- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Revvity (RVTY): Examining Valuation After FTSE All-World Index Removal

Reviewed by Kshitija Bhandaru

Revvity (NYSE:RVTY) has drawn fresh attention after being dropped from the FTSE All-World Index. For investors who follow index movements, this kind of change can trigger shifts in demand, especially from funds and strategies tied directly to index constituents. While it’s far from a reflection of the company's operational health, being removed from a widely tracked benchmark can set off a chain reaction that often leads to some volatility as positions adjust.

Looking at the bigger picture, Revvity’s shares have struggled this year, with the stock down 29% over the past twelve months. This decline isn’t a short-term blip, as the three- and five-year returns have also been negative, suggesting investors have grown more cautious. Still, the company’s annual revenue and earnings have actually increased, hinting that the narrative is about future growth and shifting risk perception, not just recent results.

But after such a prolonged selloff and a fresh index exclusion, is Revvity now trading at a discount, or is the market simply pricing in muted prospects from here?

Most Popular Narrative: 25.8% Undervalued

According to the most widely followed narrative, Revvity appears notably undervalued based on analysts’ expectations for strong future growth and improved profitability.

An ongoing shift in product mix toward higher-margin, software-enabled and consumables-driven offerings (such as SaaS Signals, reagents, and the new IDS i20 platform), combined with structural cost actions, is expected to materially expand operating and net margins. The year 2026 is projected to start at a higher 28% operating margin baseline.

Curious how this narrative arrives at such a premium for Revvity’s fair value? There is a financial forecast that does not play it safe. To understand which aggressive growth assumptions and profit multiples justify this price target, you will need to get the full details behind the numbers that are shaping this valuation.

Result: Fair Value of $116.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory changes in China or weak funding in academic markets could quickly undermine Revvity's growth and margin expansion story.

Find out about the key risks to this Revvity narrative.Another View: Market Comparison Tells a Different Story

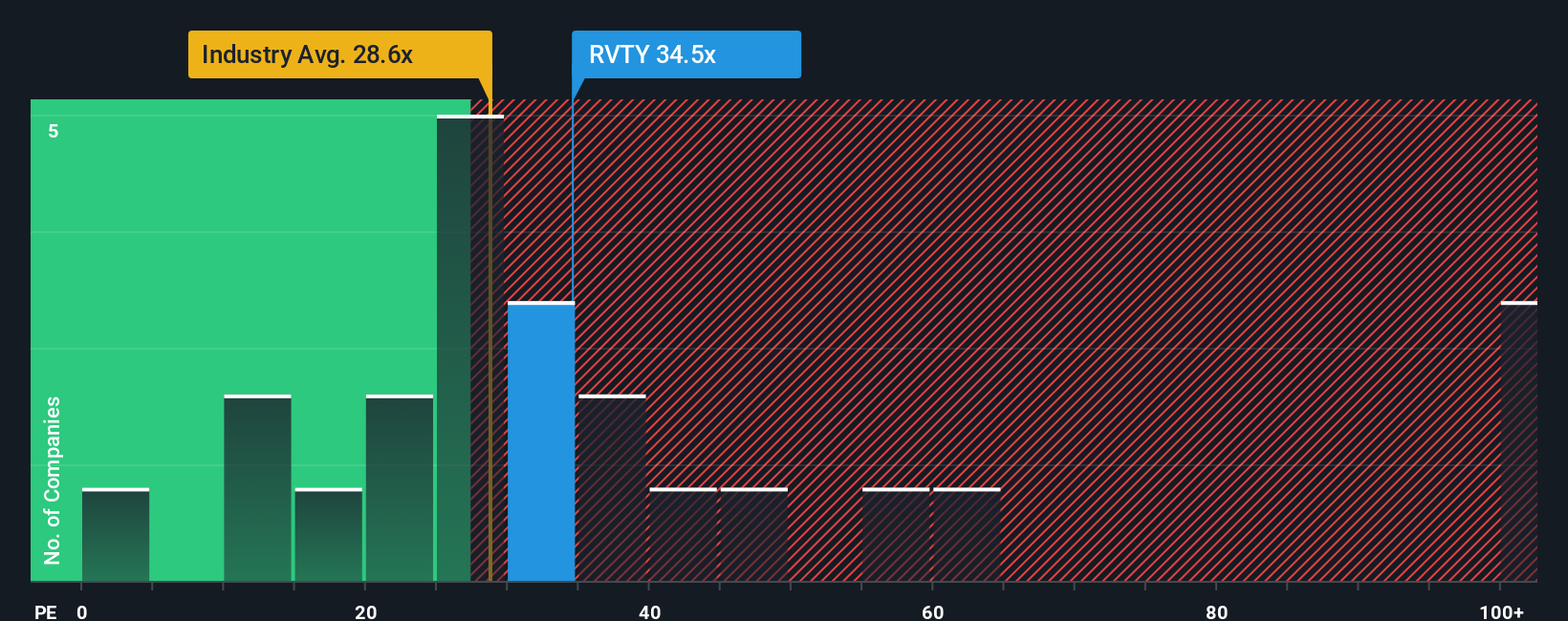

Looking at Revvity through a typical market metric, its current share price appears expensive relative to what most similar industry peers command right now. Does the market know something the models do not?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Revvity to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Revvity Narrative

If you'd rather dig into the numbers yourself or have a different take on what the future could hold, you can shape your own perspective in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Revvity.

Looking for more investment ideas?

Don’t let opportunity slip by while others move ahead. Smart investors use tailored filters to spot promising trends early, and so can you.

- Uncover potential hidden gems among undervalued stocks based on cash flows that offer strong cash flow at attractive prices before they hit the radar of the wider market.

- Catch the momentum building behind companies shaping tomorrow’s tech landscape with AI penny stocks. Artificial intelligence is driving significant growth prospects in this space.

- Tap into a stream of reliable income and stability by finding dividend stocks with yields > 3%, which features robust dividend yields and healthy fundamentals that others may overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVTY

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives