- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor (OPEN): Exploring Valuation After a Recent 67% Rally Without Major News

Reviewed by Kshitija Bhandaru

Opendoor Technologies (OPEN) has been catching the eye of investors lately, and not because of a headline-grabbing event. Sometimes, it is the absence of fresh news that makes recent stock movements all the more interesting. When a stock shifts meaningfully without a clear catalyst, it is natural to wonder whether the market is simply re-evaluating future prospects or pricing in subtle changes beneath the surface.

Over the past month, Opendoor Technologies' stock posted a strong 67% rally, even as it dipped slightly across the week. Year to date, returns remain modest, with only a 4% gain. While last year has seen only a small 3% increase, the stock’s performance over the past three years is positive, though down significantly from five-year highs. That said, the broader context remains the same. Recent upward momentum hints that investors may be warming up to Opendoor’s long-term story, even with flat revenue growth and widening losses reported over the past year.

With such a dramatic swing in the past month but flat results over the long haul, some investors may now be considering whether Opendoor Technologies is trading at a discount, or whether the market has already factored in the company’s future potential.

Most Popular Narrative: 633% Overvalued

According to the most widely followed narrative, Opendoor Technologies is considered significantly overvalued compared to its estimated fair value.

Ongoing cost efficiency initiatives and operating as a leaner organization aim to improve net margins by reducing fixed costs. This could enhance profitability despite macroeconomic challenges. Aligning marketing strategies with seasonal buying patterns may improve operational efficiency and enhance revenue by acquiring homes when demand is high and spreads are favorable.

Curious how analysts are justifying such a low fair value despite major product launches and ambitious cost-cutting plans? The narrative hinges on a set of make-or-break projections about future profitability and growth that might surprise you. Which pivotal assumptions will define Opendoor’s actual worth, and why are market expectations so far apart from consensus? The answer isn’t what most investors are expecting.

Result: Fair Value of $1.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic headwinds or rising inventory risk could quickly undermine these bullish projections and force analysts to revisit their fair value assumptions.

Find out about the key risks to this Opendoor Technologies narrative.Another View: Market Comparison Tells a Different Story

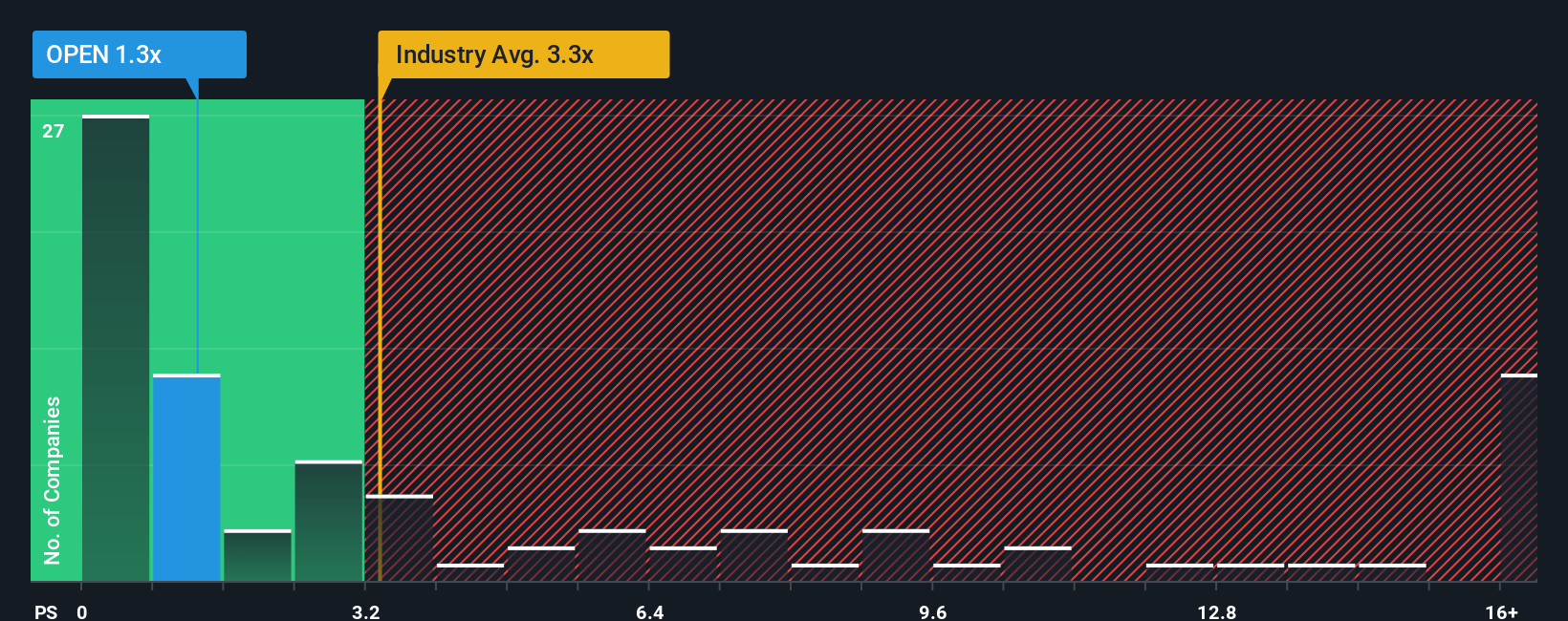

Looking at Opendoor Technologies through the lens of a common market comparison tells a story that contrasts with the analyst forecast. While one approach signals caution, this method suggests there may be more value here than the market believes. Which perspective will prove right as the dust settles?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Opendoor Technologies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Opendoor Technologies Narrative

If you see things differently or would rather draw your own conclusions, you can build a personal narrative in just a few minutes. Do it your way

A great starting point for your Opendoor Technologies research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to just one opportunity when you can spot winning stocks with a few simple steps? Make your next smart move with these unique ideas that investors are capitalizing on right now.

- Score higher returns by finding hidden gems showing strong fundamentals and momentum with penny stocks with strong financials.

- Stay ahead of technological evolution by tapping into companies harnessing the power of artificial intelligence through AI penny stocks.

- Boost your passive income potential by uncovering stable businesses offering reliable yields within dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives