- United States

- /

- Biotech

- /

- OTCPK:AURX

US Penny Stocks: 3 Picks With Market Caps Below $400M

Reviewed by Simply Wall St

As the United States stock market experiences a downturn with major indexes losing ground for the second consecutive week, investors are reassessing their strategies amid rising Treasury yields and economic uncertainties. In such volatile times, penny stocks—often associated with smaller or newer companies—can offer unique opportunities for growth at lower price points. While the term may seem outdated, these stocks can still provide value when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.26 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.84525 | $6.14M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.5235 | $10.57M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.33 | $12.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.54 | $44.07M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.36 | $24.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9599 | $86.33M | ★★★★★☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Greenpro Capital (NasdaqCM:GRNQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greenpro Capital Corp. offers financial consulting and corporate advisory services to small and medium-sized businesses mainly in Hong Kong, Malaysia, and China, with a market cap of $14.32 million.

Operations: The company's revenue is primarily derived from its Service Business, generating $2.64 million, and its Real Estate Business, contributing $0.09 million.

Market Cap: $14.32M

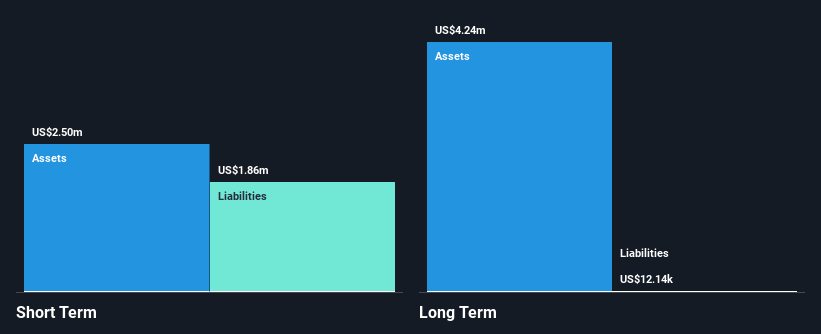

Greenpro Capital Corp. presents a mixed picture for investors in the penny stock space. The company, with a market cap of US$14.32 million, is unprofitable and has seen declining revenues from US$1.07 million to US$0.54 million year-over-year for Q3 2024, alongside increasing net losses. Despite having no debt and short-term assets exceeding liabilities, Greenpro's cash runway is less than a year if current free cash flow trends persist. While its management team is experienced with an average tenure of 11.5 years, the board lacks experience, suggesting potential governance challenges ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of Greenpro Capital.

- Gain insights into Greenpro Capital's historical outcomes by reviewing our past performance report.

Safe Bulkers (NYSE:SB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers marine drybulk transportation services and has a market cap of $377.99 million.

Operations: The company generates revenue of $318.43 million from its transportation and shipping services.

Market Cap: $377.99M

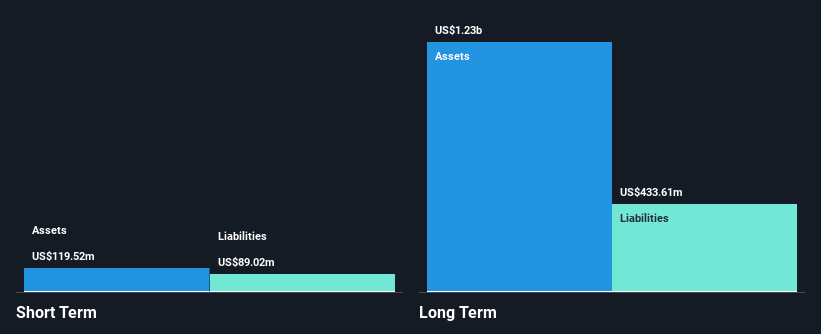

Safe Bulkers, Inc. offers a complex investment profile within the penny stock arena. With a market cap of US$377.99 million and annual revenue of US$318.43 million, it trades at a significant discount to its estimated fair value. The company has shown strong earnings growth over the past five years, but recent results were impacted by large one-off gains. While its debt levels are high relative to equity, interest payments are well covered by EBIT and operating cash flow is robust enough to manage existing debt obligations effectively. Recent share buyback announcements and dividend declarations indicate active capital management strategies.

- Jump into the full analysis health report here for a deeper understanding of Safe Bulkers.

- Gain insights into Safe Bulkers' outlook and expected performance with our report on the company's earnings estimates.

Nuo Therapeutics (OTCPK:AURX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nuo Therapeutics, Inc. is a regenerative therapies company focused on developing and marketing cell-based technologies for natural healing in the United States, with a market cap of $71.28 million.

Operations: The company's revenue is derived entirely from its Medical Products segment, totaling $1.17 million.

Market Cap: $71.28M

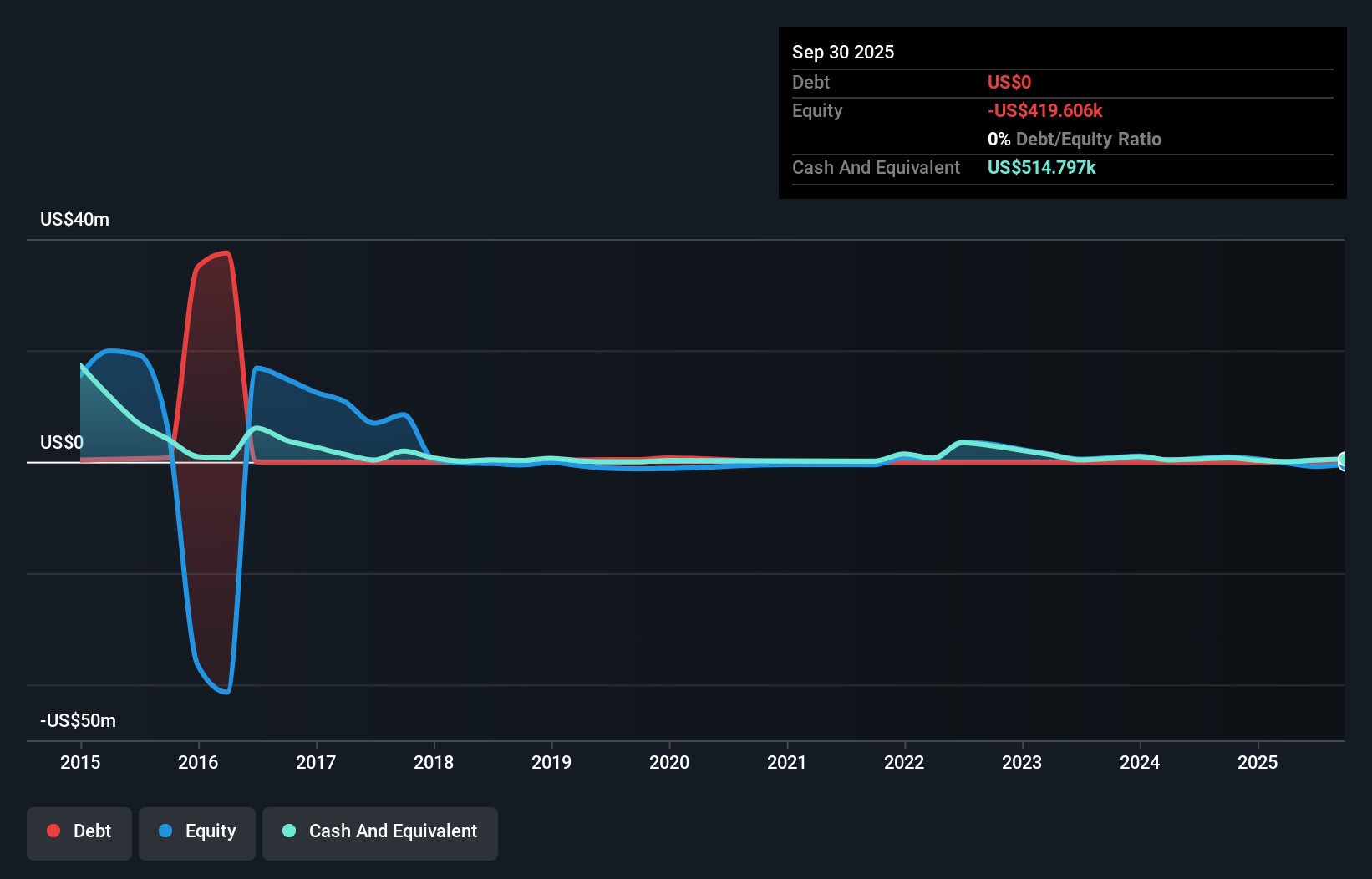

Nuo Therapeutics presents a challenging investment scenario in the penny stock landscape. With a market cap of US$71.28 million, it remains pre-revenue, generating only US$0.97 million over nine months ending September 2024. The company is debt-free but faces high volatility with its share price and has less than a year of cash runway based on current free cash flow trends. Shareholders have experienced dilution recently, and despite an experienced management team, the company is unprofitable with negative return on equity and increasing losses over five years at 39.5% annually.

- Dive into the specifics of Nuo Therapeutics here with our thorough balance sheet health report.

- Examine Nuo Therapeutics' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Navigate through the entire inventory of 735 US Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuo Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:AURX

Nuo Therapeutics

A regenerative therapies company, develops, commercializes, and markets cell-based technologies that harness the regenerative capacity of the human body to trigger natural healing in the United States.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives