- United States

- /

- Pharma

- /

- NYSE:LLY

What Does Former FDA Vaccine Chief Joining Eli Lilly Mean for Its Stock Valuation?

Reviewed by Bailey Pemberton

Thinking about what to do with Eli Lilly stock right now? You are not alone. With its long track record of innovation and blockbuster growth, this stock is always a hot topic among investors who want to balance long-term potential with today’s price tag. Over the last five years, Eli Lilly has absolutely crushed it, delivering a staggering 506.9% return. The last three years have been no slouch either, with shares up 152.5%. But sometimes even the best-run companies hit a speed bump. After rising 8.5% in the past month, Lilly shares have dipped 3% in the last week and are up about 5.3% year-to-date.

Some of these recent price changes have caught investors’ attention as headlines swirl about Eli Lilly’s next moves. News of the former FDA vaccine chief coming aboard is sparking conversation about Lilly’s future in infectious disease, while the company’s multi-billion dollar investment in India signals big plans for its manufacturing and supply chain. At the same time, shifting policy winds, such as new discussions about pharmaceutical tariffs and prescription savings, keep the whole sector under a cloud of uncertainty, at least for now.

With the spotlight on, Lilly’s current valuation score comes in at a modest 2 out of 6, meaning it looks undervalued by only two of the key metrics analysts lean on. Next, we are going to break down exactly which methods signal an undervalued opportunity and which ones suggest caution. And stick around, because after we size Lilly up by the numbers, I will share an even sharper lens for understanding what “value” really means for investors like you.

Eli Lilly scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eli Lilly Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to estimate a company’s true worth by projecting its expected future cash flows and then discounting those back to today’s dollars. This approach helps investors understand the value Eli Lilly might generate over time, rather than just focusing on current profits or revenues.

Eli Lilly’s current Free Cash Flow (FCF) stands at $2.25 billion. Analysts forecast steady growth, projecting FCF to reach $34.10 billion by 2029. These long-term projections rely on both analyst estimates for the next few years and extended forecasting by Simply Wall St for years beyond 2029. All projections are denominated in US dollars.

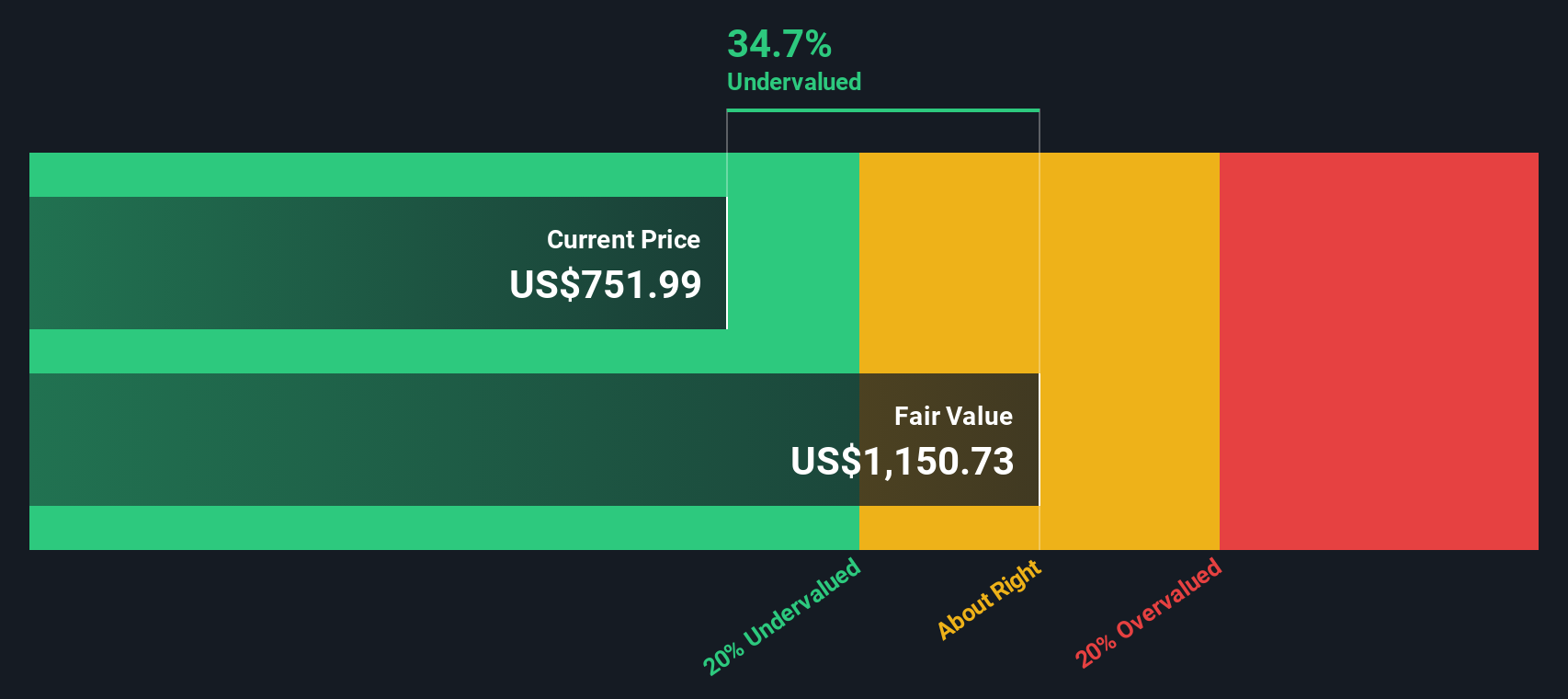

Based on the 2 Stage Free Cash Flow to Equity model, Eli Lilly’s intrinsic value is estimated at $1,170.74 per share. That figure is about 30.0% higher than the current share price. The model suggests the stock is undervalued and may have further room to run.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eli Lilly is undervalued by 30.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Eli Lilly Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a classic tool for evaluating the value of established, profitable companies like Eli Lilly. Since it compares a company's share price to its earnings per share, it provides a snapshot of how much investors are willing to pay for each dollar of earnings. This makes it especially useful for companies with steady profits and predictable cash flow.

A “normal” or “fair” P/E ratio is shaped by growth expectations and perceived risk. High-growth companies tend to command higher P/E ratios, since investors expect their future earnings to climb quickly. Conversely, firms facing bigger risks or slower growth typically trade at a lower P/E. So, context really matters when evaluating whether a stock’s P/E is justified.

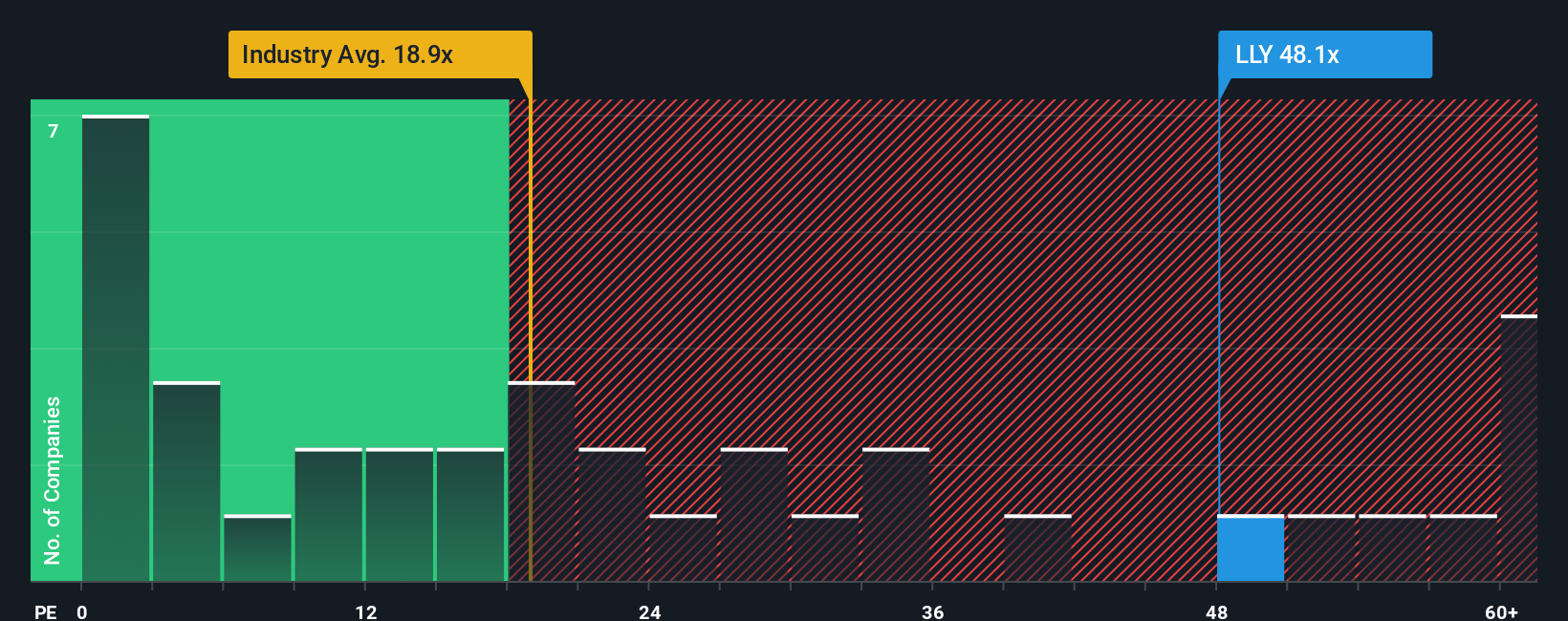

Eli Lilly currently trades at a P/E of 53.31x, which is significantly higher than both its peer average of 16.00x and the broader pharmaceutical industry average of 17.94x. However, Simply Wall St’s proprietary “Fair Ratio” stands at 39.88x, custom-calculated by factoring in Eli Lilly’s strong growth prospects, industry conditions, profit margins, market cap, and risk profile.

While it’s tempting to simply benchmark Lilly’s P/E to its peers, the “Fair Ratio” goes a step further by adjusting for performance drivers and risks that can differ widely from one company to another. This proprietary approach provides a more tailored and realistic sense of value, especially for unique leaders like Eli Lilly.

Comparing Eli Lilly’s current P/E of 53.31x to its Fair Ratio of 39.88x, the stock is trading well above what would typically be justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eli Lilly Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a tool that lets you connect your personal story or perspective about a company, such as your expectations for Eli Lilly’s growth drivers, risks, or future margins, to the numbers behind its fair value calculation. Instead of relying solely on preset analyst targets or basic ratios, Narratives encourage you to build and share a thesis that links Eli Lilly’s real business events, forecasts, and financial assumptions into one cohesive investment story.

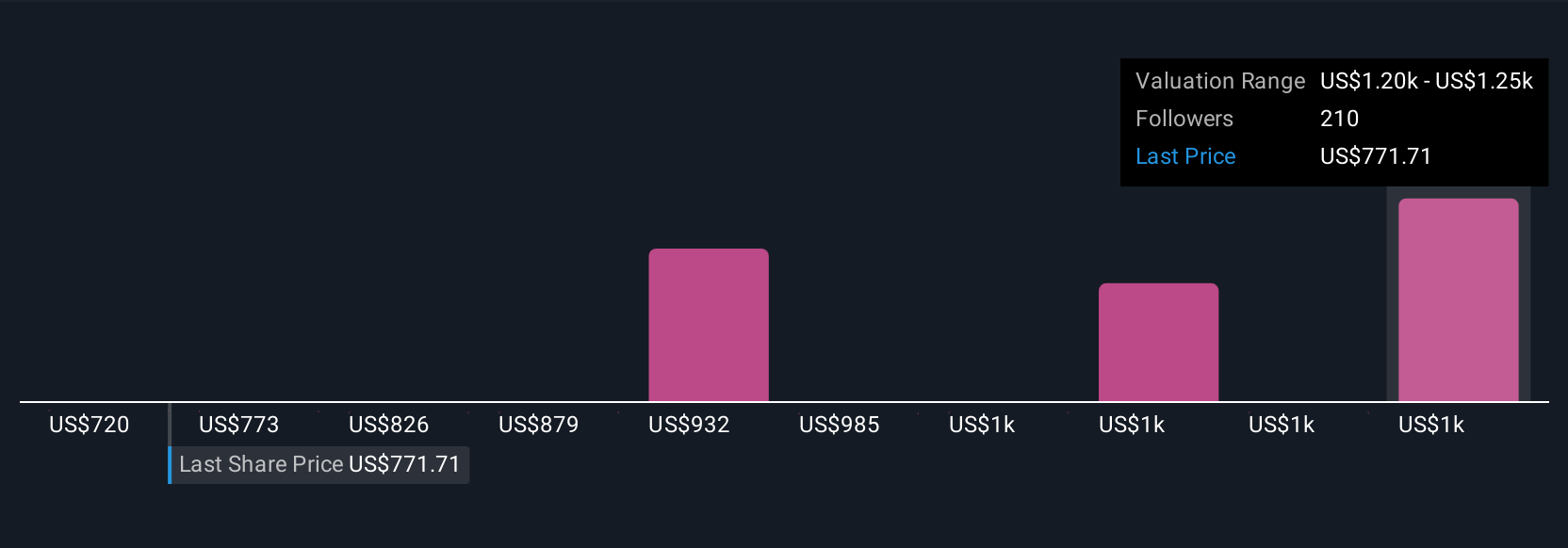

Accessible on the Simply Wall St Community page, Narratives make it easy for anyone, whether seasoned analysts or new investors, to specify their assumptions and instantly see a fair value estimate that matches their view. As new news or earnings emerge, Narratives update automatically to reflect the latest developments. This helps you decide whether Eli Lilly’s current price offers an opportunity or signals caution by clearly comparing your Narrative fair value to the real market price.

For example, one investor might highlight Eli Lilly’s expansion into digital health and emerging markets, forecasting surging revenues and arriving at a Narrative fair value of $1,190 per share, while a more cautious perspective might focus on regulatory risks and assign a value of just $650. Narratives empower you to invest with conviction, rooted in your own outlook and the evolving real-world story of Eli Lilly.

Do you think there's more to the story for Eli Lilly? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives