- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (MRK) Unveils New Cardiovascular Research Data at ESC 2025 Congress

Reviewed by Simply Wall St

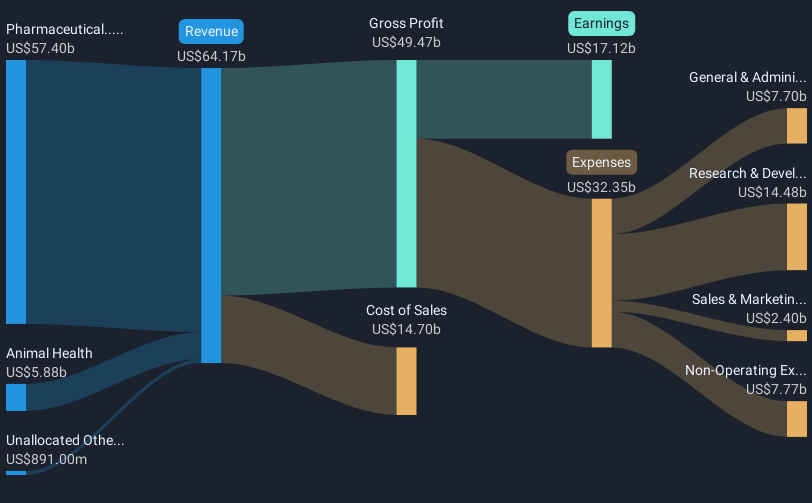

Merck (MRK) is set to present new clinical trial data at the European Society of Cardiology Congress 2025, emphasizing advancements in cardiovascular disease management. Over the last quarter, Merck's stock price increased by 13%, aligning closely with the overall market upswing driven by investor optimism regarding interest rate cuts. While Merck's developments, such as the clinical and regulatory progress with its drugs like WINREVAIR and KEYTRUDA, added weight to the company's movements, broader market trends, including general corporate earnings growth and market valuation adjustments, played significant roles in this price change.

Every company has risks, and we've spotted 1 weakness for Merck you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

Merck's upcoming presentation of clinical trial data at the European Society of Cardiology Congress 2025 could potentially bolster investor confidence and support the company's overall narrative of growth through new product launches and sustained R&D efforts. The emphasis on advancements in cardiovascular disease management aligns with Merck's strategy of expanding its pipeline and maintaining a strong position in the oncology field. These developments might positively influence analysts' revenue and earnings forecasts, as they signal ongoing innovation and the possibility of future blockbuster products.

Over the past five years, Merck's total shareholder return, including share price gains and dividends, reached 25.54%. This longer-term performance offers context to the 13% share price increase observed in the last quarter. However, the company's 1-year return fell short compared to the US Pharmaceuticals industry's 12.9% decrease. The recent price movement sets the current share price at US$87.37, approaching analysts' consensus price target of US$100.41. A potential alignment with this target could reflect positive expectations for earnings growth, despite challenges like declining GARDASIL sales and future potential pricing pressures.

Explore Merck's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives