- United States

- /

- Real Estate

- /

- NasdaqGS:CSGP

CoStar Group (CSGP): Examining Valuation After Momentum Cools and Short-Term Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for CoStar Group.

Despite the recent pullback, CoStar Group's share price remains above where it started the year. However, momentum has clearly cooled as short-term losses stack up. With a 1-year total shareholder return of -2.8%, long-term gains have been modest while the stock continues to trade around $75 per share.

If you want to broaden your scope and discover other market movers, now is a great moment to check out fast growing stocks with high insider ownership

With the stock’s recent shift in momentum, investors may be asking whether CoStar Group is now trading below its true value or if the current share price already accounts for all expected growth potential.

Most Popular Narrative: 22.6% Undervalued

At $75.18, CoStar Group trades well below the most cited narrative's fair value estimate of $97.12. This sizable gap has caught investors’ attention, especially as analysts remain in broad agreement about the stock’s upside potential.

• Robust user growth, tech innovation, and regulatory trends are strengthening CoStar's role as an industry standard. These factors support sustainable pricing and expanding profit margins.

• Major investments in residential real estate, international expansion, and advanced analytics are unlocking new revenue streams and accelerating long-term growth opportunities.

Want to know which financial leaps justify this premium? There’s a bold formula driving that price tag, hinging on blockbuster revenue growth, surging earnings, and margin expansion set against a backdrop of aggressive investment and industry transformation. See exactly what assumptions and projections analysts are betting on. Miss them and you might miss the next big move.

Result: Fair Value of $97.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential risks such as rising operating expenses from rapid expansion or heightened competition could present challenges for CoStar Group’s ability to deliver on its growth forecasts.

Find out about the key risks to this CoStar Group narrative.

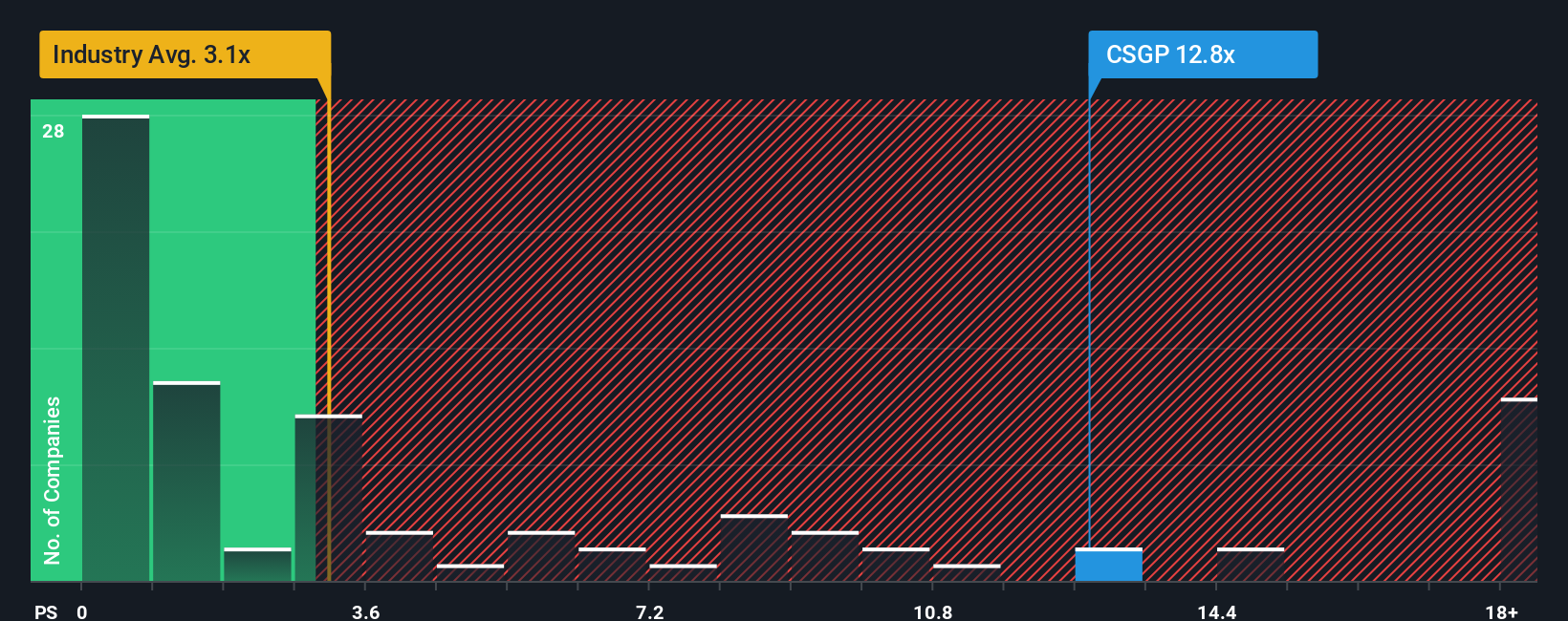

Another View: The Price-to-Sales Ratio Puts Valuation in Perspective

While analyst forecasts point to a big upside, CoStar Group trades at a hefty price-to-sales ratio of 10.9x. This is nearly four times the US Real Estate industry average of 2.8x and double its fair ratio of 5.3x. This suggests investors are paying a significant premium for growth that may already be priced in. Is the market overlooking risk, or could future performance finally justify this valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If you see things differently or want to uncover your own story in the numbers, you can try building your perspective in just a few minutes with Do it your way.

A great starting point for your CoStar Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to just one company. Unlock smarter investing and get ahead of trends by checking out the hottest stocks rising in other fast-moving sectors on Simply Wall Street.

- Tap into the demand for financial independence and browse these 18 dividend stocks with yields > 3%, which offer reliable returns and dependable income streams.

- Ride the next frontier of computing and scroll through these 26 quantum computing stocks, positioned at the heart of tomorrow’s breakthroughs in speed and innovation.

- Capitalize on untapped tech by pinpointing these 25 AI penny stocks, companies that harness artificial intelligence to reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGP

CoStar Group

Provides information, analytics, and online marketplace services in the United States, Canada, Europe, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives