- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific (NYSE:TMO) Partners With Cybin For Phase 3 Depression Treatment

Reviewed by Simply Wall St

Thermo Fisher Scientific (NYSE:TMO) recently partnered with Cybin Inc. to support the Phase 3 clinical supply and potential commercial manufacturing of CYB003, a promising treatment for Major Depressive Disorder. Despite this partnership news, the company's stock price was flat last week, in contrast to a positive broader market trend marked by a 5.1% rise. Factors such as the overall market sentiment driven by strong economic data and earnings reports likely influenced stock movements more significantly, while Thermo Fisher's recent developments added a counterbalancing weight to the modest movement.

Be aware that Thermo Fisher Scientific is showing 2 possible red flags in our investment analysis.

The partnership between Thermo Fisher Scientific and Cybin Inc. is a significant development with potential implications for the company's future revenue and earnings forecasts. By supporting the Phase 3 clinical supply of CYB003, Thermo Fisher is positioning itself in a promising treatment area for Major Depressive Disorder. This partnership could potentially enhance future revenue streams if CYB003 gains commercial traction. However, the immediate flat response in Thermo Fisher's share price suggests that broader market influences and other news might have played a more significant role in recent stock movements.

Over the past five years, Thermo Fisher's total return, including both share price appreciation and dividends, amounted to 20.47%. This is an indicator of the company's ability to deliver shareholder value over a more extended period, despite short-term fluctuations. In comparison, on a one-year basis, the company's shares matched the US Life Sciences industry's return of 31.9% decline, reflecting broader sector challenges.

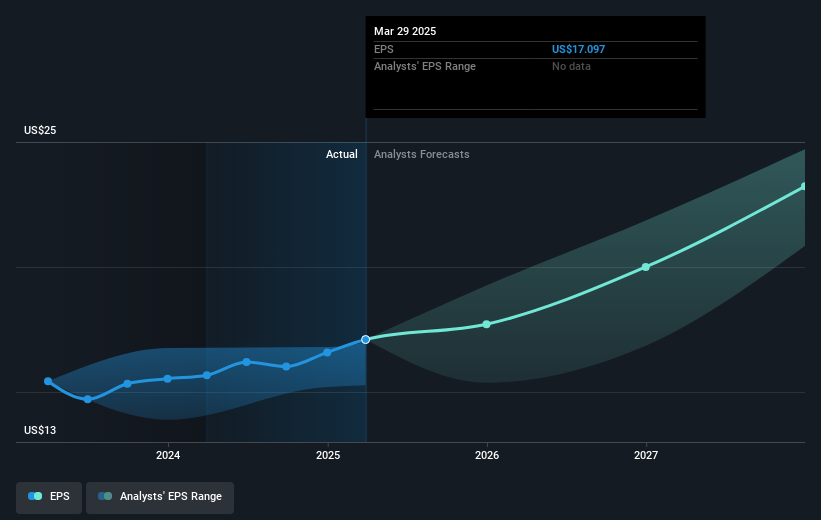

With the company's current share price at US$407.02 and analysts' consensus price target sitting at US$570.17, there is an anticipated upside potential of 28.6%. This highlights market expectations for Thermo Fisher's growth prospects as they integrate new acquisitions and pursue innovation within the life sciences sphere. As analysts project revenue to grow at 5.3% annually over the next three years, supported by innovations like the Vulcan Automated Lab, partnerships like that with Cybin Inc. poise Thermo Fisher to capitalize on emerging opportunities, potentially adjusting forward-looking revenue and earnings estimates upward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives