- United States

- /

- Real Estate

- /

- NasdaqCM:CHCI

The Market Lifts Comstock Holding Companies, Inc. (NASDAQ:CHCI) Shares 32% But It Can Do More

Despite an already strong run, Comstock Holding Companies, Inc. (NASDAQ:CHCI) shares have been powering on, with a gain of 32% in the last thirty days. The last month tops off a massive increase of 118% in the last year.

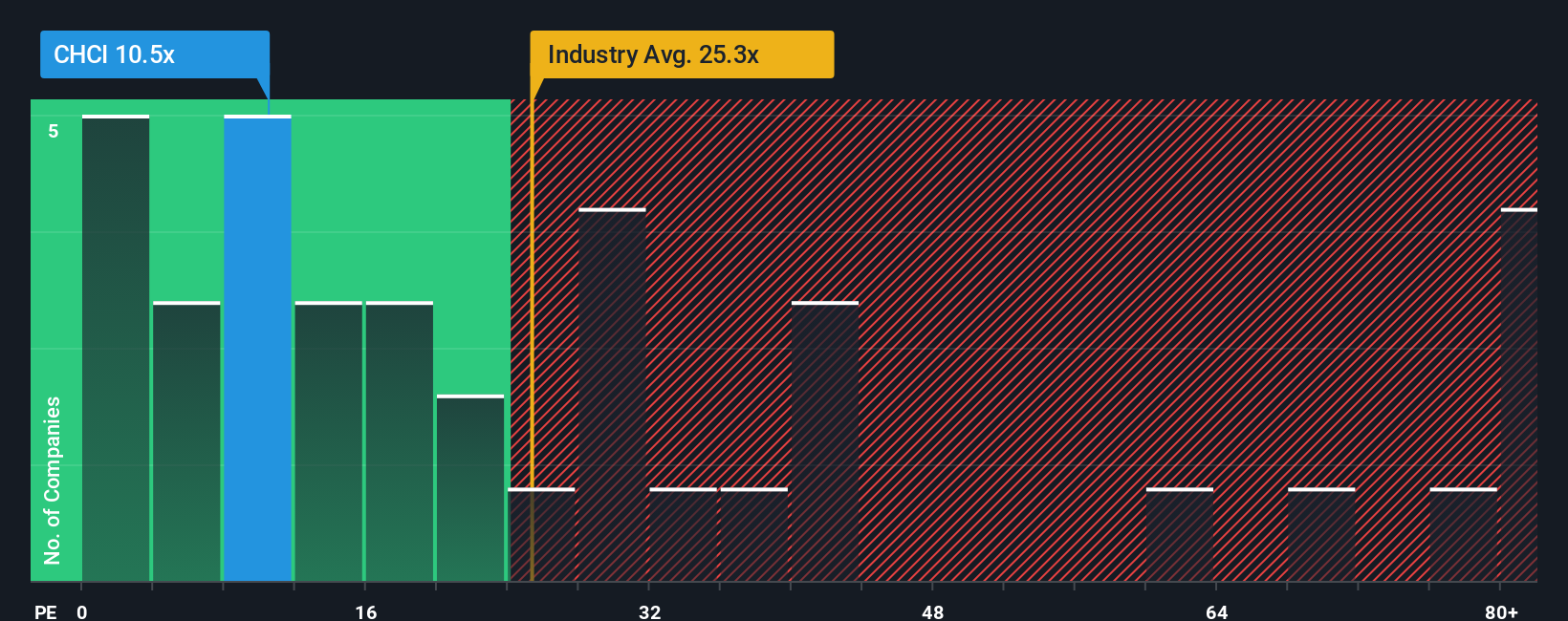

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Comstock Holding Companies as an attractive investment with its 10.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, Comstock Holding Companies has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Comstock Holding Companies

Is There Any Growth For Comstock Holding Companies?

Comstock Holding Companies' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 83% last year. Pleasingly, EPS has also lifted 49% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's about the same on an annualised basis.

With this information, we find it odd that Comstock Holding Companies is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Despite Comstock Holding Companies' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Comstock Holding Companies revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Comstock Holding Companies that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CHCI

Comstock Holding Companies

Operates as a asset manager, developer, and operator of mixed-use and transit-oriented properties in the Washington, D.C.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives