- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (NYSE:LLY) Gains FDA Approval for EBGLYSS, Expands Strategic Alliances for Market Growth

Eli Lilly(NYSE:LLY) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a robust 36% surge in Q2 revenue, driven by new product launches, contrasted against supply constraints and a significant decline in Trulicity revenue. In the discussion that follows, we will delve into Eli Lilly's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Unlock comprehensive insights into our analysis of Eli Lilly stock here.

Strengths: Core Advantages Driving Sustained Success For Eli Lilly

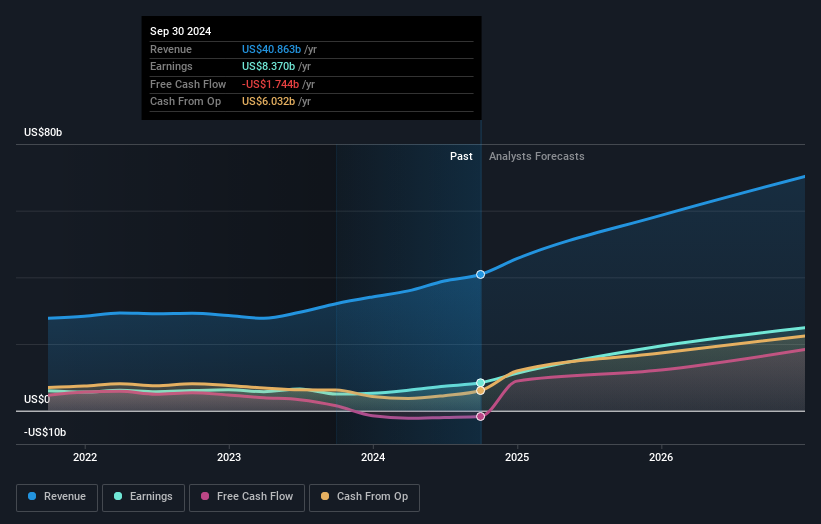

Eli Lilly exhibits robust revenue growth, with Q2 revenue surging by 36%, driven by new products contributing nearly $3.5 billion compared to the same period last year (David Ricks, Chair and CEO). The company’s financial health is underscored by a 90% increase in operating income, primarily due to higher revenue from new products (Gordon Brooks, Interim CFO). Additionally, Eli Lilly is executing an ambitious manufacturing expansion agenda, which is crucial for meeting the growing demand for its products. The company also achieved several key pipeline milestones, including the approval of Kisunla for Alzheimer's disease, showcasing its strong R&D capabilities. Despite its high Price-To-Earnings Ratio of 111.1x compared to the industry average of 19x, Eli Lilly is trading below its estimated fair value of $1092.73, indicating potential undervaluation based on discounted cash flow estimates.

Weaknesses: Critical Issues Affecting Eli Lilly's Performance and Areas For Growth

Eli Lilly faces supply constraints, with weekly prescription volumes being volatile due to challenges in fulfilling high demand. The company also saw a 31% decline in worldwide Trulicity revenue in Q2, impacting its overall financial performance . Increased R&D expenses, which rose by 15%, are another concern, driven by continued investment in the portfolio and personnel (Gordon Brooks, Interim CFO). Furthermore, the company's high Price-To-Earnings Ratio of 111.1x, compared to the peer average of 25.8x, suggests it is expensive relative to its peers. Current net profit margins of 18.9% are lower than last year's 22%, indicating a potential area for improvement.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Eli Lilly has significant opportunities for market expansion, particularly through its broad internal portfolio and active business development. The company is also planning to expand access for Zepbound, which could enhance its market position. With 11 new molecules currently in the clinic across multiple indications, Eli Lilly's innovative pipeline presents a substantial growth opportunity. The acquisition of Morphic, a biopharma company developing oral integrin therapies, further strengthens its strategic position. Additionally, Eli Lilly's revenue is forecast to grow at 17.2% per year, faster than the US market's 8.8% growth rate, indicating strong future potential.

Threats: Key Risks and Challenges That Could Impact Eli Lilly's Success

Eli Lilly faces significant competition, which could impact its market share and operational efficiency. Regulatory risks are also a concern, as the company is actively engaged with regulators and considering various legal actions. Market dynamics, such as periodic supply tightness for certain presentations and dose levels, pose additional challenges. Potential safety risks related to compounded tirzepatide highlight the importance of maintaining stringent safety standards (Daniel Skovronsky, Chief Scientific Officer). Additionally, the company's debt is not well covered by operating cash flow, indicating potential financial vulnerabilities.

Conclusion

Eli Lilly's strong revenue growth and significant increase in operating income, driven by new product launches, underscore its financial health and ability to meet rising demand through an ambitious manufacturing expansion. However, supply constraints and declining revenue from key products like Trulicity highlight operational challenges that need addressing. The company's innovative pipeline and strategic acquisitions present substantial growth opportunities, positioning it well for future market expansion. Despite its high Price-To-Earnings Ratio of 111.1x, which suggests it is expensive relative to peers, Eli Lilly's trading below its estimated fair value indicates potential for future appreciation based on discounted cash flow estimates. This complex interplay of strengths, weaknesses, opportunities, and threats will shape Eli Lilly's financial stability and growth trajectory in the coming years.

Have a stake in these NYSE:LLY? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives