- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Synopsys And 2 Other Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market grapples with concerns over tariffs and economic uncertainties, major indices like the S&P 500 and Nasdaq have seen significant declines, erasing post-election gains. In such volatile times, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to navigate these challenging conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.02 | $21.98 | 49.9% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $28.44 | $56.33 | 49.5% |

| Associated Banc-Corp (NYSE:ASB) | $22.64 | $44.89 | 49.6% |

| Gilead Sciences (NasdaqGS:GILD) | $117.41 | $230.37 | 49% |

| Similarweb (NYSE:SMWB) | $9.08 | $18.00 | 49.6% |

| Cadre Holdings (NYSE:CDRE) | $34.02 | $67.34 | 49.5% |

| Coastal Financial (NasdaqGS:CCB) | $82.99 | $162.87 | 49% |

| Albemarle (NYSE:ALB) | $75.51 | $150.98 | 50% |

| JBT Marel (NYSE:JBTM) | $132.93 | $260.64 | 49% |

| Workiva (NYSE:WK) | $85.87 | $168.65 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Synopsys (NasdaqGS:SNPS)

Overview: Synopsys, Inc. develops electronic design automation software for designing and testing integrated circuits, with a market cap of approximately $69.72 billion.

Operations: The company's revenue segments include Design IP, generating $1.82 billion, and Design Automation, contributing $4.26 billion.

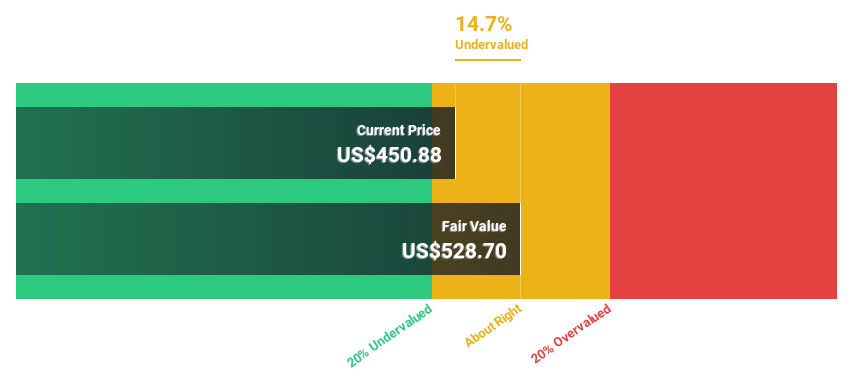

Estimated Discount To Fair Value: 14.7%

Synopsys is trading at US$450.88, below its estimated fair value of US$528.7, suggesting it may be undervalued based on cash flows. Recent innovations like the Synopsys Virtualizer Native Execution enhance software development efficiency for edge devices, potentially boosting future cash flows. The company completed significant fixed-income offerings totaling over US$8 billion, which could support strategic growth initiatives and improve financial flexibility despite a recent dip in quarterly earnings compared to last year.

- Our comprehensive growth report raises the possibility that Synopsys is poised for substantial financial growth.

- Dive into the specifics of Synopsys here with our thorough financial health report.

Zillow Group (NasdaqGS:ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States, with a market cap of approximately $18.22 billion.

Operations: The company's revenue primarily comes from its Internet, Media & Technology (IMT) segment, excluding mortgages, which generated $2.24 billion.

Estimated Discount To Fair Value: 39%

Zillow Group, trading at US$73.85, is valued below its estimated fair value of US$121.1, highlighting potential undervaluation based on cash flows. Despite a net loss reduction to US$112 million in 2024 from the previous year, earnings are forecast to grow significantly annually. The recent partnership with Redfin expands Zillow's multifamily rental listings reach and could enhance future cash flows as it becomes profitable over the next three years amidst strategic operational expansions.

- The growth report we've compiled suggests that Zillow Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Zillow Group.

Nu Holdings (NYSE:NU)

Overview: Nu Holdings Ltd. operates a digital banking platform across several countries including Brazil, Mexico, and Colombia, with a market cap of $52.09 billion.

Operations: The company generates revenue of $5.51 billion from its banking segment.

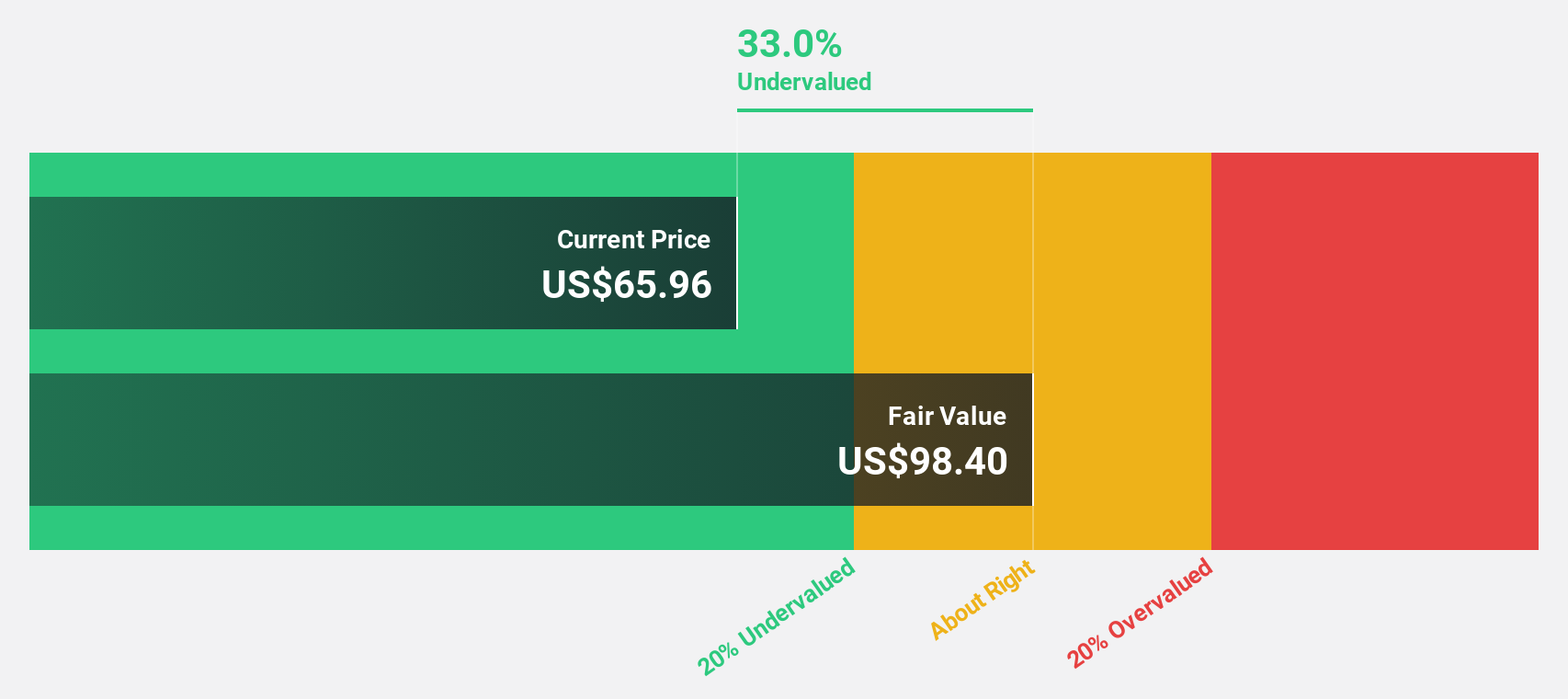

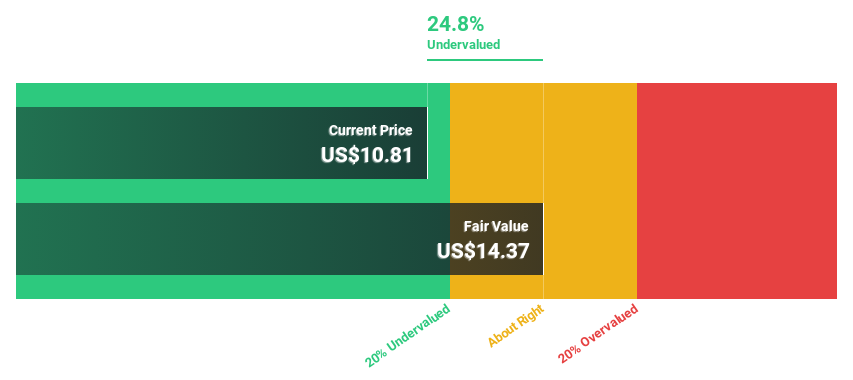

Estimated Discount To Fair Value: 24.8%

Nu Holdings, trading at US$10.81, is below its estimated fair value of US$14.37, indicating potential undervaluation based on cash flows. The company reported a significant rise in net income to nearly US$2 billion for 2024 and forecasts suggest robust annual earnings growth of 24.5%, outpacing the broader market. However, a high level of bad loans (7.8%) remains a concern amidst expectations of strong revenue growth exceeding 40% annually over the next three years.

- According our earnings growth report, there's an indication that Nu Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Nu Holdings stock in this financial health report.

Turning Ideas Into Actions

- Dive into all 191 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives