- United States

- /

- Pharma

- /

- NYSE:LLY

Should Omvoh’s Clinical Success and Earnings Optimism Prompt Action from Eli Lilly (LLY) Investors?

Reviewed by Sasha Jovanovic

- In the past week, Eli Lilly announced strong long-term clinical trial results for its ulcerative colitis therapy Omvoh, showing sustained efficacy and a favorable safety profile over four years. Investors are also looking ahead to Eli Lilly’s quarterly earnings, which are expected to showcase robust sales for popular treatments Mounjaro and Zepbound.

- This combination of compelling clinical data and earnings optimism is reinforcing Eli Lilly’s reputation for innovation and product strength in key growth areas.

- We’ll explore how these pivotal Omvoh results and earnings expectations could influence Eli Lilly’s investment narrative moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Eli Lilly Investment Narrative Recap

As a shareholder, the key belief is that Eli Lilly's innovation in high-demand therapies, especially for diabetes and obesity, will continue to fuel growth and outpace risks from competition and regulatory change. The recent appointment of former FDA executive Peter Marks as head of infectious disease is unlikely to materially shift the near-term catalyst of strong Mounjaro and Zepbound sales, nor does it lessen the biggest risk: ongoing pricing pressure and potential policy-driven margin compression in core markets.

Among recent announcements, robust four-year results for Omvoh in ulcerative colitis stand out, highlighting Lilly's commitment to broadening its portfolio beyond incretins and addressing pipeline concentration risks. This therapy's success supports the business catalyst of expanding specialty drugs, even as investor focus remains centered on revenue growth from metabolic disease treatments.

However, despite promising news on growth and innovation, investors should also be aware that increasing drug price scrutiny in the US and Europe could mean...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly’s outlook projects $89.1 billion in revenue and $34.2 billion in earnings by 2028. This assumes an 18.7% annual revenue growth rate and a $20.4 billion increase in earnings from the current $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $891.62 fair value, a 7% upside to its current price.

Exploring Other Perspectives

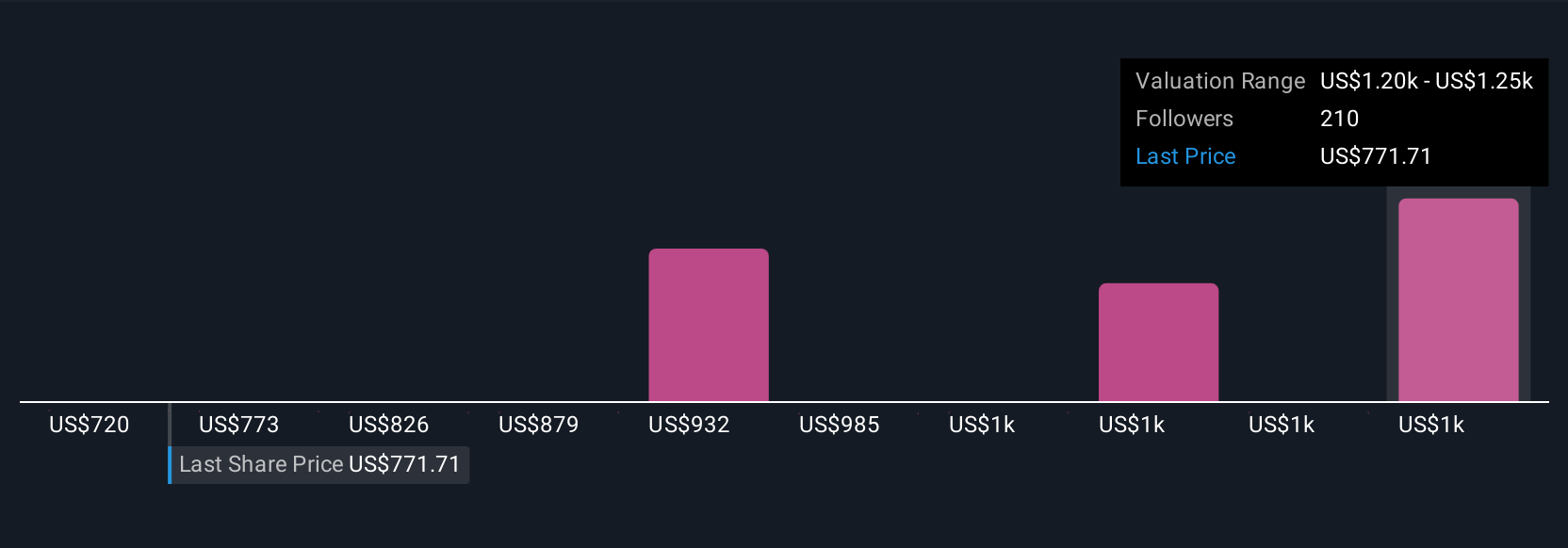

Thirty members of the Simply Wall St Community place Eli Lilly’s fair value estimates between US$650 and US$1,189 per share. Against this backdrop of mixed expectations, ongoing policy and pricing risks could shape future returns, explore several perspectives before forming your own view.

Explore 30 other fair value estimates on Eli Lilly - why the stock might be worth as much as 43% more than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives