- United States

- /

- Pharma

- /

- NYSE:LLY

Will FDA Breakthrough Status for KRAS Therapy Reshape Eli Lilly’s (LLY) Oncology Growth Story?

Reviewed by Simply Wall St

- In the past week, Eli Lilly announced that the FDA granted Breakthrough Therapy designation to olomorasib in combination with pembrolizumab for first-line treatment of advanced or metastatic KRAS G12C-mutant non-small cell lung cancer, based on encouraging early and late-stage trial results.

- This milestone accelerates the path to potential approval for a next-generation targeted lung cancer therapy and underscores Lilly's increasing presence in oncology innovation.

- We'll explore how this FDA designation could shape investor expectations for Eli Lilly's expanding oncology pipeline and long-term growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Eli Lilly Investment Narrative Recap

The core investment thesis for Eli Lilly centers on its leadership in high-growth therapeutic areas like obesity, diabetes, and oncology, fueled by a robust late-stage pipeline. The recent FDA Breakthrough Therapy designation for olomorasib in lung cancer reflects progress in oncology but is unlikely to materially alter the near-term focus on obesity and diabetes products as the primary growth catalysts; however, it highlights expansion beyond reliance on established therapies. The biggest immediate risk remains heavy dependence on blockbuster diabetes and obesity drugs, with competitive and reimbursement pressures looming.

Among recent developments, the positive Phase 3 ATTAIN-2 results for orforglipron in adults with obesity and type 2 diabetes stand out, reinforcing Lilly’s short-term momentum in the obesity and diabetes space. Together with the olomorasib news, these milestones showcase how Lilly’s pipeline is adding breadth, even as the company’s market performance continues to hinge on maximizing near-term opportunities in metabolic disease.

However, investors should also consider that, against the exciting growth story in new indications, emerging risks around payor coverage and regulatory pricing pressures...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly’s outlook anticipates $89.0 billion in revenue and $34.0 billion in earnings by 2028. This scenario assumes annual revenue growth of 18.7% and a $20.2 billion increase in earnings from current levels of $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $888.52 fair value, a 22% upside to its current price.

Exploring Other Perspectives

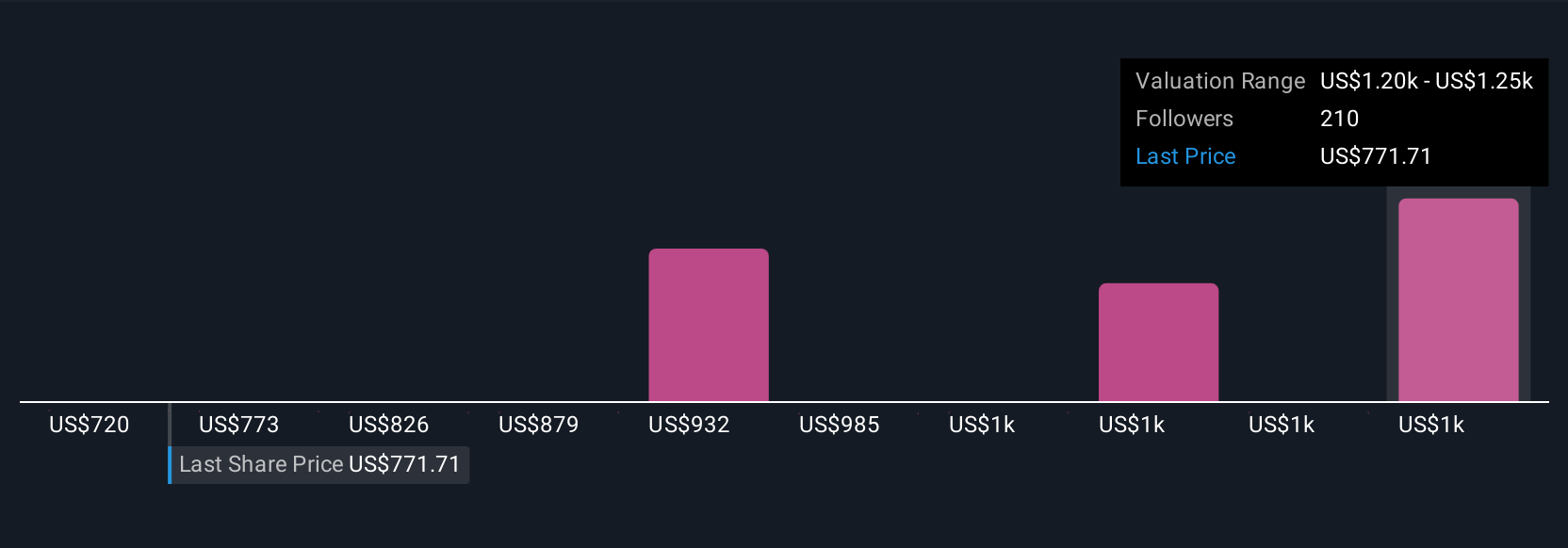

The Simply Wall St Community’s 27 fair value estimates for Lilly span from US$650 to US$1,186, with the majority below recent analyst targets. While enthusiasm for the pipeline is high, investor opinions reflect sharp differences on future competitive and pricing risks that could influence long-term outcomes. Explore how others assess these challenges and opportunities.

Explore 27 other fair value estimates on Eli Lilly - why the stock might be worth 11% less than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives