- United States

- /

- Real Estate

- /

- NasdaqGS:CSGP

CoStar Group (CSGP): Exploring Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

CoStar Group (CSGP) has been on the radar lately, and if you have a stake in the company or are thinking about jumping in, recent moves in its share price might give you pause. While there hasn't been a dramatic event driving headlines, the stock’s latest pullback could be enough to make investors ask whether the market is sending an early signal or if there is just some routine volatility unfolding.

The context is that after gaining 12% over the past year, CoStar Group has actually slipped about 6% this past month and is down 3% in the week, reversing some of the momentum built earlier in the year. Longer term, its total return over three years is up 22%, but the five-year mark shows it roughly flat. These moves come as the company has reported strong annual revenue and especially net income growth, yet the stock seems to be retracing recent gains for now.

With shares sliding lately but fundamentals continuing to grow, is this a setup for a buying opportunity, or have investors already priced in all the growth that is ahead?

Most Popular Narrative: 12.2% Undervalued

The latest, most-followed narrative has CoStar Group trading well below its calculated fair value, implying a notable upside for investors who buy in at today’s levels. Market watchers cite a blend of rapid user growth, technology innovation, and market expansion as key to the bullish outlook.

Major investments in residential real estate, international expansion, and advanced analytics are unlocking new revenue streams and accelerating long-term growth opportunities. However, aggressive investments, competitive pressures, and market uncertainties could increase expenses, compress profitability, and drive revenue volatility across key CoStar business segments.

Ready to uncover what could fuel the next big move for CoStar Group? The narrative’s valuation hinges on ambitious growth targets, margin projections, and some eye-popping future earnings estimates. Curious about the exact numbers and bold assumptions behind this “undervalued” call? The deeper insights just might surprise you.

Result: Fair Value of $97.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, aggressive investments and competitive threats could still limit profitability. This may challenge the assumptions behind the current undervalued outlook.

Find out about the key risks to this CoStar Group narrative.Another View: Looking Through a Different Lens

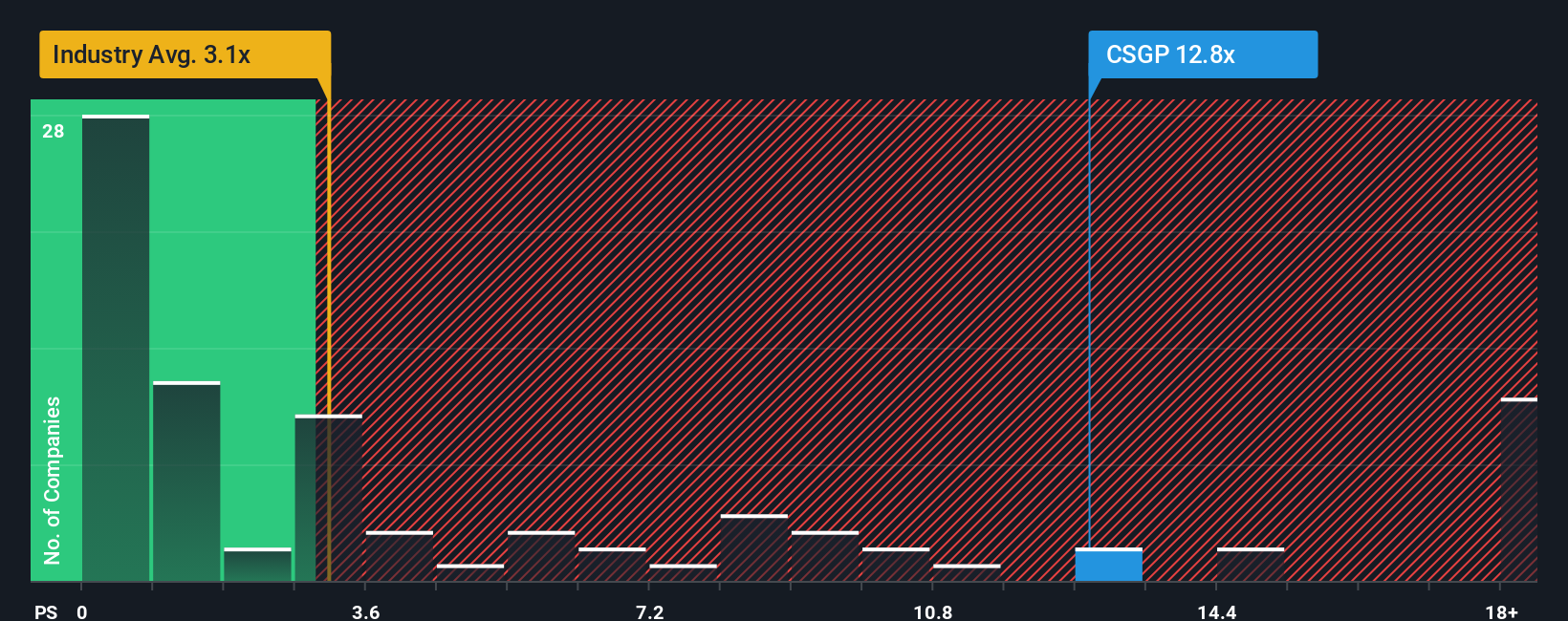

While most analysts see CoStar Group as undervalued when judging by its future earnings, a quick look at its price-to-sales ratio tells a different story. This suggests it may actually be expensive compared to the industry. Could the story be more complex than the surface numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding CoStar Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own CoStar Group Narrative

If you think the real story goes deeper or want to test your own ideas, you can dive into the data and craft your narrative in just a few minutes. Do it your way

A great starting point for your CoStar Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Missing out on these unique stock ideas could mean overlooking growth, income, or breakthrough technology opportunities. Give your portfolio an edge today:

- Explore high potential growth by scanning for penny stocks with strong financials, featuring strong financials and bold strategies.

- Take advantage of the latest developments in artificial intelligence by discovering AI penny stocks that are positioned to shape future markets.

- Enhance your passive income by focusing on dividend stocks with yields > 3%, which offer reliable yields above 3% from financially sound companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGP

CoStar Group

Provides information, analytics, and online marketplace services in the United States, Canada, Europe, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives