- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Revvity (RVTY): Evaluating Valuation After New Imaging Center Launch in Research Triangle

Reviewed by Simply Wall St

When Revvity (RVTY) announces the launch of a new In Vivo Imaging Center of Excellence right in North Carolina’s Research Triangle, investors are likely to take notice. This facility is positioned to transform R&D innovation by bringing together the company’s brightest minds in hardware, software, and life sciences under one roof. The integration of AI-powered imaging systems is a strategic move that signals Revvity’s intent to address some of the more complex hurdles researchers face in disease workflows, potentially refining approaches to healthcare innovation.

This development follows a challenging year for Revvity’s stock. Shares are down 27% over the past year, with momentum slowing across multiple time frames. While annual revenue and net income have shown growth, the market appears to be weighing these achievements against the risks and uncertainty surrounding near-term returns. Recent declines suggest the news of the new center could mark a turning point, or at least provide a moment for investors to re-evaluate the long-term outlook.

With Revvity trading well below its estimated value, some may wonder whether this latest move presents a genuine opportunity, or if the market already reflects expectations for future growth from these innovations.

Most Popular Narrative: 26.1% Undervalued

The most widely followed narrative suggests that Revvity is currently priced well below its estimated fair value, with a significant margin of upside potential based on future growth and margin expansion.

Ongoing shift in product mix toward higher-margin, software-enabled and consumables-driven offerings (e.g., SaaS Signals, reagents, new IDS i20 platform), along with structural cost actions, are expected to materially expand operating and net margins. The year 2026 is projected to start at a higher 28% operating margin baseline.

Curious why analysts think Revvity should trade at a much higher valuation? There is a bold growth thesis here: massive profit expansion and a financial model packed with ambitious projections. Want to discover what makes this narrative so convinced of Revvity’s untapped value? The logic behind these numbers might surprise you.

Result: Fair Value of $116.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory changes in China and persistent weakness in key end-markets could challenge Revvity’s optimistic outlook. These factors could also pressure both revenue and margins.

Find out about the key risks to this Revvity narrative.Another View: Valuation by Earnings Multiple

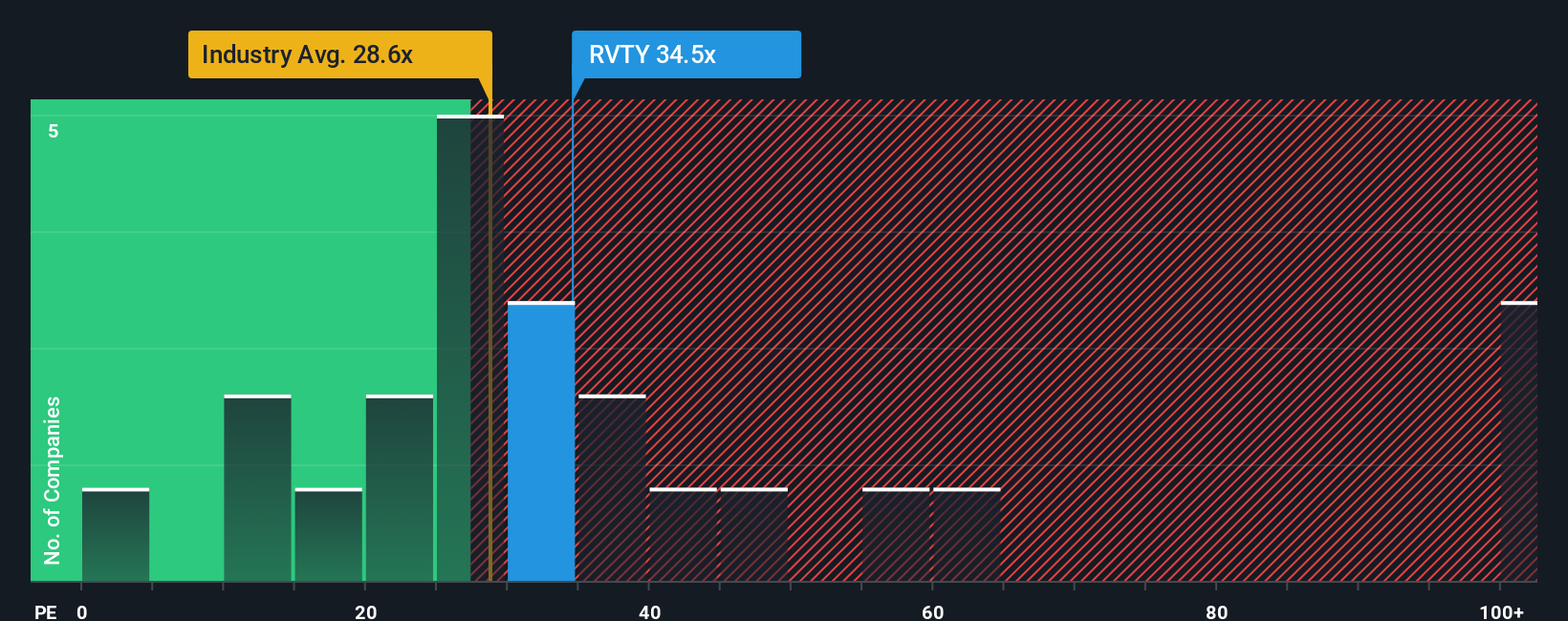

Looking at a valuation based on the usual earnings multiple for the industry, Revvity's stock is actually priced higher than similar companies. This raises the question of whether investor optimism is excessive or if potential growth is being underestimated.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Revvity Narrative

If you see things differently or believe there is another story in the numbers, crafting your own perspective is quick and easy. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Revvity.

Looking for more investment ideas?

Smart investing means staying ahead of the crowd. You can seize new opportunities by targeting stocks that match your goals. Don’t let these promising ideas slip by. Take action now and start your research:

- Tap into the explosive growth of next-gen automation and robotics by scanning for AI-powered businesses using AI penny stocks.

- Uncover reliable cash return opportunities by finding companies committed to robust payouts with dividend stocks with yields > 3%.

- Kickstart your hunt for stocks trading at a discount and brimming with rebound potential thanks to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:RVTY

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)