- United States

- /

- Pharma

- /

- NYSE:OGN

Are OGN’s Debt Reduction Efforts Enough to Shift Market Perception on Long-Term Growth?

Reviewed by Sasha Jovanovic

- Organon recently reported quarterly revenues and earnings that surpassed analysts' expectations, alongside progress in reducing long-term debt and implementing cost savings aimed at lowering net leverage ratios by the end of 2025 and 2026.

- Despite these strong operational results and active financial management, Organon's stock performance and valuation metrics suggest the market remains cautious about its long-term growth prospects.

- To assess how Organon’s better-than-expected financial results impact its outlook, we’ll examine the effect of ongoing debt reduction efforts on its investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Organon Investment Narrative Recap

To be an Organon shareholder today, you need to believe that its cost savings, ongoing debt reduction, and new product launches will ultimately offset the drag from declining legacy product revenues and recent market pessimism. The latest earnings beat and further progress in deleveraging are encouraging, but they do not significantly shift the immediate risk: sustained erosion in US contraceptive revenues due to policy uncertainty remains the most important short term concern, while owning the stock still relies on confidence in margin improvement and pipeline execution over time.

The recent FDA approval of Organon's BILDYOS and BILPREVDA biosimilars for osteoporosis is particularly relevant, as it directly supports one of the company’s top growth catalysts, biosimilar portfolio expansion, and could help counterbalance pressure from legacy product declines in the quarters ahead.

However, investors should be aware that despite new approvals, persistent risks in the Women's Health franchise remain front of mind if policy headwinds grow more severe...

Read the full narrative on Organon (it's free!)

Organon's narrative projects $6.5 billion revenue and $990.3 million earnings by 2028. This requires 1.2% yearly revenue growth and a $290.3 million earnings increase from $700.0 million today.

Uncover how Organon's forecasts yield a $13.17 fair value, a 37% upside to its current price.

Exploring Other Perspectives

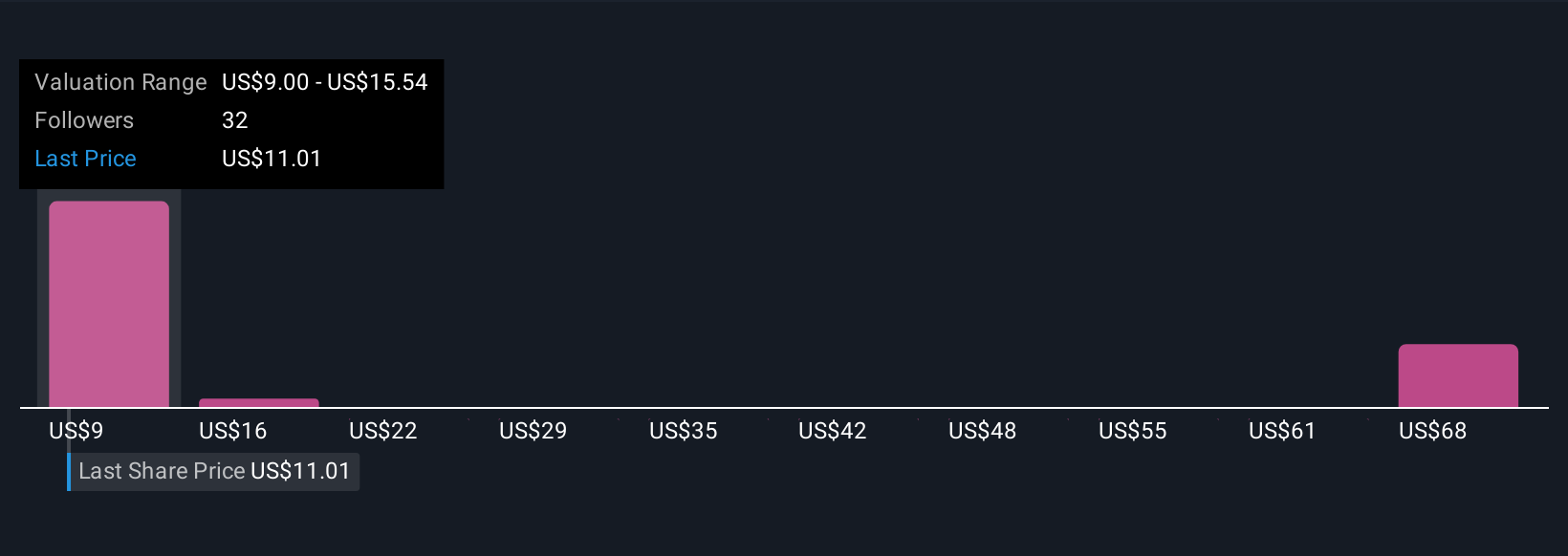

Seven Simply Wall St Community fair value estimates for Organon range from US$9 to over US$72 per share, reflecting broad disparities in investor outlooks. Given ongoing pressure on legacy revenues, these differences show there is plenty to consider if you want a full picture of potential outcomes.

Explore 7 other fair value estimates on Organon - why the stock might be worth over 7x more than the current price!

Build Your Own Organon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Organon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organon's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives