- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (NYSE:PFE) Collaborates With Guardant Health on Oncology; Declares US$0.43 Dividend

Reviewed by Simply Wall St

Pfizer (NYSE:PFE) recently made headlines with a strategic collaboration with Guardant Health, aimed at enhancing its oncology portfolio through advanced liquid biopsy technology. Simultaneously, the company maintained its strong commitment to shareholders by declaring a quarterly dividend. Pfizer's share price saw a modest increase of 1.59% over the past week, aligning with the broader market trend but slightly underperforming the 2.3% market surge. While these company-specific events underscored Pfizer’s strategic ambitions, they broadly contributed to the company’s standing in an optimistic market environment driven by earnings reports and broader economic sentiments.

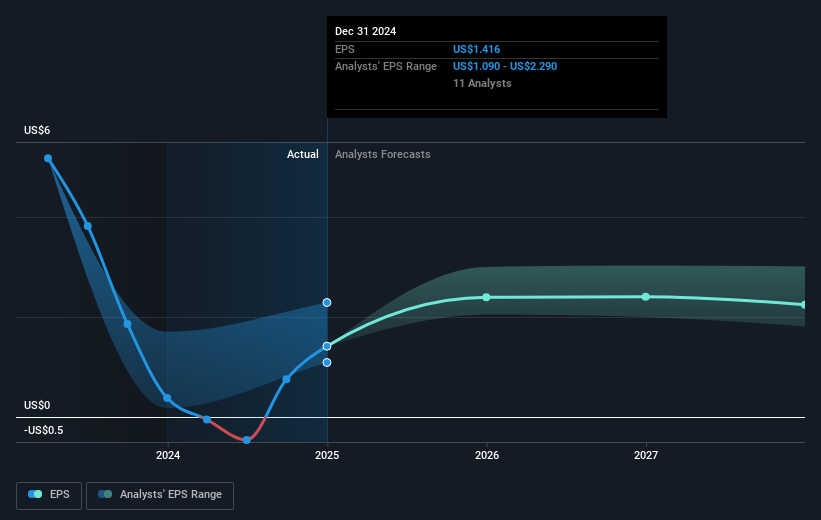

The recent collaboration between Pfizer and Guardant Health emphasizes the company's efforts to advance its oncology portfolio, potentially leading to enhanced research and development capabilities. This renewed focus on R&D might contribute to future revenue and earnings growth, although the initial impact may not be immediately visible given anticipated cost savings initiatives and operational improvements. Meanwhile, Pfizer's share price has experienced a modest increase but remains at a significant discount to the more bearish analyst price target of US$24.41.

Over the past year, Pfizer's total shareholder return, including dividends, was a decline of 9.43%, reflecting broader challenges the company faces, including those outlined in the Inflation Reduction Act's Medicare changes. This performance contrasts with the broader market and the US Pharmaceuticals industry, with Pfizer underperforming both, as it returned less in the same period. Against this backdrop, Pfizer's prospective earnings growth and profitability improvements are anticipated through strategic initiatives but may take time to materialize.

Considering the analyst consensus, Pfizer's shares are currently trading below the consensus price target, suggesting some skepticism about near-term growth prospects. The positive news of the collaboration may contribute to long-term revenue streams and earnings projections if successful, potentially aligning the share price more closely with these targets. However, given current estimations, the market requires more convincing evidence of sustained revenue and earnings improvements before significant upward adjustments are seen in its share valuation.

Learn about Pfizer's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives