- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

Rapid Micro Biosystems And 2 Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market continues to climb, with indices like the Nasdaq and S&P 500 reaching new highs, investors are exploring various opportunities in different segments of the market. Penny stocks, a term that may seem outdated yet remains significant, represent smaller or less-established companies that can offer potential value. By focusing on those with solid financials and growth potential, investors might uncover promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.04 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.97 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.16 | $201.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.90 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.98 | $636.96M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.97 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $88.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.99 | $10.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.92 | $165.51M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 362 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Rapid Micro Biosystems (RPID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rapid Micro Biosystems, Inc. is a life sciences technology company that offers products for detecting microbial contamination in the manufacturing of pharmaceuticals, medical devices, and personal care products across various international markets, with a market cap of $167.56 million.

Operations: The company generates revenue primarily from Systems and Related LIMS Connection Software, Consumables, and Services, totaling $30.29 million.

Market Cap: $167.56M

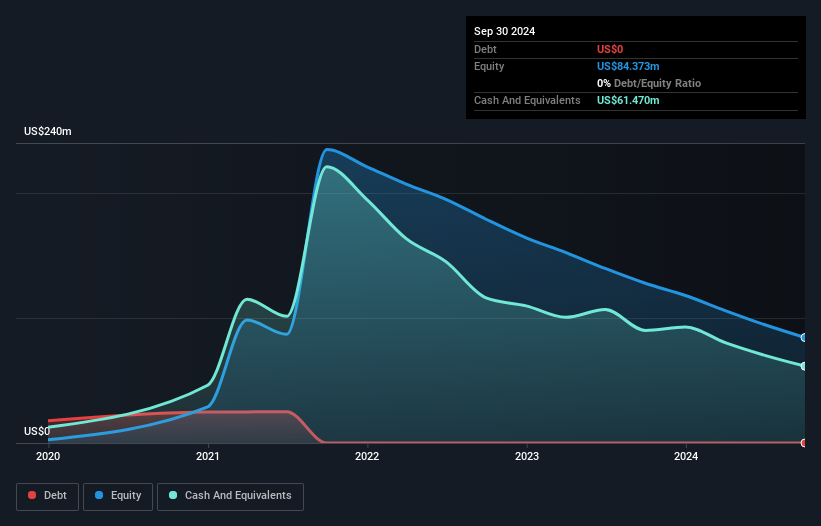

Rapid Micro Biosystems, Inc., with a market cap of US$167.56 million, is navigating the challenging landscape of penny stocks by focusing on revenue growth and financial stability. Despite being unprofitable with a negative return on equity, the company has shown consistent revenue increases, reporting US$14.47 million for the first half of 2025 compared to US$12.23 million in 2024. It remains debt-free and has recently secured a US$45 million loan facility to support its global expansion efforts and enhance manufacturing efficiencies. The management team is experienced, and short-term liabilities are well-covered by assets worth US$60.1 million.

- Click to explore a detailed breakdown of our findings in Rapid Micro Biosystems' financial health report.

- Evaluate Rapid Micro Biosystems' prospects by accessing our earnings growth report.

Nuvation Bio (NUVB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nuvation Bio Inc. is a clinical-stage biopharmaceutical company that develops therapeutic candidates for oncology, with a market cap of approximately $1.27 billion.

Operations: Nuvation Bio generates revenue from its oncology development activities, totaling $14.36 million.

Market Cap: $1.27B

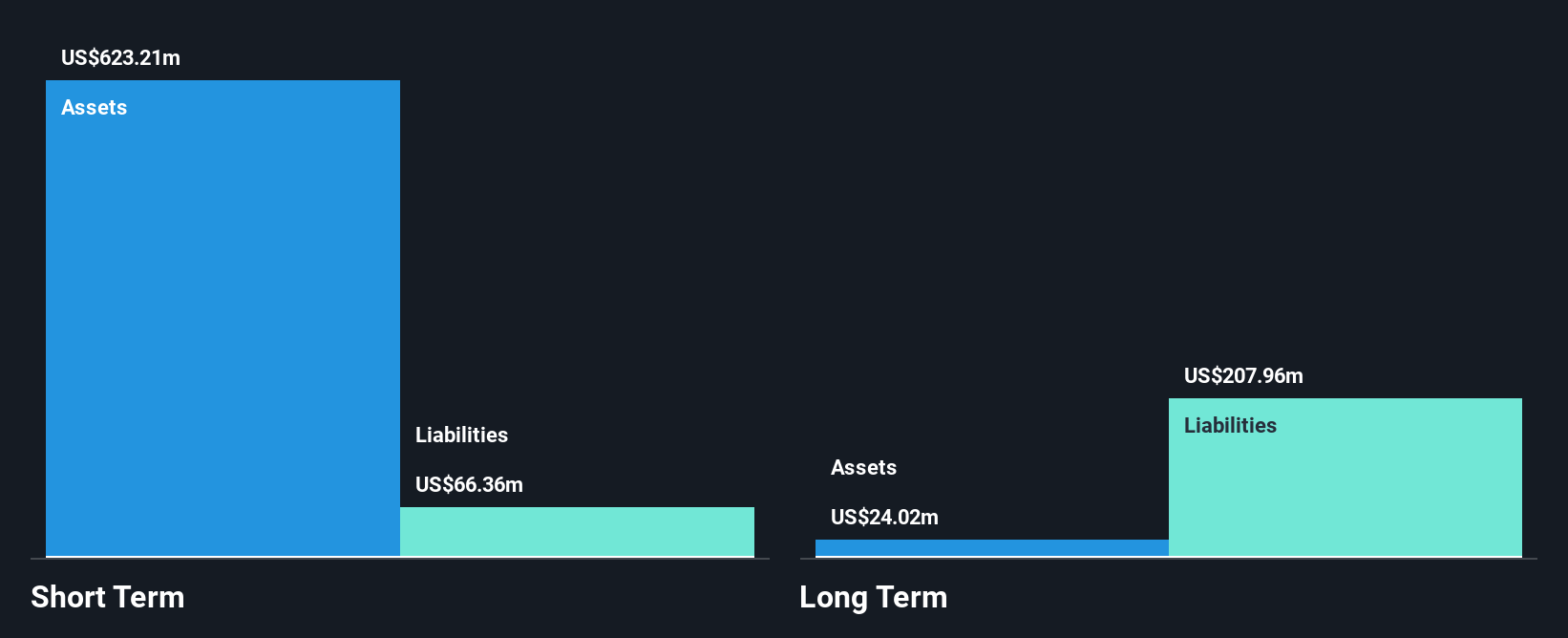

Nuvation Bio Inc., a clinical-stage biopharmaceutical company with a market cap of US$1.27 billion, is navigating the penny stock landscape by advancing its oncology pipeline, particularly with IBTROZI™ (taletrectinib). Recent approvals from Japan's MHLW and the U.S. FDA highlight its potential in treating ROS1-positive non-small cell lung cancer. Despite being unprofitable, Nuvation Bio reported US$7.92 million in revenue for the first half of 2025 and maintains strong liquidity with short-term assets exceeding liabilities significantly. The company has more cash than debt but faces challenges like high volatility and an inexperienced board of directors.

- Unlock comprehensive insights into our analysis of Nuvation Bio stock in this financial health report.

- Assess Nuvation Bio's future earnings estimates with our detailed growth reports.

Waterdrop (WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in China, connecting users with insurance products, and has a market cap of approximately $705.24 million.

Operations: The company's revenue is primarily derived from its insurance segment, which generated CN¥2.78 billion, complemented by CN¥153.68 million from crowd funding activities.

Market Cap: $705.24M

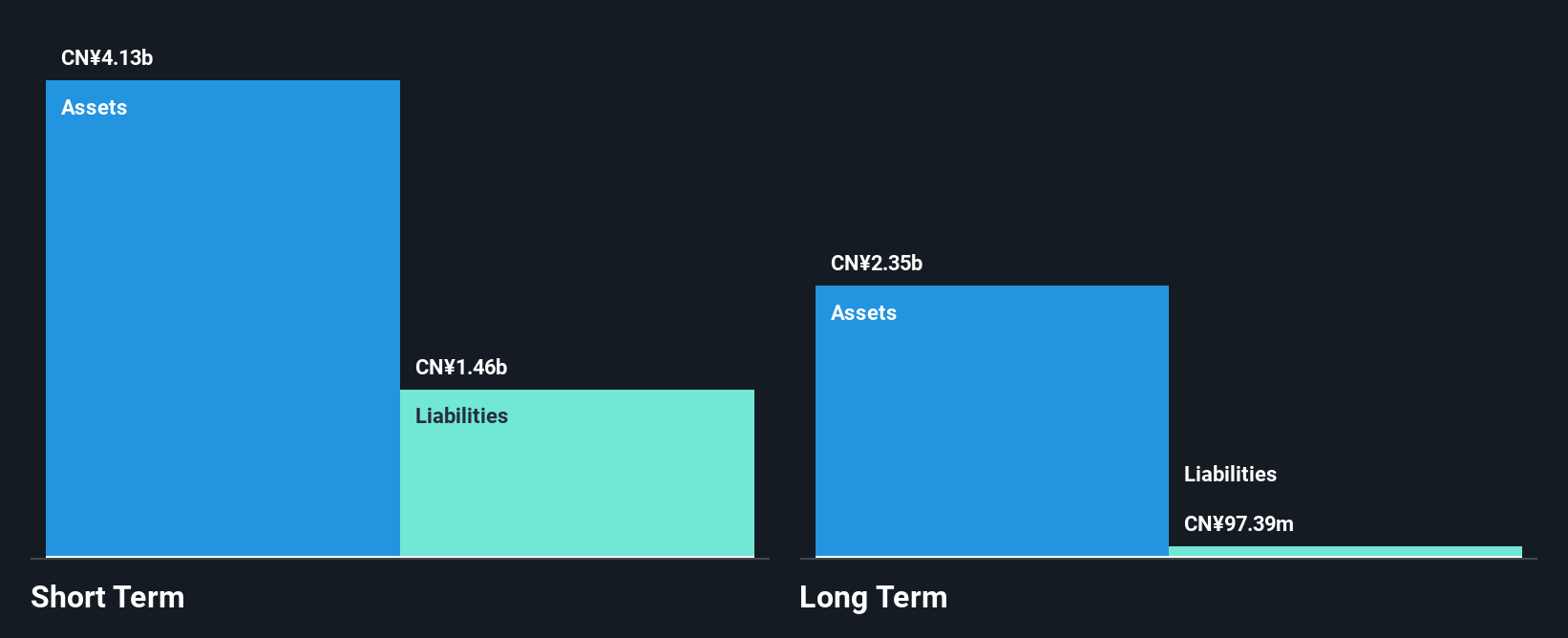

Waterdrop Inc., with a market cap of approximately US$705.24 million, has shown robust financial performance in the penny stock arena. The company reported significant earnings growth, with net income rising to CN¥140.16 million for Q2 2025, up from CN¥88.29 million a year ago. Its short-term assets (CN¥4 billion) comfortably cover liabilities, and it maintains strong liquidity by having more cash than debt. Despite trading below its estimated fair value and boasting high-quality earnings, Waterdrop's return on equity remains low at 8.6%. Recent strategic moves include a share repurchase program worth US$50 million and dividend affirmations enhancing shareholder value.

- Take a closer look at Waterdrop's potential here in our financial health report.

- Examine Waterdrop's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Get an in-depth perspective on all 362 US Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives