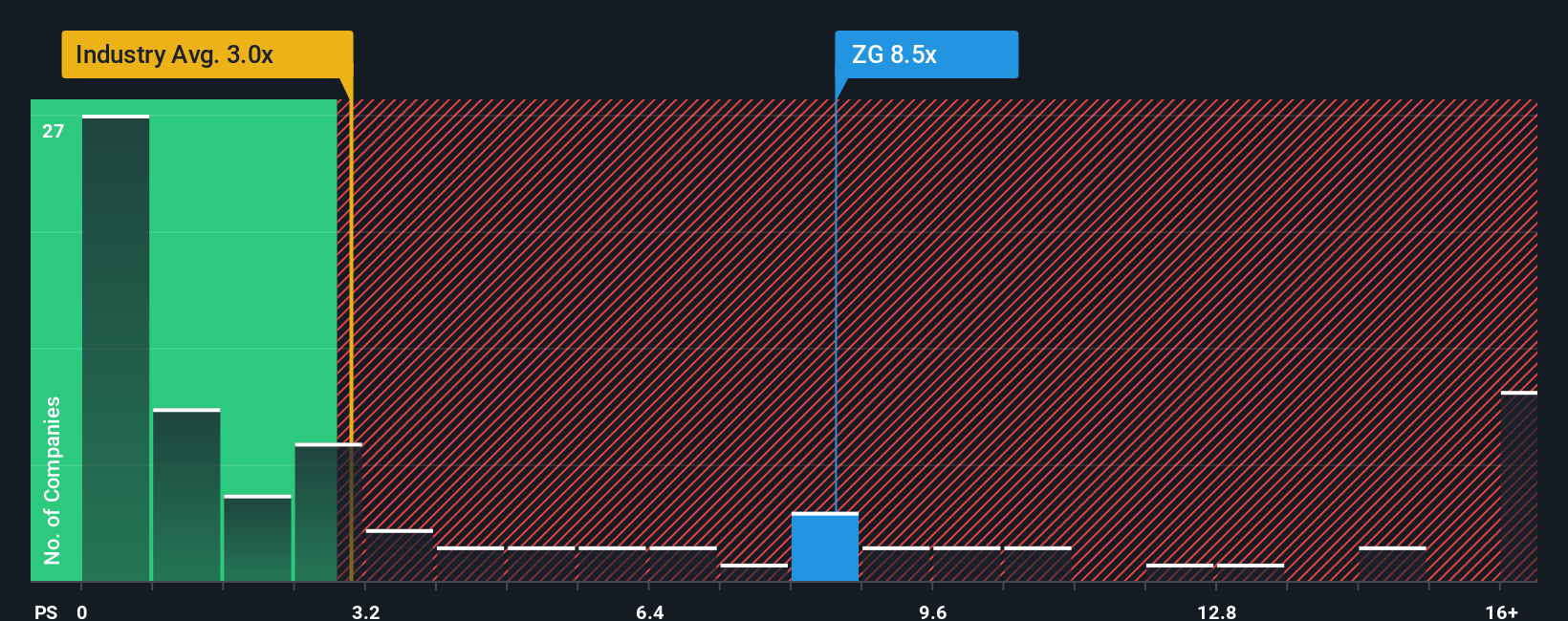

Taking a step back from earnings forecasts, market ratios suggest Zillow may be pricey compared to the real estate industry average. Does this premium reflect unique potential, or is enthusiasm running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Zillow Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Zillow Group Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Zillow Group.

Looking for More Investment Ideas?

Why settle for just one promising stock when opportunities are everywhere? Seize your chance to uncover fresh possibilities with investment screens built for real results.

- Unlock early-growth potential by tapping into penny stocks with strong financials, which stand out for robust financial strength and the ability to surprise the market.

- Supercharge your portfolio by checking out AI penny stocks, which are leading the artificial intelligence revolution and making waves in next-gen technology sectors.

- Grow your income stream with dividend stocks with yields > 3%, which offer attractive yields and the stability many investors seek for the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)